Xinjiang Tianshan Animal Husbandry Bio-engineering Co., Ltd. (SZSE:300313) Investors Are Less Pessimistic Than Expected

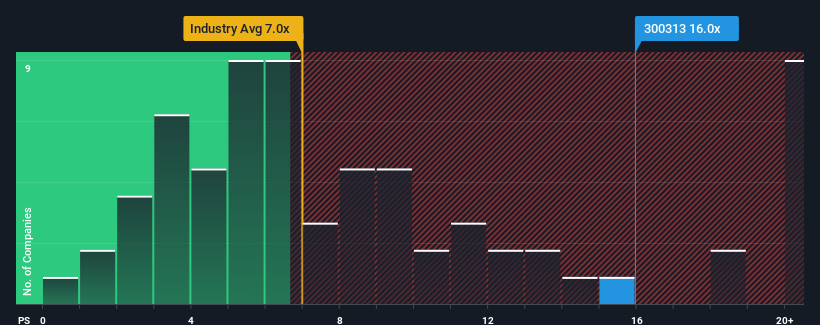

When close to half the companies in the Biotechs industry in China have price-to-sales ratios (or "P/S") below 7x, you may consider Xinjiang Tianshan Animal Husbandry Bio-engineering Co., Ltd. (SZSE:300313) as a stock to avoid entirely with its 16x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Xinjiang Tianshan Animal Husbandry Bio-engineering

What Does Xinjiang Tianshan Animal Husbandry Bio-engineering's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Xinjiang Tianshan Animal Husbandry Bio-engineering has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Xinjiang Tianshan Animal Husbandry Bio-engineering, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Xinjiang Tianshan Animal Husbandry Bio-engineering?

In order to justify its P/S ratio, Xinjiang Tianshan Animal Husbandry Bio-engineering would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 48%. The strong recent performance means it was also able to grow revenue by 48% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 230% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that Xinjiang Tianshan Animal Husbandry Bio-engineering's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Xinjiang Tianshan Animal Husbandry Bio-engineering revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Xinjiang Tianshan Animal Husbandry Bio-engineering with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Xinjiang Tianshan Animal Husbandry Bio-engineering, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Xinjiang Tianshan Animal Husbandry Bio-engineering, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300313

Xinjiang Tianshan Animal Husbandry Bio-engineering

Xinjiang Tianshan Animal Husbandry Bio-engineering Co., Ltd.

Mediocre balance sheet minimal.

Market Insights

Community Narratives