- China

- /

- Semiconductors

- /

- SHSE:688325

Undiscovered Gems with Promising Potential In February 2025

Reviewed by Simply Wall St

In the wake of recent geopolitical tensions and consumer spending concerns, global markets have experienced a turbulent period, with major indices like the S&P 500 seeing sharp fluctuations. Amidst this backdrop, small-cap stocks often present unique opportunities for investors seeking growth potential in less crowded areas of the market. Identifying a promising stock involves assessing its fundamentals, growth prospects, and resilience to broader economic pressures—qualities that can be particularly appealing in today's uncertain environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Kondotec | 11.26% | 7.01% | 7.06% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| GENOVA | 0.46% | 25.48% | 27.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Guangdong Cellwise Microelectronics (SHSE:688325)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong Cellwise Microelectronics Co., Ltd. (ticker: SHSE:688325) is a company focused on the semiconductor industry, with a market capitalization of CN¥4.34 billion.

Operations: The company generates revenue primarily from its semiconductor segment, amounting to CN¥379.37 million. It has a market capitalization of CN¥4.34 billion.

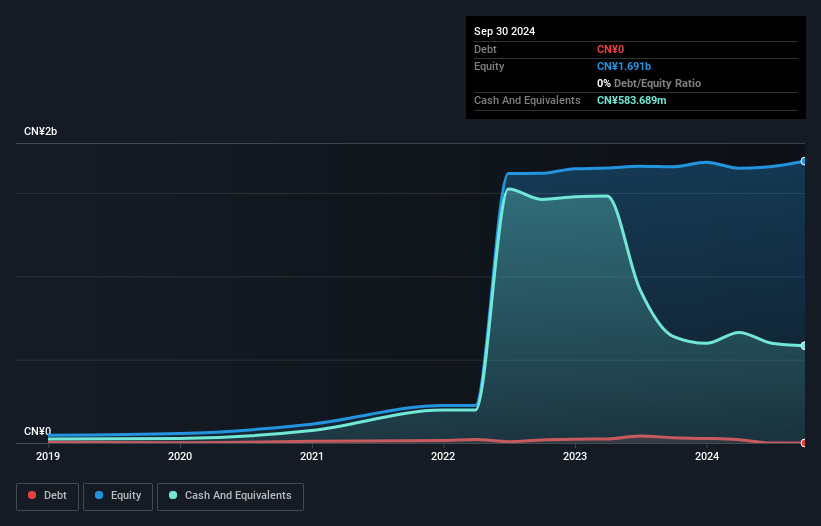

Guangdong Cellwise Microelectronics, a company in the semiconductor space, is trading at 40.2% below its estimated fair value, indicating potential undervaluation. Over the past year, its earnings surged by 122%, significantly outpacing the industry's growth of 13.9%. The firm boasts high-quality earnings and remains debt-free, a notable improvement from five years ago when it had a debt-to-equity ratio of 4.8%. Despite recent share buybacks totaling CNY 37.58 million for about 1.79% of shares, no additional repurchases occurred in early 2025 as per their latest update on January's tranche completion.

Tibet Cheezheng Tibetan Medicine (SZSE:002287)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tibet Cheezheng Tibetan Medicine Co., Ltd. specializes in the production and distribution of traditional Tibetan medicinal products, with a market cap of CN¥11.56 billion.

Operations: The company generates revenue primarily from the sale of traditional Tibetan medicinal products.

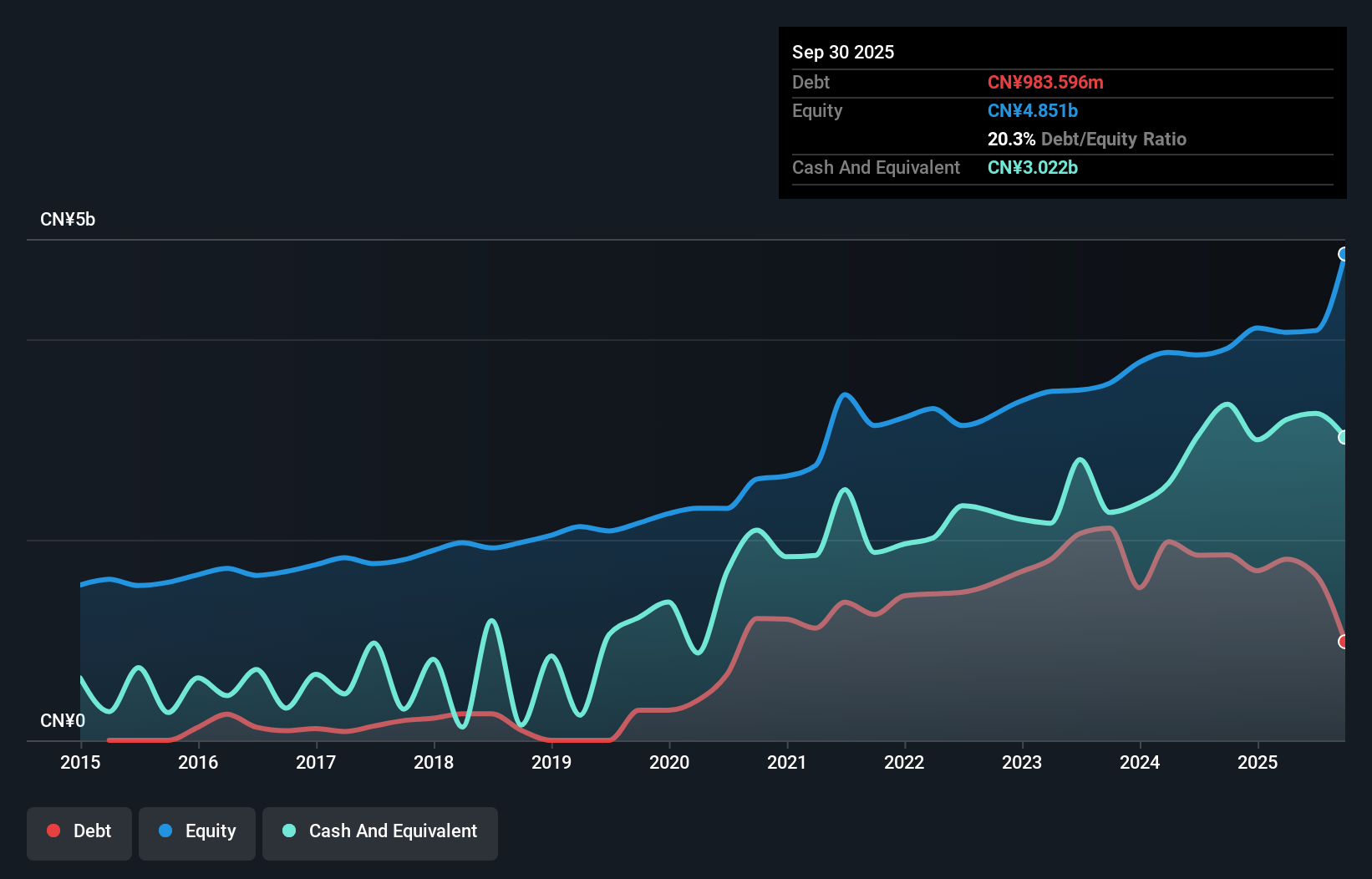

Tibet Cheezheng Tibetan Medicine, a niche player in the pharmaceuticals sector, has seen its earnings grow by 20% over the past year, outpacing the industry average of -2.5%. Despite a significant one-off gain of CN¥229M impacting recent financials, it trades at 34% below estimated fair value. The company’s debt to equity ratio rose from 13.8 to 47.3 over five years but remains manageable with interest payments covered 8 times by EBIT. With more cash than total debt and positive free cash flow, Tibet Cheezheng appears financially robust despite its small market presence.

Tsubakimoto Chain (TSE:6371)

Simply Wall St Value Rating: ★★★★★★

Overview: Tsubakimoto Chain Co. is a Japanese company that produces and markets chains, motion control products, mobility solutions, and materials handling systems components, with a market capitalization of approximately ¥193.64 billion.

Operations: Tsubakimoto Chain generates revenue primarily from its production and sale of chains, motion control products, mobility solutions, and materials handling systems components. The company has a market capitalization of approximately ¥193.64 billion.

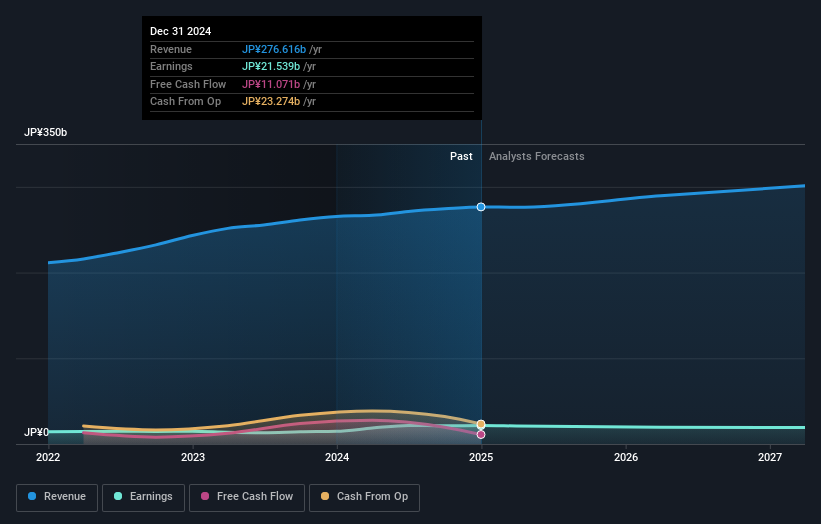

Tsubakimoto Chain, a notable player in the machinery industry, has shown impressive earnings growth of 45.7% over the past year, outpacing the industry's 4%. Its price-to-earnings ratio of 9x suggests it's trading at a favorable value compared to Japan's market average of 13.1x. The company's debt-to-equity ratio improved significantly from 25.1% to 10.7% over five years, indicating stronger financial health. Recent guidance revisions predict net sales reaching ¥278 billion and net income per share at ¥201.86 due to increased sales volume and favorable exchange rates, highlighting its potential for continued success amidst market fluctuations.

- Unlock comprehensive insights into our analysis of Tsubakimoto Chain stock in this health report.

Evaluate Tsubakimoto Chain's historical performance by accessing our past performance report.

Summing It All Up

- Get an in-depth perspective on all 4749 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688325

Guangdong Cellwise Microelectronics

Guangdong Cellwise Microelectronics Co., Ltd.

Excellent balance sheet with low risk.

Market Insights

Community Narratives