What Xinjiang Tianshan Animal Husbandry Bio-engineering Co., Ltd.'s (SZSE:300313) 44% Share Price Gain Is Not Telling You

Xinjiang Tianshan Animal Husbandry Bio-engineering Co., Ltd. (SZSE:300313) shareholders are no doubt pleased to see that the share price has bounced 44% in the last month, although it is still struggling to make up recently lost ground. The last 30 days bring the annual gain to a very sharp 73%.

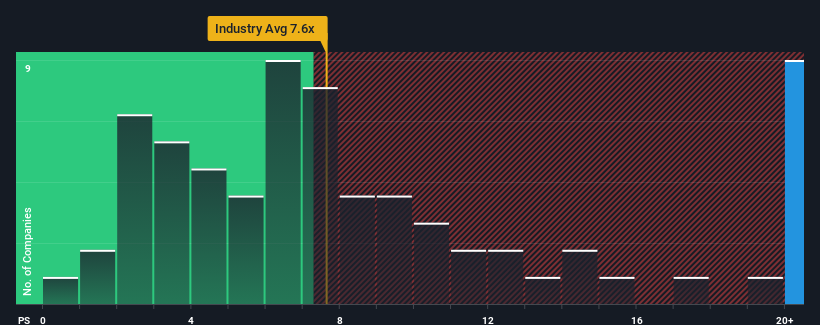

Following the firm bounce in price, given around half the companies in China's Biotechs industry have price-to-sales ratios (or "P/S") below 7.6x, you may consider Xinjiang Tianshan Animal Husbandry Bio-engineering as a stock to avoid entirely with its 23.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Xinjiang Tianshan Animal Husbandry Bio-engineering

How Has Xinjiang Tianshan Animal Husbandry Bio-engineering Performed Recently?

Xinjiang Tianshan Animal Husbandry Bio-engineering certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Xinjiang Tianshan Animal Husbandry Bio-engineering, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Xinjiang Tianshan Animal Husbandry Bio-engineering's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Xinjiang Tianshan Animal Husbandry Bio-engineering's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 53%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 49% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 167% shows it's an unpleasant look.

With this in mind, we find it worrying that Xinjiang Tianshan Animal Husbandry Bio-engineering's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Xinjiang Tianshan Animal Husbandry Bio-engineering's P/S?

The strong share price surge has lead to Xinjiang Tianshan Animal Husbandry Bio-engineering's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Xinjiang Tianshan Animal Husbandry Bio-engineering currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

Plus, you should also learn about these 2 warning signs we've spotted with Xinjiang Tianshan Animal Husbandry Bio-engineering.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Xinjiang Tianshan Animal Husbandry Bio-engineering, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300313

Xinjiang Tianshan Animal Husbandry Bio-engineering

Xinjiang Tianshan Animal Husbandry Bio-engineering Co., Ltd.

Mediocre balance sheet minimal.

Market Insights

Community Narratives