- China

- /

- Life Sciences

- /

- SZSE:301333

Top Growth Companies With Insider Ownership In October 2024

Reviewed by Simply Wall St

As global markets navigate the challenges of rising U.S. Treasury yields and tepid economic growth, investors are paying close attention to how these factors influence stock performance across various indices. In this environment, companies that demonstrate robust growth potential paired with high insider ownership can offer a compelling investment narrative, as insider confidence often signals alignment with shareholder interests and a positive outlook on future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Pharma Mar (BME:PHM) | 11.8% | 55.1% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

Here we highlight a subset of our preferred stocks from the screener.

Zhuzhou Kibing GroupLtd (SHSE:601636)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhuzhou Kibing Group Co., Ltd is a company that manufactures and sells glass in China, with a market capitalization of approximately CN¥17.97 billion.

Operations: Zhuzhou Kibing Group Co., Ltd generates its revenue primarily through the manufacturing and sale of glass products in China.

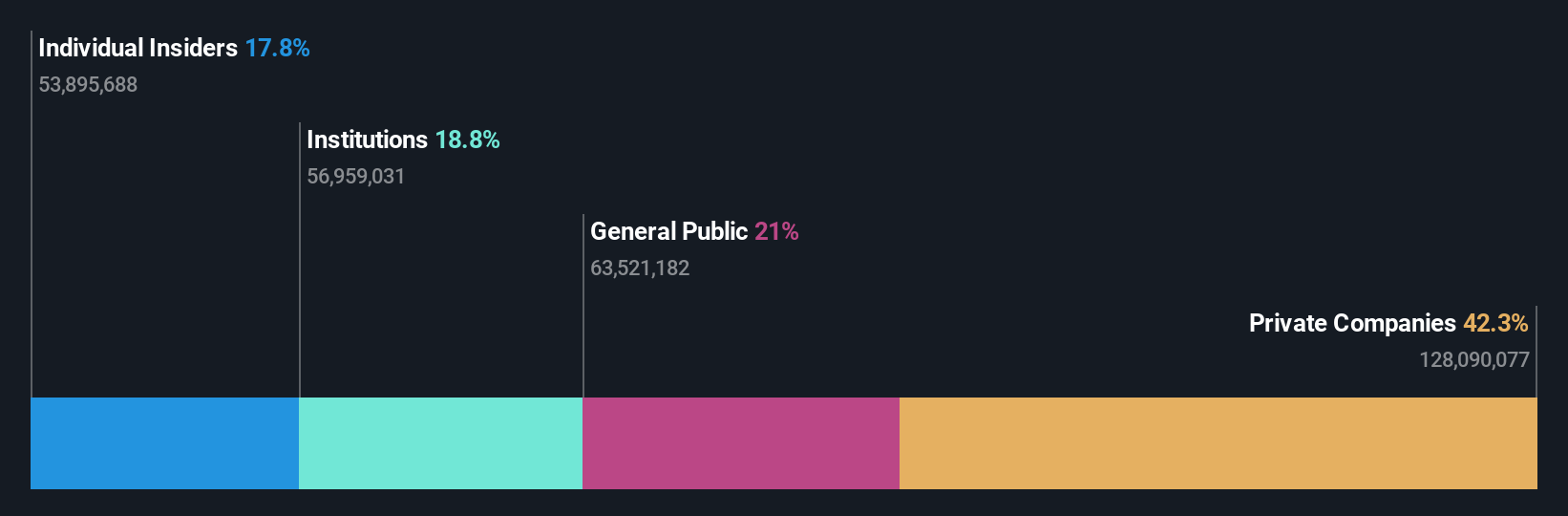

Insider Ownership: 16.6%

Earnings Growth Forecast: 24.9% p.a.

Zhuzhou Kibing Group Ltd. demonstrates characteristics of a growth company with high insider ownership, despite some financial challenges. The company's revenue for the first nine months of 2024 increased to CNY 11.60 billion from CNY 11.18 billion a year ago, though net income decreased significantly to CNY 699.14 million from CNY 1.24 billion, affecting earnings per share negatively. Forecasts suggest significant annual profit growth at approximately 24.9%, exceeding the Chinese market average and indicating potential value despite current debt concerns and low return on equity forecasts.

- Click here and access our complete growth analysis report to understand the dynamics of Zhuzhou Kibing GroupLtd.

- Our valuation report here indicates Zhuzhou Kibing GroupLtd may be undervalued.

Naruida Technology (SHSE:688522)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Naruida Technology Co., Ltd. manufactures and sells polarized multifunctional active phased array radars in China, with a market cap of CN¥12.48 billion.

Operations: Naruida Technology's revenue segments are not detailed in the provided text, so a summary cannot be generated.

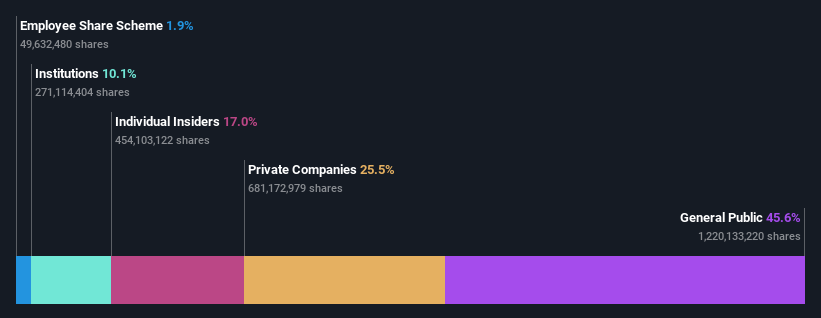

Insider Ownership: 17.8%

Earnings Growth Forecast: 72.3% p.a.

Naruida Technology's revenue for the nine months ended September 2024 grew to CNY 136.2 million from CNY 113.51 million, but net income fell to CNY 26.01 million from CNY 33.24 million, impacting earnings per share negatively. Despite this, forecasts indicate robust annual revenue growth of over 60%, significantly outpacing the Chinese market average of 13.7%. However, profit margins have declined and return on equity is expected to remain low in coming years.

- Get an in-depth perspective on Naruida Technology's performance by reading our analyst estimates report here.

- Our valuation report here indicates Naruida Technology may be overvalued.

R&G PharmaStudies (SZSE:301333)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: R&G PharmaStudies Co., Ltd. offers clinical research outsourcing services to pharmaceutical and medical device companies, as well as scientific research institutions in China, with a market cap of CN¥6.50 billion.

Operations: R&G PharmaStudies Co., Ltd. generates revenue by providing clinical research outsourcing services to the pharmaceutical and medical device sectors, as well as scientific research institutions in China.

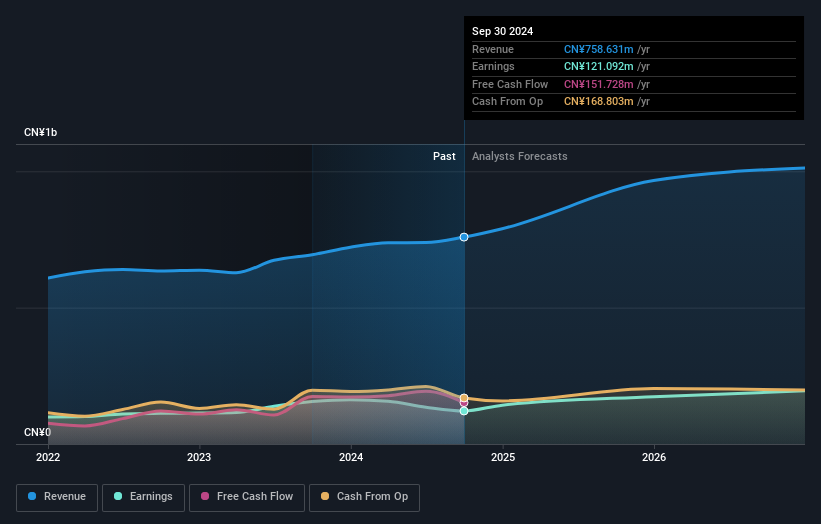

Insider Ownership: 12.2%

Earnings Growth Forecast: 27.8% p.a.

R&G PharmaStudies reported sales of CNY 561.92 million for the nine months ending September 2024, up from CNY 524.67 million a year earlier, while net income decreased to CNY 84.42 million from CNY 125.86 million. Despite this decline in profitability, earnings are forecast to grow at a significant annual rate of 27.8%, outpacing the Chinese market average of 24.6%. The company recently completed a share buyback worth CNY 56.06 million, reflecting strong insider confidence.

- Dive into the specifics of R&G PharmaStudies here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that R&G PharmaStudies is trading beyond its estimated value.

Make It Happen

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1460 more companies for you to explore.Click here to unveil our expertly curated list of 1463 Fast Growing Companies With High Insider Ownership.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301333

R&G PharmaStudies

Provides clinical research outsourcing services for pharmaceutical and medical device companies, and scientific research institutions in China.

Excellent balance sheet with reasonable growth potential.