- China

- /

- Medical Equipment

- /

- SHSE:600587

Undiscovered Gems Three Small Cap Stocks With Promising Potential

Reviewed by Simply Wall St

In a week marked by a flurry of earnings reports and economic data, small-cap stocks demonstrated resilience compared to their large-cap counterparts, despite broader market indices like the Nasdaq Composite and S&P MidCap 400 experiencing volatility. As global markets navigate these turbulent conditions, identifying promising small-cap stocks can offer unique opportunities for investors seeking growth potential in an uncertain environment. A good stock in this context often exhibits strong fundamentals, adaptability to economic shifts, and the ability to capitalize on niche market opportunities that larger companies might overlook.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Thai Energy Storage Technology | 11.21% | -1.12% | 0.18% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Piccadily Agro Industries | 50.57% | 13.86% | 42.85% | ★★★★★☆ |

| Nibe | 39.26% | 80.75% | 84.69% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Petchsrivichai Enterprise | 31.46% | -14.18% | nan | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Shinva Medical InstrumentLtd (SHSE:600587)

Simply Wall St Value Rating: ★★★★★★

Overview: Shinva Medical Instrument Co., Ltd. offers a range of medical instruments and equipment in the People’s Republic of China with a market capitalization of CN¥10.74 billion.

Operations: Shinva generates revenue primarily from its medical instruments and equipment segment. The company has reported a gross profit margin of 25.6%.

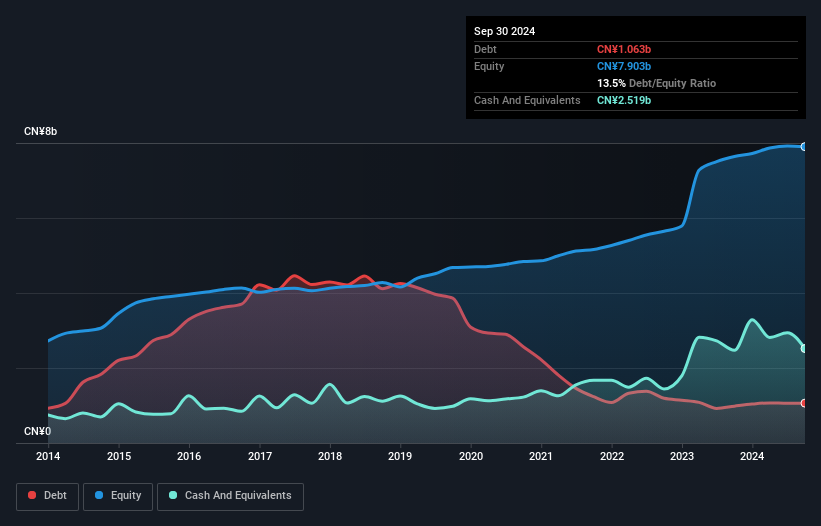

Shinva Medical Instrument, a promising player in the medical equipment sector, shows a strong financial profile with its price-to-earnings ratio at 16.2x, notably lower than the CN market average of 35.6x. Over the past year, earnings grew by 5.1%, outpacing the industry which saw an -8.8% change. The company has successfully reduced its debt to equity ratio from 82.5% to 13.5% over five years and reported net income of CNY 617 million for nine months ending September 2024, up from CNY 578 million last year, reflecting robust operational performance and strategic debt management.

Jiangnan Mould & Plastic Technology (SZSE:000700)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangnan Mould & Plastic Technology Co., Ltd. operates in the manufacturing sector, focusing on the production of moulds and plastic products, with a market cap of CN¥6.63 billion.

Operations: Jiangnan Mould & Plastic Technology generates revenue primarily through its manufacturing of moulds and plastic products. The company's financial performance is reflected in its market capitalization of CN¥6.63 billion, indicating a significant presence in the sector.

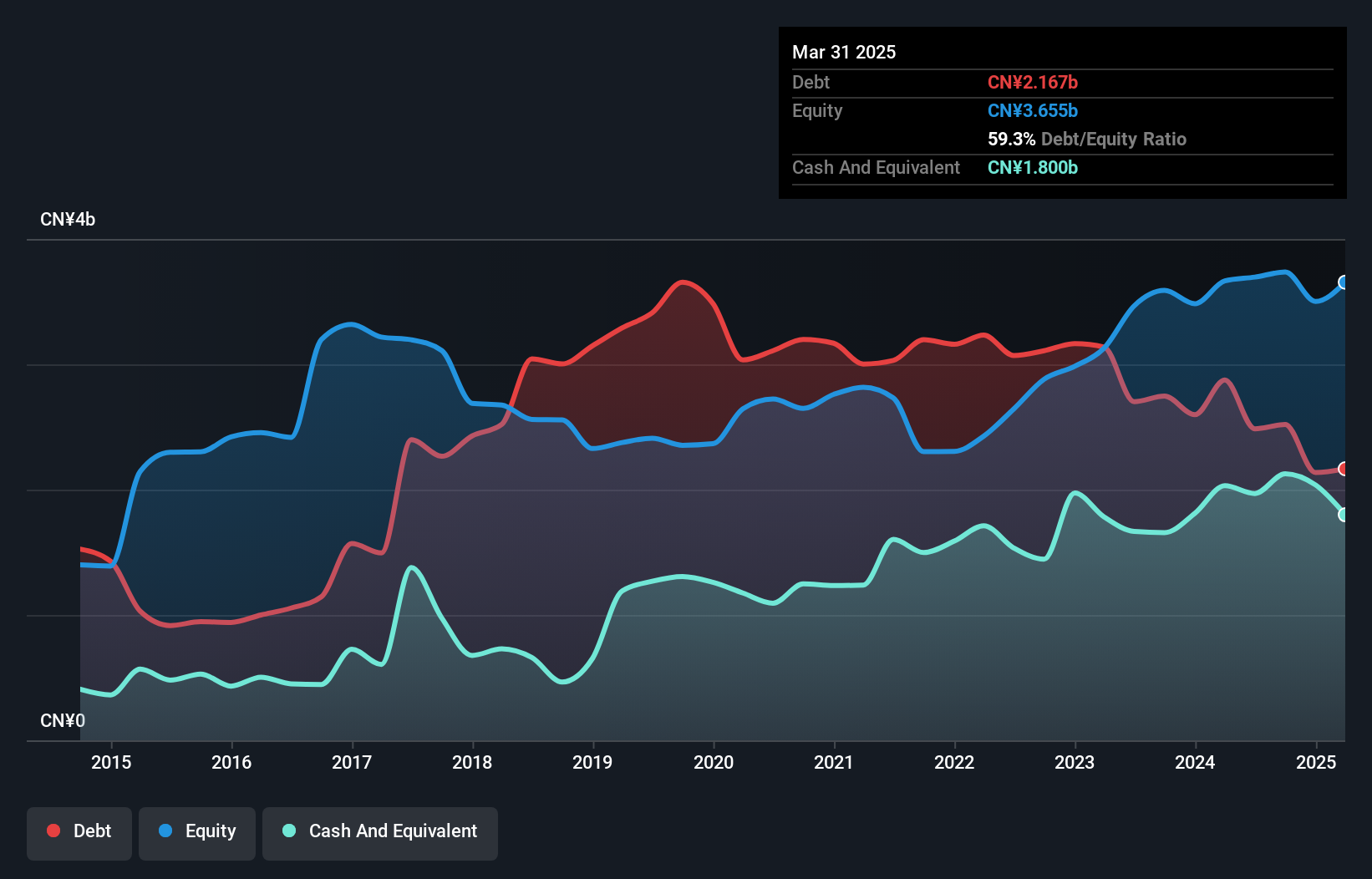

Jiangnan Mould & Plastic Technology has shown a robust performance, with its net income rising to CNY 539.12 million for the nine months ending September 2024, up from CNY 413.05 million the previous year. Despite a dip in sales to CNY 5.25 billion from CNY 6.12 billion, earnings per share increased to CNY 0.587 from CNY 0.45, reflecting improved profitability and operational efficiency within the auto components industry where it outpaces peers with a remarkable earnings growth of 17%. The company also reduced its debt-to-equity ratio significantly over five years, enhancing financial stability and value potential by trading below estimated fair value by about one-third.

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Jolly Pharmaceutical Co., LTD focuses on the research, production, and marketing of Chinese medicinal products both domestically and internationally, with a market capitalization of CN¥11 billion.

Operations: Zhejiang Jolly Pharmaceutical generates revenue primarily from the sale of Chinese medicinal products. The company's net profit margin is a key financial metric, reflecting its profitability after accounting for all expenses.

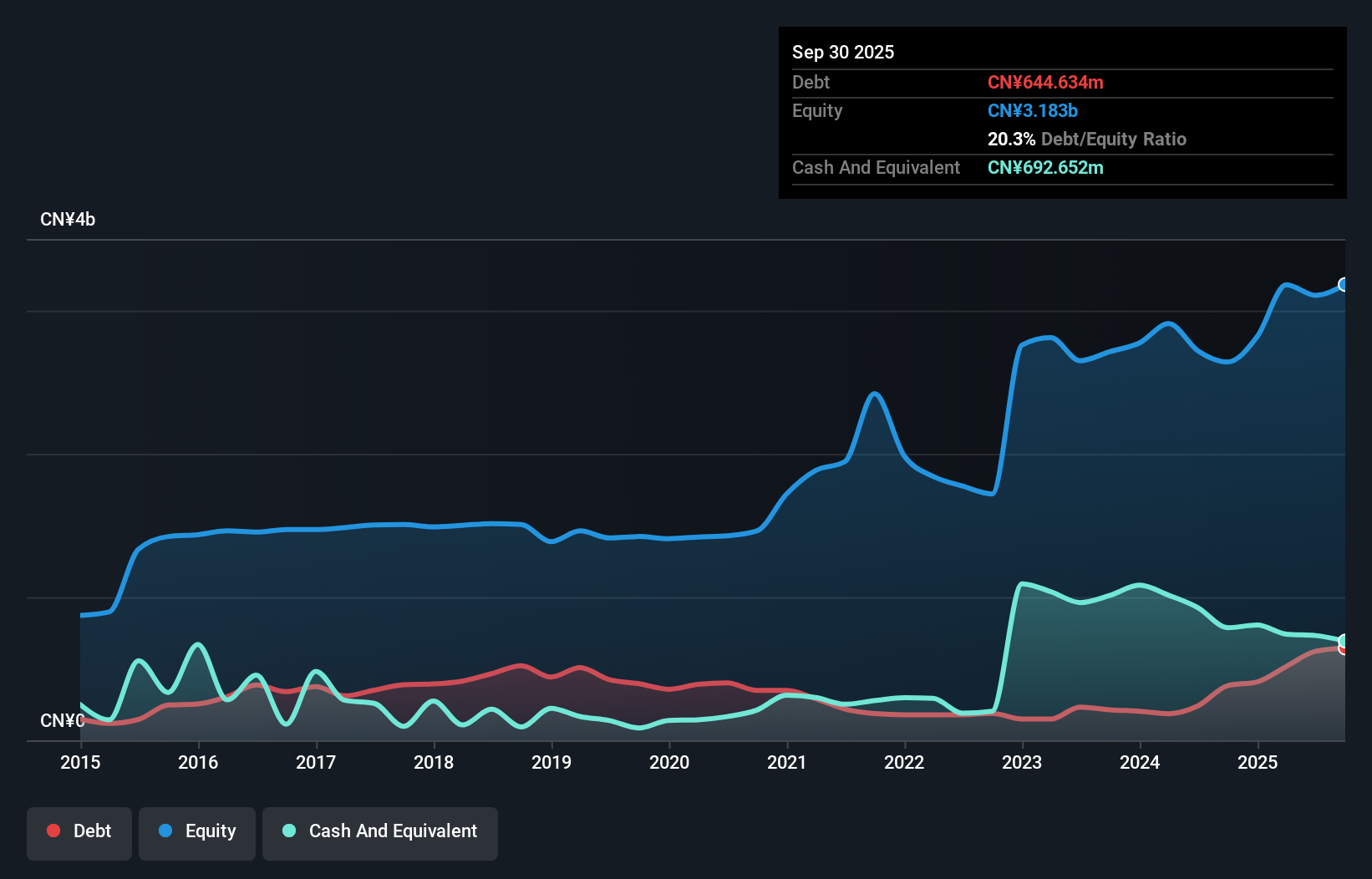

Zhejiang Jolly Pharmaceutical, a promising player in the industry, has shown impressive earnings growth of 45.4% over the past year, outpacing the broader pharmaceuticals sector. This company is trading at a good value, being 58.4% below its estimated fair value and boasts high-quality earnings with more cash than total debt. Recent financials reveal sales of CNY 2.04 billion for nine months ending September 2024, up from CNY 1.46 billion last year; net income rose to CNY 421 million from CNY 287 million previously. Notably, it repurchased shares worth CNY 204 million recently, enhancing shareholder value further.

Where To Now?

- Gain an insight into the universe of 4702 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600587

Shinva Medical InstrumentLtd

Provides medical devices, pharmaceutical equipment, medical services, and medical trade in the People’s Republic of China.

Flawless balance sheet established dividend payer.