3 Growth Companies To Watch With At Least 17% Insider Ownership

Reviewed by Simply Wall St

In a week marked by cautious commentary from the Federal Reserve and looming political uncertainties, global markets have experienced notable volatility, with U.S. stocks seeing broad-based declines amid tempered expectations for future rate cuts. Despite these challenges, opportunities for growth remain as investors look towards companies with strong insider ownership—a factor often indicative of confidence and alignment between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 25.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's uncover some gems from our specialized screener.

Anhui Estone Materials TechnologyLtd (SHSE:688733)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anhui Estone Materials Technology Co., Ltd specializes in the production of lithium battery coatings, electronic communication functional fillings, and low-smoke halogen-free flame-retardant materials in China, with a market cap of CN¥4.34 billion.

Operations: The company's revenue is primarily derived from its specialty chemicals segment, which generated CN¥491.84 million.

Insider Ownership: 33.4%

Anhui Estone Materials Technology Ltd. exhibits strong growth potential, with earnings forecast to grow significantly at 59.1% annually, outpacing the Chinese market average. Despite a recent drop from the S&P Global BMI Index and volatile share prices, revenue is expected to rise by 39.4% per year, exceeding market expectations. However, profit margins have declined over the past year and return on equity is projected to be low in three years at 5%.

- Click to explore a detailed breakdown of our findings in Anhui Estone Materials TechnologyLtd's earnings growth report.

- Our valuation report unveils the possibility Anhui Estone Materials TechnologyLtd's shares may be trading at a premium.

Hunan Zhongke Electric (SZSE:300035)

Simply Wall St Growth Rating: ★★★★★☆

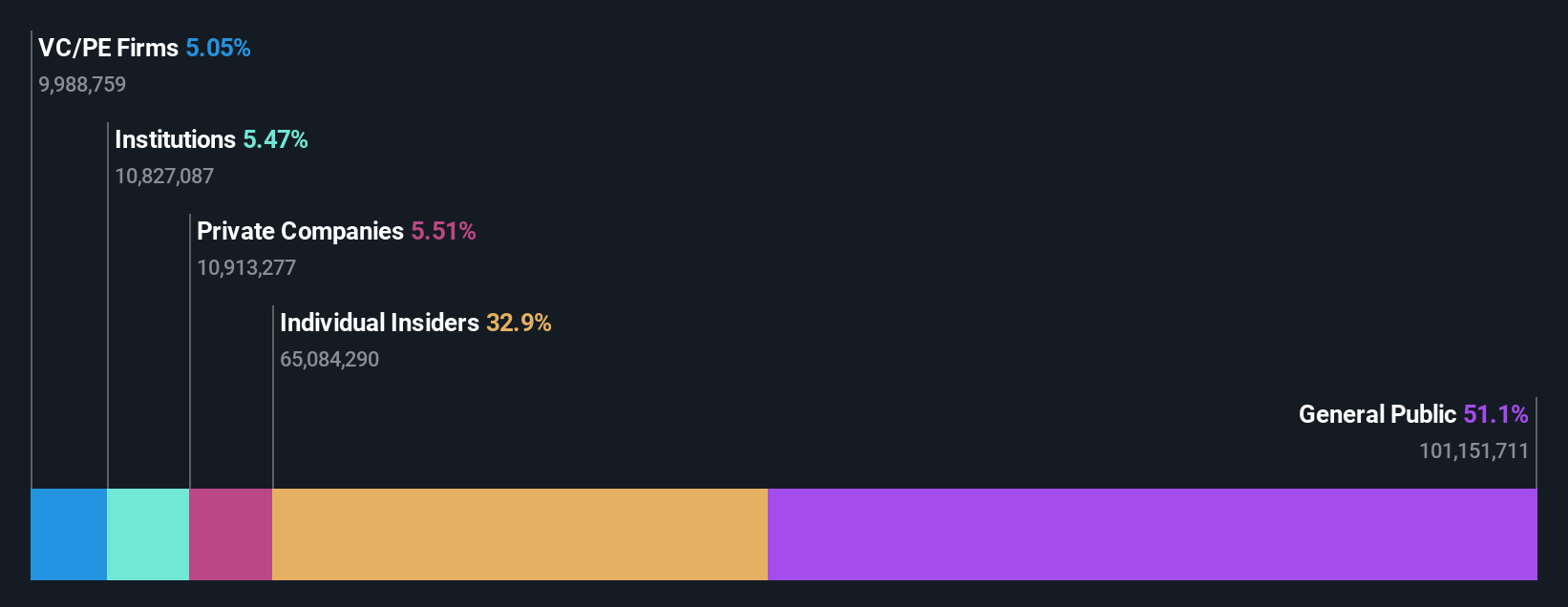

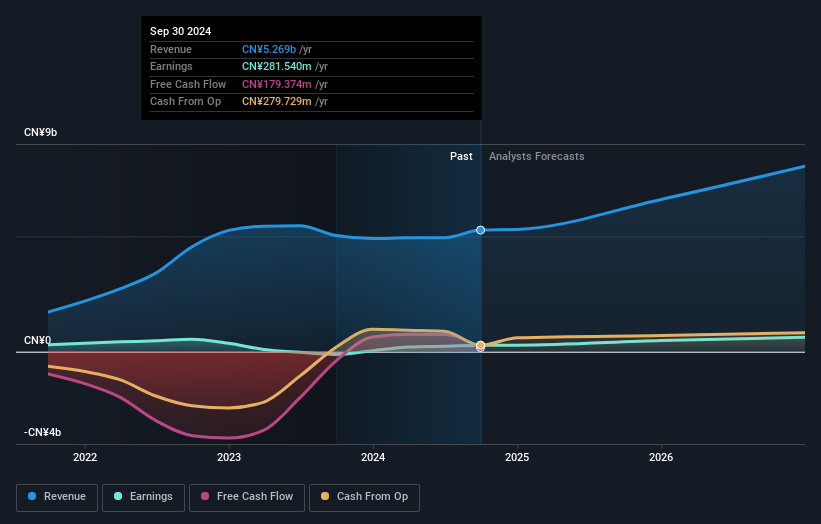

Overview: Hunan Zhongke Electric Co., Ltd. manufactures electromagnetic metallurgy products in China and has a market cap of CN¥9.77 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment details for Hunan Zhongke Electric Co., Ltd. Please provide the necessary information to summarize its revenue segments accurately.

Insider Ownership: 20.1%

Hunan Zhongke Electric demonstrates significant growth potential with earnings forecast to grow 39.2% annually, surpassing the Chinese market average. The company has recently become profitable, reporting a net income of CNY 183.57 million for the first nine months of 2024 compared to a loss last year. Revenue is expected to grow at 20% per year, outpacing market expectations, though share price volatility and low return on equity projections remain concerns.

- Delve into the full analysis future growth report here for a deeper understanding of Hunan Zhongke Electric.

- The valuation report we've compiled suggests that Hunan Zhongke Electric's current price could be inflated.

Inner Mongolia Furui Medical Science (SZSE:300049)

Simply Wall St Growth Rating: ★★★★★☆

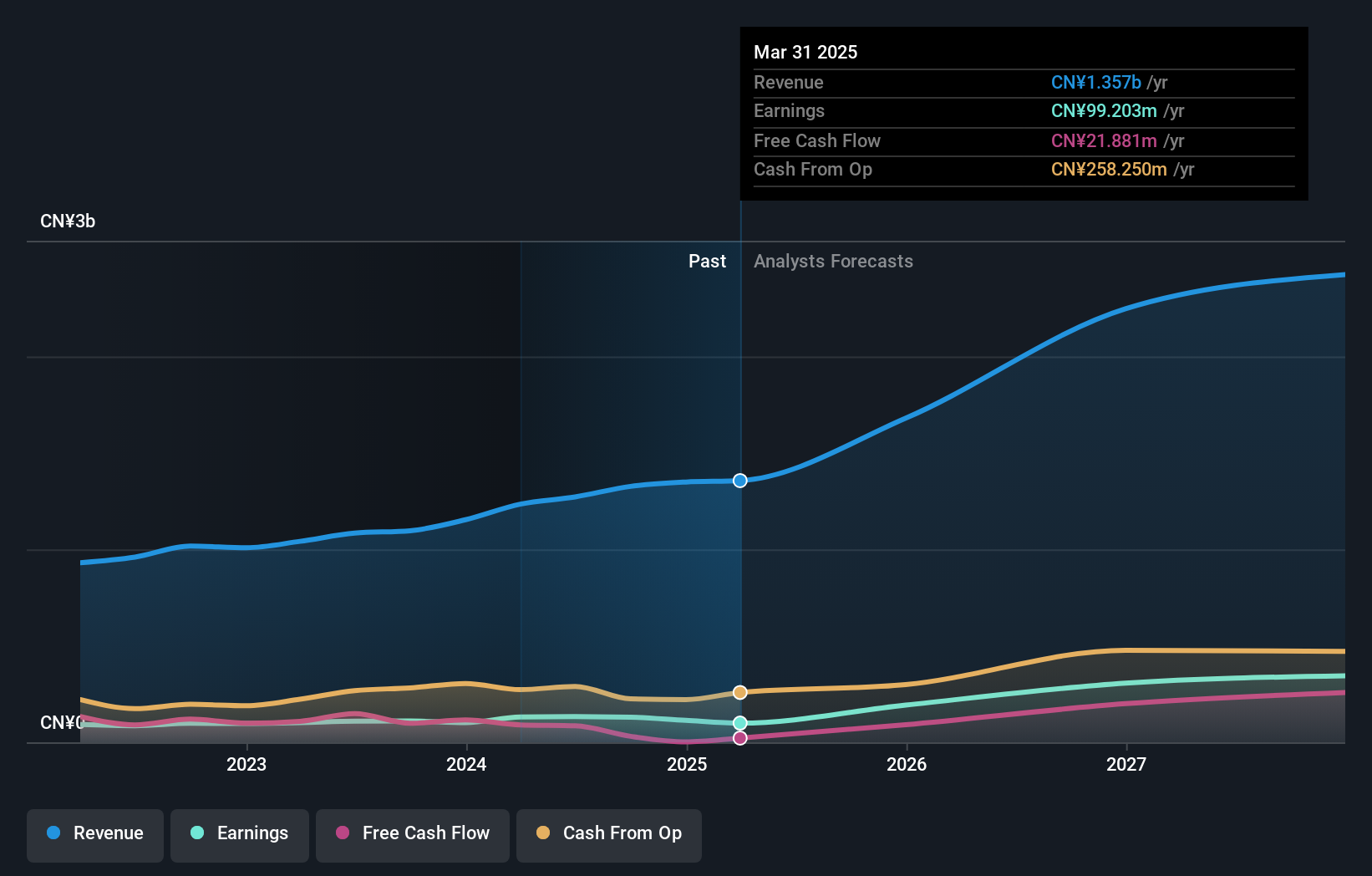

Overview: Inner Mongolia Furui Medical Science Co., Ltd. operates in the medical science industry and has a market cap of CN¥9.02 billion.

Operations: Inner Mongolia Furui Medical Science Co., Ltd. does not have specified revenue segments provided in the available text.

Insider Ownership: 17.4%

Inner Mongolia Furui Medical Science is poised for strong growth, with earnings expected to increase significantly at 46.2% annually, outpacing the Chinese market average. Recent financial results show a rise in net income to CNY 102 million for the first nine months of 2024 from CNY 73.16 million a year earlier, alongside revenue growth from CNY 807 million to CNY 979.86 million. Despite low future return on equity forecasts, insider ownership remains stable without substantial recent trading activity.

- Click here to discover the nuances of Inner Mongolia Furui Medical Science with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Inner Mongolia Furui Medical Science is priced higher than what may be justified by its financials.

Key Takeaways

- Get an in-depth perspective on all 1511 Fast Growing Companies With High Insider Ownership by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688733

Anhui Estone Materials TechnologyLtd

Provides lithium battery coating, electronic communication functional filling, and low-smoke halogen-free flame-retardant materials in China.

High growth potential with mediocre balance sheet.