Guizhou Bailing Group Pharmaceutical Co., Ltd. (SZSE:002424) Stock's 32% Dive Might Signal An Opportunity But It Requires Some Scrutiny

The Guizhou Bailing Group Pharmaceutical Co., Ltd. (SZSE:002424) share price has fared very poorly over the last month, falling by a substantial 32%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

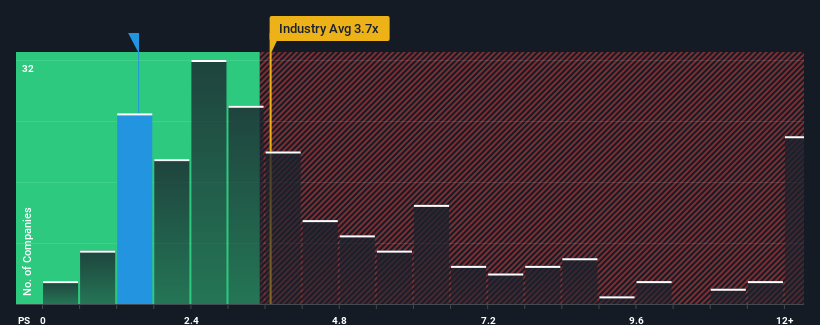

After such a large drop in price, Guizhou Bailing Group Pharmaceutical may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.5x, since almost half of all companies in the Pharmaceuticals industry in China have P/S ratios greater than 3.7x and even P/S higher than 7x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Guizhou Bailing Group Pharmaceutical

How Guizhou Bailing Group Pharmaceutical Has Been Performing

Recent times haven't been great for Guizhou Bailing Group Pharmaceutical as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guizhou Bailing Group Pharmaceutical.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Guizhou Bailing Group Pharmaceutical's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 47% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 26% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 18%, which is noticeably less attractive.

In light of this, it's peculiar that Guizhou Bailing Group Pharmaceutical's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Guizhou Bailing Group Pharmaceutical's P/S

Guizhou Bailing Group Pharmaceutical's P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Guizhou Bailing Group Pharmaceutical's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Guizhou Bailing Group Pharmaceutical you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002424

Guizhou Bailing Group Pharmaceutical

Guizhou Bailing Group Pharmaceutical Co., Ltd.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives