As global markets navigate a choppy start to the year, driven by inflation concerns and political uncertainties, small-cap stocks have notably underperformed, with the Russell 2000 Index slipping into correction territory. In this environment, identifying high-growth tech stocks requires careful consideration of companies that can demonstrate resilience amid economic fluctuations and possess innovative capabilities that align with evolving market demands.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.18% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.47% | 56.58% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 29.58% | 61.86% | ★★★★★★ |

Click here to see the full list of 1228 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Q Technology (Group) (SEHK:1478)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Q Technology (Group) Company Limited is an investment holding company involved in designing, researching and developing, manufacturing, and selling camera and fingerprint recognition modules across Mainland China, Hong Kong, India, and internationally, with a market capitalization of HK$6.65 billion.

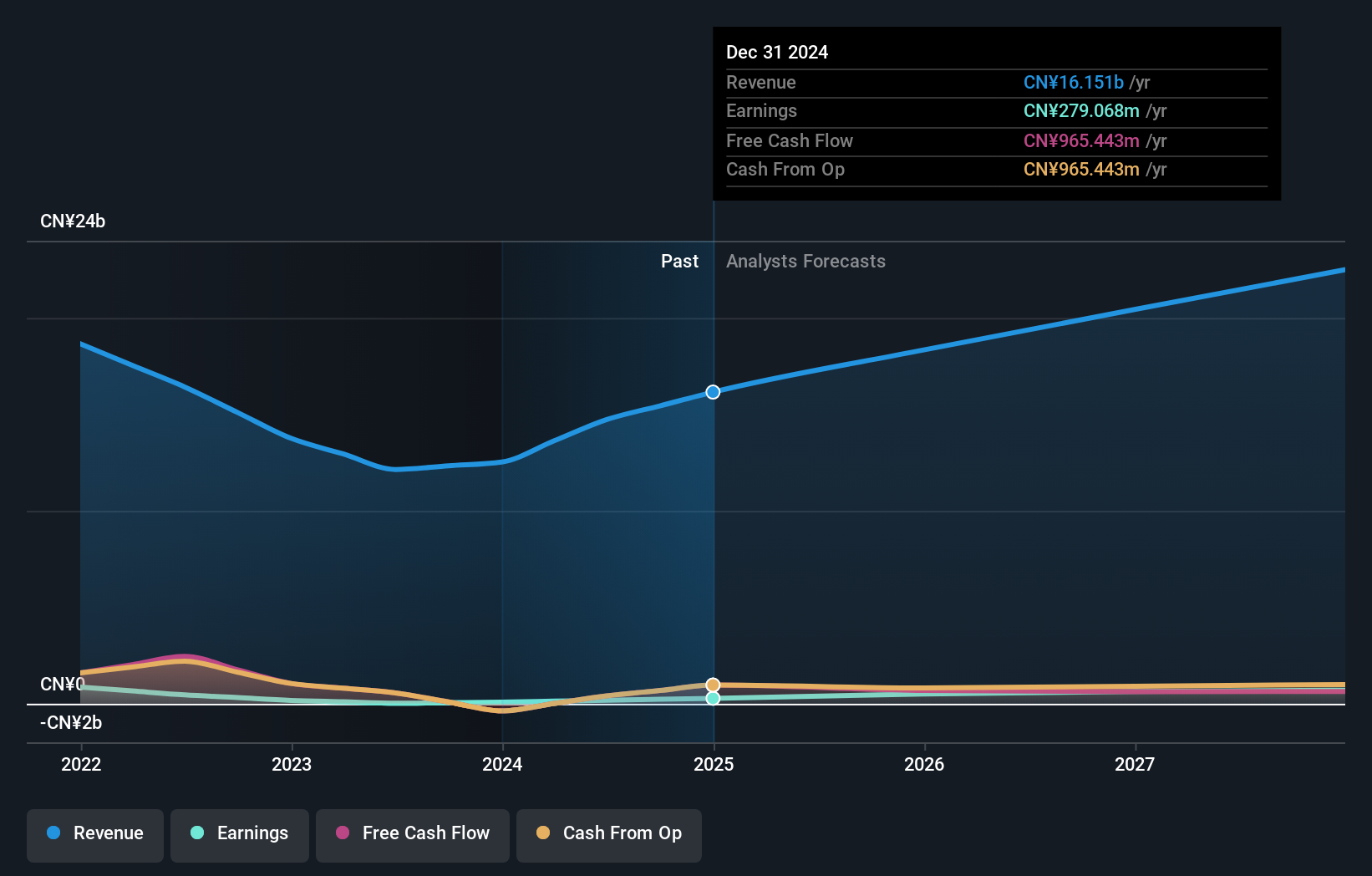

Operations: The company's primary revenue stream is from camera modules, generating CN¥13.79 billion, while fingerprint recognition modules contribute CN¥781.23 million. The business focuses on the design and manufacture of these technologies across several key markets globally.

Q Technology (Group) has demonstrated robust performance in the tech sector, particularly with its camera and fingerprint recognition modules. In recent updates, the company reported significant sales volumes: 41.6 million camera modules and 19.5 million fingerprint modules for November 2024 alone, underscoring a strong demand trajectory in mobile and other fields. Financially, Q Technology is on a growth path with earnings expected to surge by 35.7% annually, outpacing the broader Hong Kong market's forecast of 10.6%. This performance is supported by an impressive past year's earnings growth of 583.8%, significantly higher than the industry average of 11.7%. Despite these strengths, it's crucial to note that its projected revenue growth rate stands at 7.5% per year—modest compared to high-growth benchmarks but still ahead of market averages. The company’s investment in research and development (R&D) is pivotal for maintaining its competitive edge in technology innovation; however specific R&D expenditure figures are not disclosed here for a more detailed analysis of investment trends relative to revenue or overall expenses.

- Navigate through the intricacies of Q Technology (Group) with our comprehensive health report here.

Explore historical data to track Q Technology (Group)'s performance over time in our Past section.

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited is an investment holding company that provides value-added services, online advertising, fintech, and business services both in China and internationally, with a market capitalization of approximately HK$3.38 trillion.

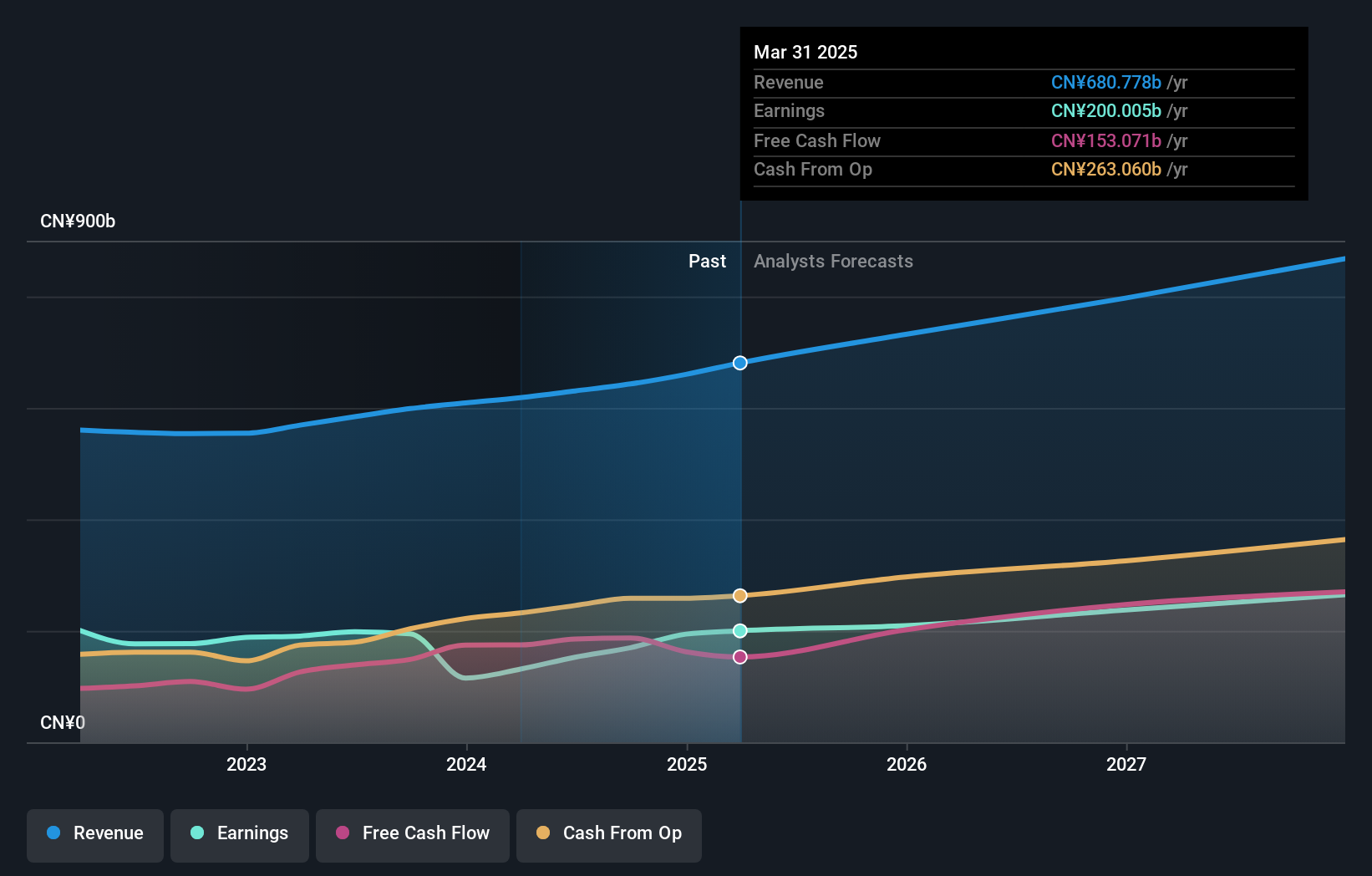

Operations: Value-added services (VAS) are the largest revenue segment for Tencent, generating CN¥309.23 billion, followed by fintech and business services at CN¥210.21 billion, and marketing services at CN¥116.16 billion.

Tencent Holdings has been actively enhancing its technological footprint, evident from the launch of CarbonX Program 2.0 aimed at fostering climate technologies for a net-zero future. This initiative not only underscores Tencent's commitment to 'Tech for Good' but also aligns with global sustainability goals, potentially opening new revenue streams in green tech. Financially, the company's robust performance continues with a significant year-on-year increase in Q3 revenues to CNY 167.19 billion and net income rising to CNY 53.23 billion. The strategic share repurchase further reflects confidence in its growth trajectory, having bought back shares worth HKD 65.42 billion recently, signaling strong future prospects amidst expanding market presence and innovation-driven strategies.

- Get an in-depth perspective on Tencent Holdings' performance by reading our health report here.

Assess Tencent Holdings' past performance with our detailed historical performance reports.

Sino BiologicalInc (SZSE:301047)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sino Biological, Inc. specializes in supplying recombinant protein and antibody reagents to life science researchers globally, with a market cap of CN¥7.06 billion.

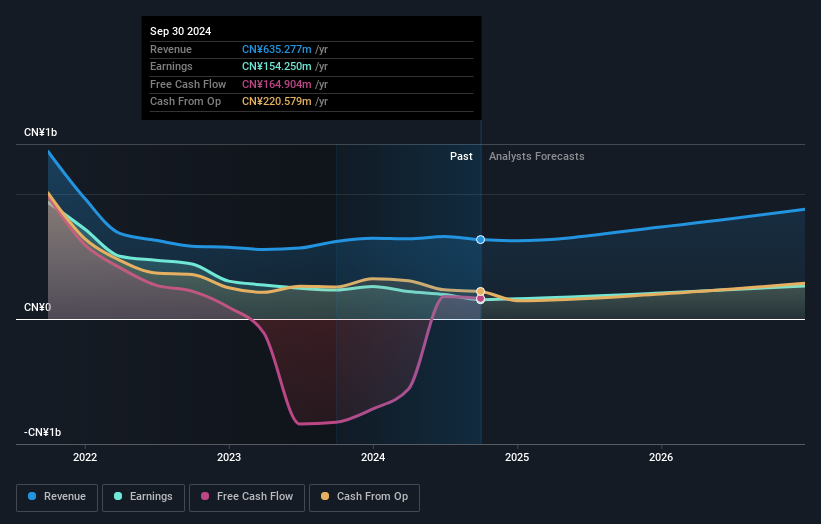

Operations: Sino Biological, Inc. generates revenue primarily from research and experimental development, amounting to CN¥635.28 million. The company focuses on providing essential reagents for life science research worldwide.

Sino BiologicalInc., despite recent setbacks including its removal from key indices, continues to demonstrate resilience with a forecasted revenue growth of 15.6% per year, outpacing the CN market's 13.3%. This growth is underpinned by a robust R&D commitment, crucial for maintaining competitiveness in the biotech sector. The firm has also completed significant share repurchases amounting to CNY 253.3 million, underscoring confidence in its operational strategy and future prospects despite a downturn in net income and earnings per share over the last nine months.

- Click here and access our complete health analysis report to understand the dynamics of Sino BiologicalInc.

Understand Sino BiologicalInc's track record by examining our Past report.

Summing It All Up

- Click here to access our complete index of 1228 High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301047

Sino BiologicalInc

Provides recombinant protein and antibody reagents for life science researchers worldwide.

Excellent balance sheet low.

Market Insights

Community Narratives