Spotlight On December 2024's Leading Growth Companies With Insider Ownership

Reviewed by Simply Wall St

In a global market characterized by mixed performances, with major U.S. stock indexes reaching record highs and growth stocks outpacing value shares by significant margins, investors are increasingly focusing on companies with strong growth potential and substantial insider ownership. Such companies often align management's interests with those of shareholders, a crucial factor for success in today's volatile economic environment.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 27.9% | 24.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's dive into some prime choices out of the screener.

Guangdong Zhongsheng Pharmaceutical (SZSE:002317)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangdong Zhongsheng Pharmaceutical Co., Ltd. operates in the pharmaceutical industry and has a market capitalization of approximately CN¥11.06 billion.

Operations: Guangdong Zhongsheng Pharmaceutical Co., Ltd. does not have specific revenue segments listed in the provided text.

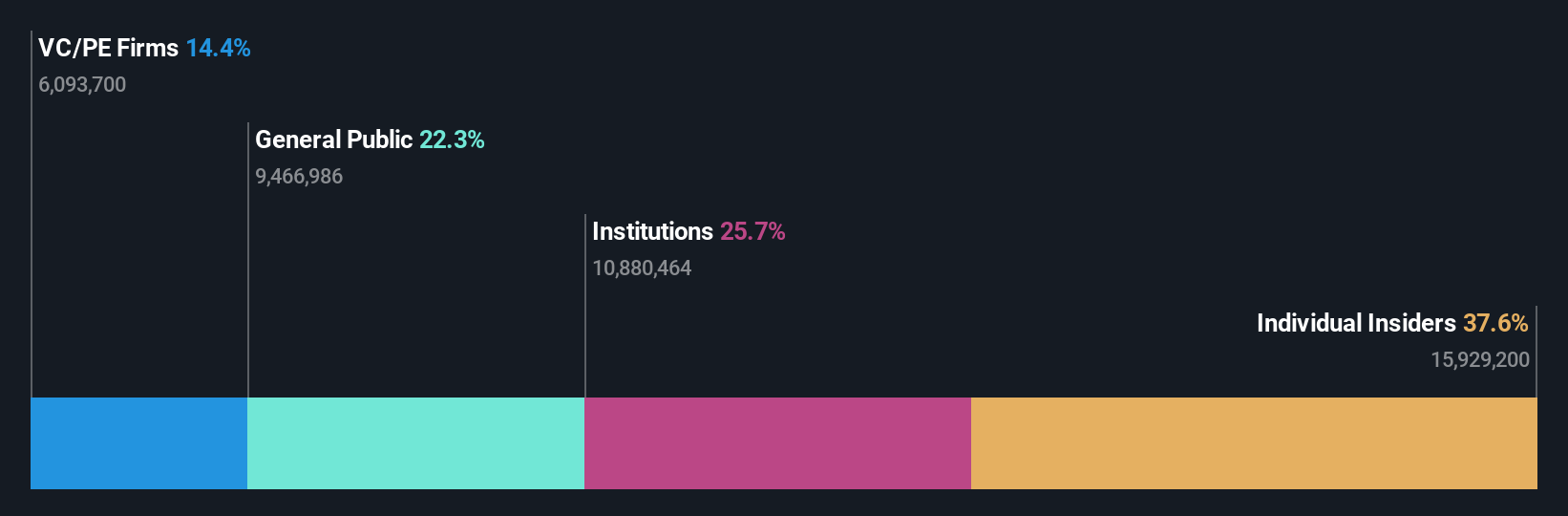

Insider Ownership: 27.8%

Earnings Growth Forecast: 41.7% p.a.

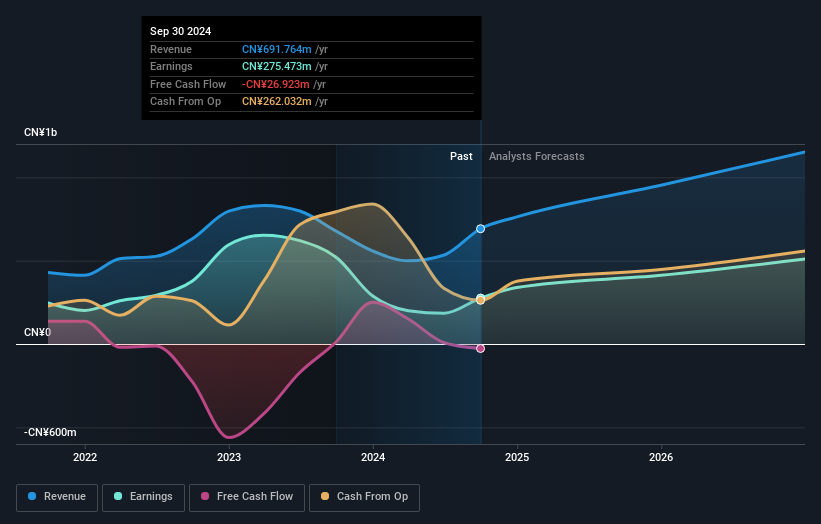

Guangdong Zhongsheng Pharmaceutical shows potential for growth with earnings forecasted to grow significantly at 41.7% annually, outpacing the broader Chinese market's 25.9%. However, recent financial performance indicates a decline, with net income dropping to CNY 148.8 million from CNY 279.5 million year-over-year as of September 2024. Revenue growth is expected at 16.3%, slower than desired for high-growth companies, and profit margins have decreased from last year’s figures, posing challenges amidst insider ownership stability.

- Click to explore a detailed breakdown of our findings in Guangdong Zhongsheng Pharmaceutical's earnings growth report.

- In light of our recent valuation report, it seems possible that Guangdong Zhongsheng Pharmaceutical is trading beyond its estimated value.

Sinofibers TechnologyLtd (SZSE:300777)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sinofibers Technology Co., Ltd. specializes in the research, development, production, and sales of high-performance carbon fibers and fabrics, with a market capitalization of CN¥12.14 billion.

Operations: The company generates revenue through its involvement in the research, development, production, and sales of advanced carbon fibers and fabrics.

Insider Ownership: 12.5%

Earnings Growth Forecast: 25.2% p.a.

Sinofibers Technology Ltd. demonstrates growth potential with revenue forecasted to increase by 22.6% annually, surpassing the Chinese market's average of 13.8%. Despite this, earnings growth at 25.2% is slightly below market expectations of 25.9%, and profit margins have decreased significantly from last year’s figures of 76.8% to 39.8%. Recent financials show increased sales but a slight decline in net income, alongside stable insider ownership and a completed share buyback worth CNY 8.22 million.

- Unlock comprehensive insights into our analysis of Sinofibers TechnologyLtd stock in this growth report.

- Upon reviewing our latest valuation report, Sinofibers TechnologyLtd's share price might be too optimistic.

Plus Alpha ConsultingLtd (TSE:4071)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plus Alpha Consulting Co., Ltd. offers marketing solutions and has a market capitalization of ¥78.95 billion.

Operations: The company generates revenue through its HR Solutions segment, contributing ¥10.13 billion, and Marketing Solutions segment, contributing ¥3.78 billion.

Insider Ownership: 39.4%

Earnings Growth Forecast: 17.4% p.a.

Plus Alpha Consulting Ltd. is positioned for growth with earnings forecasted to rise by 17.4% annually, outpacing the JP market's average of 7.9%. Despite a volatile share price, it trades at a significant discount to its estimated fair value. The company has announced a share repurchase program worth ¥3 billion and increased dividends, reflecting efforts to enhance shareholder returns and capital efficiency while maintaining stable insider ownership levels.

- Take a closer look at Plus Alpha ConsultingLtd's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Plus Alpha ConsultingLtd is trading behind its estimated value.

Make It Happen

- Investigate our full lineup of 1513 Fast Growing Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002317

Guangdong Zhongsheng Pharmaceutical

Guangdong Zhongsheng Pharmaceutical Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives