- China

- /

- Real Estate

- /

- SHSE:600094

Global Penny Stocks Under US$1B Market Cap Worth Watching

Reviewed by Simply Wall St

Global markets have recently experienced significant turbulence, with the announcement of unexpected tariffs leading to steep declines in major indices and raising concerns about economic growth and inflation. In such a volatile market, investors often seek opportunities that balance potential growth with manageable risk. Penny stocks, while an older term, still capture the essence of investing in smaller or newer companies that may offer considerable value due to their low price points. When these stocks are backed by strong financials and clear growth prospects, they can present intriguing opportunities for those looking to explore under-the-radar investments.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.325 | SGD131.72M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD1.90 | SGD7.5B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.59 | SEK269.2M | ✅ 4 ⚠️ 3 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.22 | MYR612.08M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.36B | ✅ 5 ⚠️ 0 View Analysis > |

| Sarawak Plantation Berhad (KLSE:SWKPLNT) | MYR2.22 | MYR619.45M | ✅ 5 ⚠️ 2 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.05 | HK$675.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.47 | £245.66M | ✅ 4 ⚠️ 5 View Analysis > |

| Warpaint London (AIM:W7L) | £3.45 | £278.72M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.14 | £355.76M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 5,730 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

New Provenance Everlasting Holdings (SEHK:2326)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: New Provenance Everlasting Holdings Limited is an investment holding company that sources and sells metal minerals and related industrial materials in Hong Kong and the People’s Republic of China, with a market cap of HK$231.92 million.

Operations: The company generates revenue from two segments: HK$331.80 million from sourcing and selling metal minerals and related industrial materials, and HK$96.57 million from the production and sale of industrial products.

Market Cap: HK$231.92M

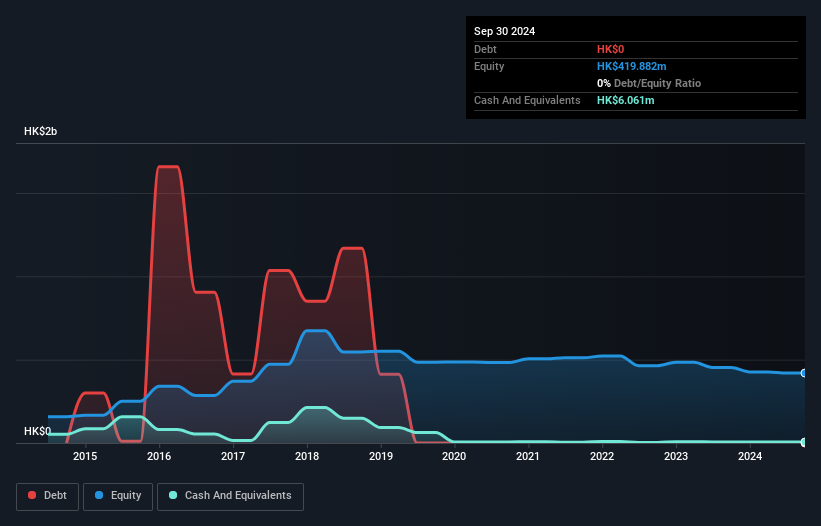

New Provenance Everlasting Holdings, with a market cap of HK$231.92 million, operates in the metal minerals and industrial materials sector in Hong Kong and China. The company generates significant revenue from its two main segments: HK$331.80 million from sourcing and selling metal minerals and HK$96.57 million from industrial products sales. Despite being unprofitable with a negative return on equity of -11.69%, it benefits from having no debt, reducing financial risk related to interest payments or cash flow coverage needs. Its experienced board has an average tenure of 4.3 years, providing stability amid its volatile earnings history.

- Jump into the full analysis health report here for a deeper understanding of New Provenance Everlasting Holdings.

- Learn about New Provenance Everlasting Holdings' historical performance here.

Greattown Holdings (SHSE:600094)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Greattown Holdings Ltd. operates in the real estate development sector in China with a market capitalization of CN¥7.07 billion.

Operations: The company generates revenue of CN¥5.28 billion from its operations in China.

Market Cap: CN¥7.07B

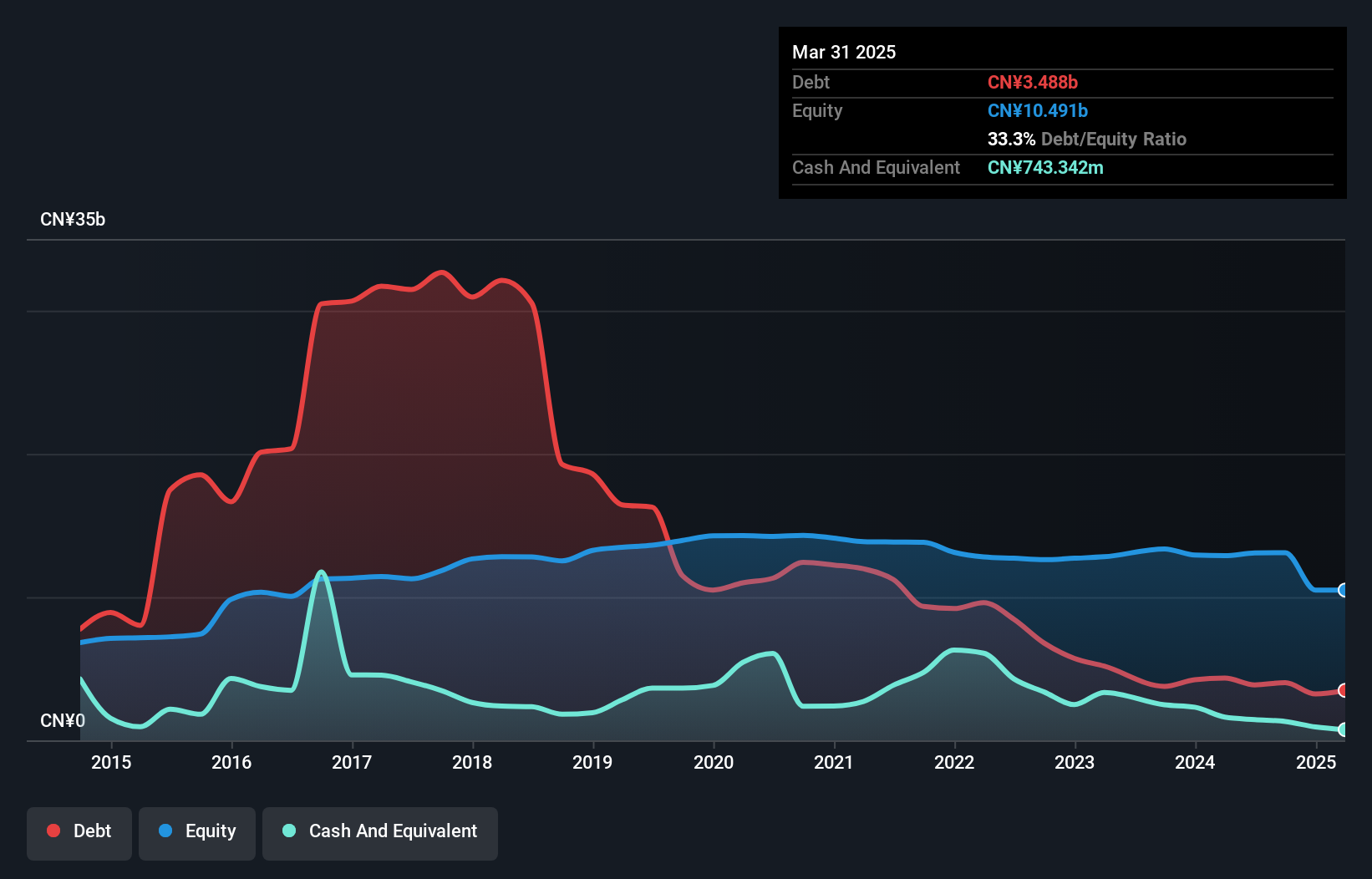

Greattown Holdings, with a market cap of CN¥7.07 billion, operates in the Chinese real estate sector. Despite generating CN¥5.28 billion in revenue, it remains unprofitable and struggles with debt coverage as operating cash flow covers only 8.5% of its debt. However, interest payments are well-covered by EBIT at 3.2x coverage, and its net debt to equity ratio is satisfactory at 20.7%. The company benefits from strong short-term asset coverage over liabilities and an experienced board with an average tenure of 7.8 years, though profitability challenges persist with losses increasing by 31% annually over five years.

- Click here and access our complete financial health analysis report to understand the dynamics of Greattown Holdings.

- Examine Greattown Holdings' past performance report to understand how it has performed in prior years.

Cosmos Group (SZSE:002133)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cosmos Group Co., Ltd. operates in the real estate development sector in China with a market cap of CN¥1.84 billion.

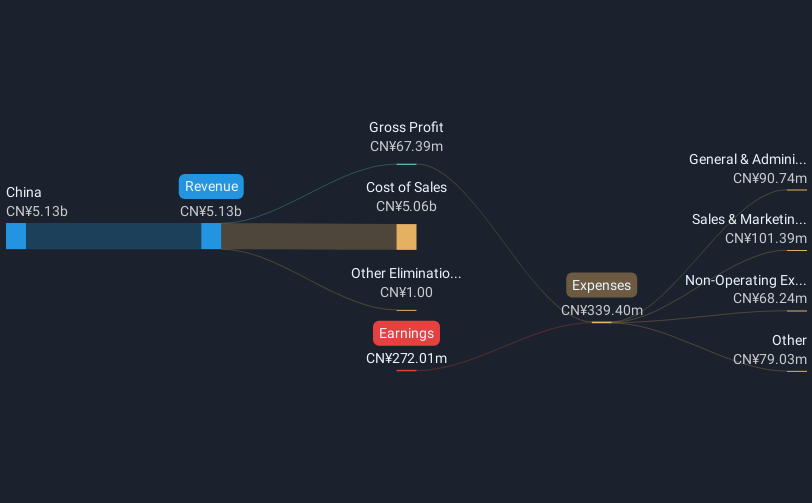

Operations: The company's revenue for China is CN¥5.13 billion.

Market Cap: CN¥1.84B

Cosmos Group Co., Ltd., with a market cap of CN¥1.84 billion, operates in the Chinese real estate sector but remains unprofitable with increasing losses over the past five years. Despite this, it maintains strong short-term asset coverage over both its short and long-term liabilities, and its net debt to equity ratio is satisfactory at 17%. The company recently announced a share repurchase program worth up to CN¥30 million, highlighting potential shareholder value initiatives. Management and board members are seasoned with average tenures of 14.6 and 11.6 years respectively, yet profitability challenges remain significant obstacles for growth.

- Click here to discover the nuances of Cosmos Group with our detailed analytical financial health report.

- Assess Cosmos Group's previous results with our detailed historical performance reports.

Make It Happen

- Dive into all 5,730 of the Global Penny Stocks we have identified here.

- Contemplating Other Strategies? Rare earth metals are the new gold rush. Find out which 20 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Greattown Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600094

Greattown Holdings

Engages in the real estate development business in China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives