Top Growth Companies With Strong Insider Ownership December 2024

Reviewed by Simply Wall St

As global markets navigate a challenging landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are keenly observing the implications of recent rate cuts and economic data. Amidst this backdrop, identifying growth companies with strong insider ownership can provide valuable insights into potential resilience and confidence within these firms. In such an environment, high insider ownership often signals alignment between management and shareholder interests, offering a layer of assurance in times of market volatility.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 25.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's uncover some gems from our specialized screener.

Zhejiang XCC GroupLtd (SHSE:603667)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang XCC Group Co., Ltd specializes in the research, development, manufacture, and sale of bearings across the United States, Japan, Korea, Brazil, and other international markets with a market cap of approximately CN¥9.82 billion.

Operations: The company generates its revenue primarily from the research, development, manufacturing, and sales of bearings in various international markets including the United States, Japan, Korea, and Brazil.

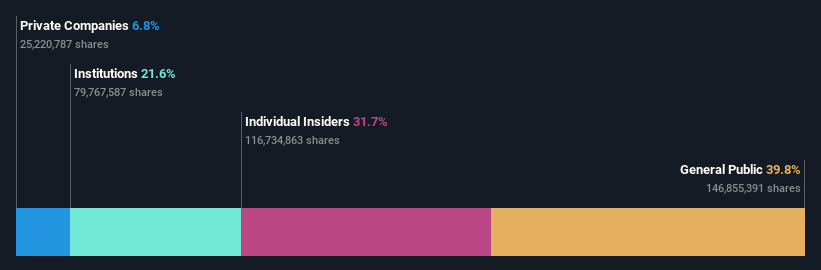

Insider Ownership: 31.7%

Zhejiang XCC Group Ltd. shows potential as a growth company with high insider ownership, despite recent earnings challenges. For the nine months ended September 2024, net income declined to CNY 98.23 million from CNY 122.77 million year-on-year, with basic EPS dropping to CNY 0.27 from CNY 0.37. However, its earnings are expected to grow significantly at an annual rate of 28.5%, outpacing the broader Chinese market's forecasted growth of 25.4%.

- Click to explore a detailed breakdown of our findings in Zhejiang XCC GroupLtd's earnings growth report.

- The analysis detailed in our Zhejiang XCC GroupLtd valuation report hints at an inflated share price compared to its estimated value.

Hangzhou Jingye Intelligent Technology (SHSE:688290)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hangzhou Jingye Intelligent Technology Co., Ltd. operates in the intelligent technology sector with a market capitalization of CN¥4.11 billion.

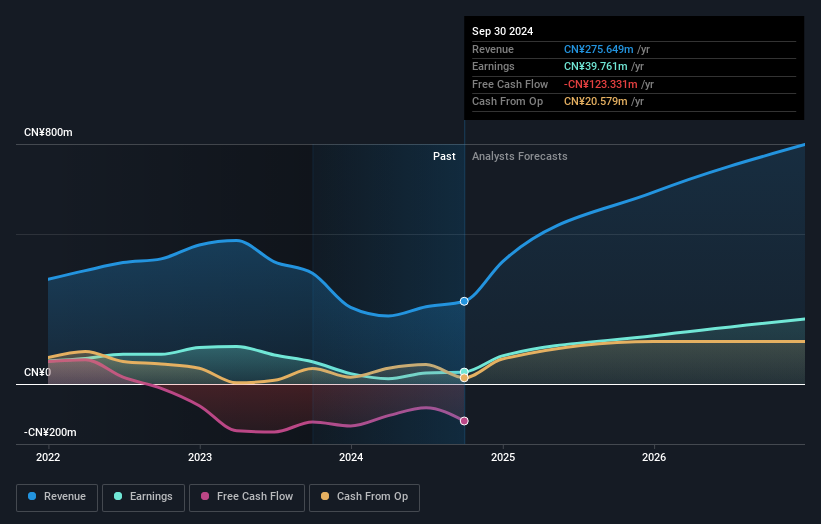

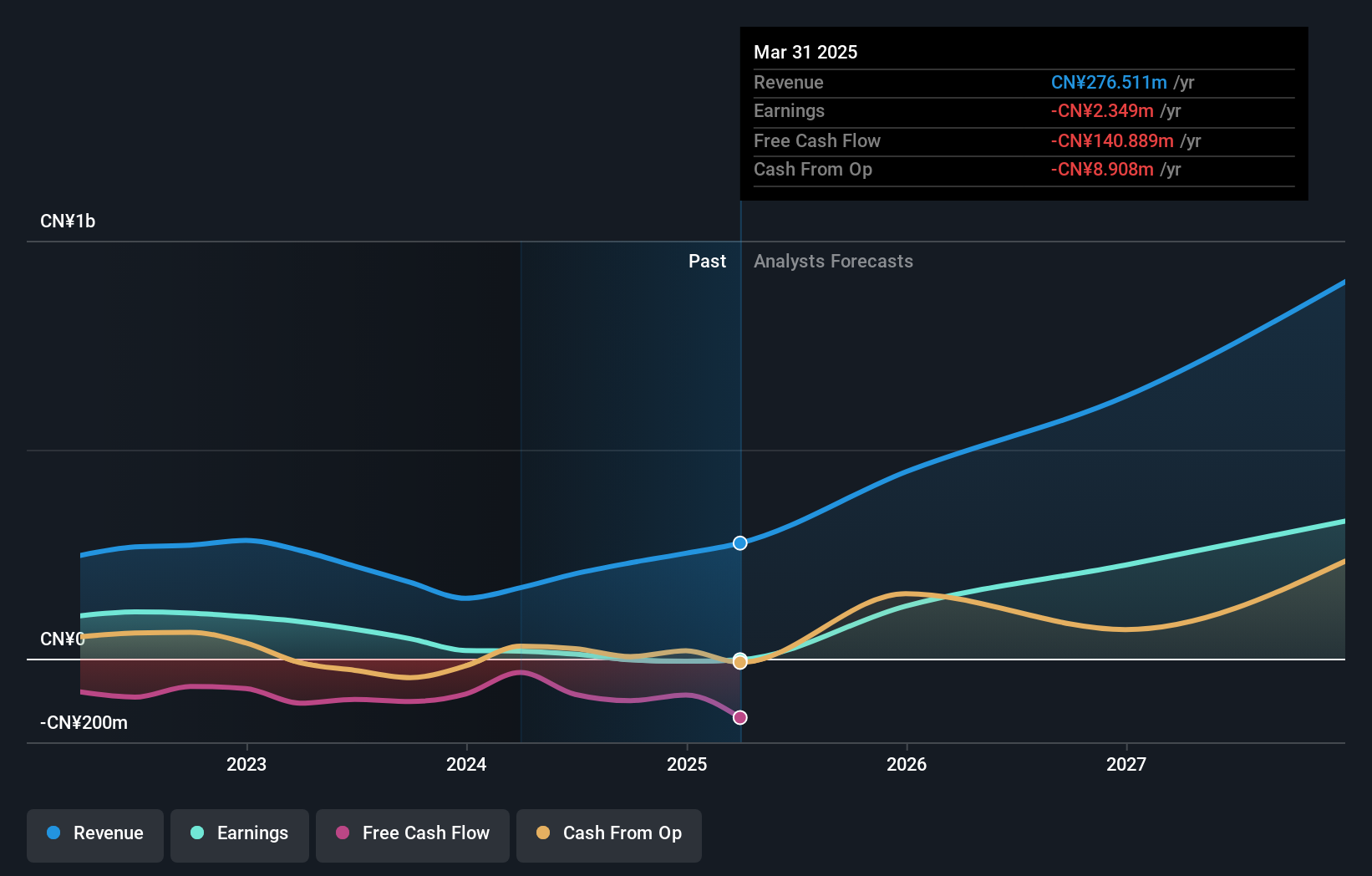

Operations: The company's revenue is primarily derived from its Machinery & Industrial Equipment segment, which amounts to CN¥275.65 million.

Insider Ownership: 33.5%

Hangzhou Jingye Intelligent Technology's recent earnings demonstrate strong growth, with net income rising to CNY 7.06 million from CNY 1.99 million year-on-year. Revenue increased to CNY 149.28 million, reflecting robust performance despite a highly volatile share price recently. Forecasts suggest significant annual earnings growth of 58.1%, surpassing the broader Chinese market's expectations, while revenue is projected to grow at an impressive rate of 42.7% annually, indicating substantial potential for future expansion.

- Navigate through the intricacies of Hangzhou Jingye Intelligent Technology with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Hangzhou Jingye Intelligent Technology shares in the market.

Yuanjie Semiconductor Technology (SHSE:688498)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yuanjie Semiconductor Technology Co., Ltd. operates in the semiconductor industry and has a market capitalization of approximately CN¥11.28 billion.

Operations: Unfortunately, the provided text does not include specific details about Yuanjie Semiconductor Technology's revenue segments.

Insider Ownership: 27.8%

Yuanjie Semiconductor Technology is experiencing substantial revenue growth, with recent sales rising to CNY 178.18 million from CNY 93.19 million year-on-year, despite a net loss of CNY 0.55 million compared to previous profits. The company forecasts robust annual revenue growth of 45.8%, outpacing the Chinese market average, and aims for profitability within three years. Although share prices have been volatile recently, no significant insider trading activity has been reported over the past three months.

- Get an in-depth perspective on Yuanjie Semiconductor Technology's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Yuanjie Semiconductor Technology's share price might be on the expensive side.

Turning Ideas Into Actions

- Delve into our full catalog of 1511 Fast Growing Companies With High Insider Ownership here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang XCC GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603667

Zhejiang XCC GroupLtd

Engages in the research, development, manufacture, and sale of bearings in the United States, Japan, Korea, Brazil, and internationally.

Excellent balance sheet with reasonable growth potential.