Investors Still Aren't Entirely Convinced By Hefei Lifeon Pharmaceutical Co., Ltd.'s (SZSE:003020) Earnings Despite 25% Price Jump

Hefei Lifeon Pharmaceutical Co., Ltd. (SZSE:003020) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 37% over that time.

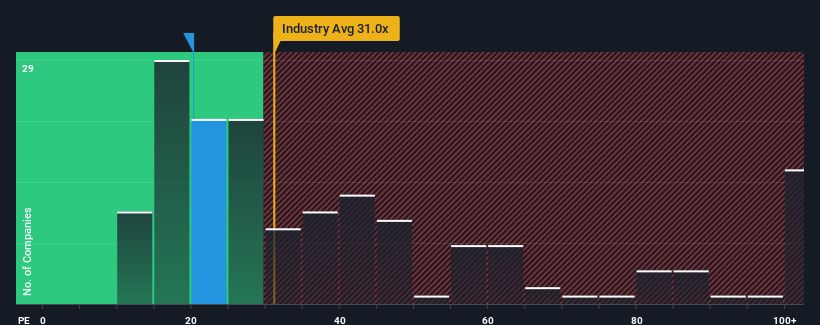

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 33x, you may still consider Hefei Lifeon Pharmaceutical as an attractive investment with its 20.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Hefei Lifeon Pharmaceutical could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Hefei Lifeon Pharmaceutical

How Is Hefei Lifeon Pharmaceutical's Growth Trending?

In order to justify its P/E ratio, Hefei Lifeon Pharmaceutical would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 55% during the coming year according to the two analysts following the company. That's shaping up to be materially higher than the 38% growth forecast for the broader market.

In light of this, it's peculiar that Hefei Lifeon Pharmaceutical's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Hefei Lifeon Pharmaceutical's P/E?

Hefei Lifeon Pharmaceutical's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Hefei Lifeon Pharmaceutical's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 1 warning sign for Hefei Lifeon Pharmaceutical that you should be aware of.

Of course, you might also be able to find a better stock than Hefei Lifeon Pharmaceutical. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hefei Lifeon Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:003020

Hefei Lifeon Pharmaceutical

Engages in the research, development, production, and sale of pharmaceutical preparations and active pharmaceutical ingredients.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives