We Think That There Are More Issues For Jilin Aodong Pharmaceutical Group (SZSE:000623) Than Just Sluggish Earnings

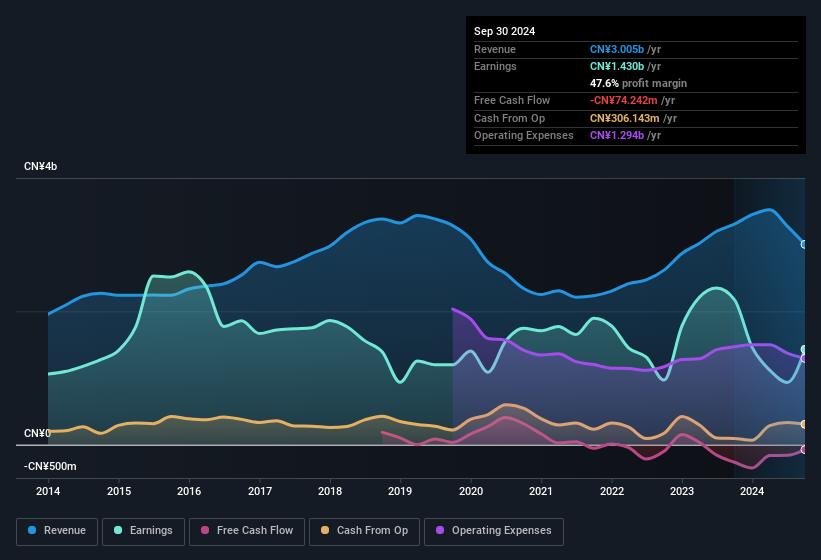

Jilin Aodong Pharmaceutical Group Co., Ltd.'s (SZSE:000623) stock wasn't much affected by its recent lackluster earnings numbers. We did some digging, and we believe that investors are missing some worrying factors underlying the profit figures.

Check out our latest analysis for Jilin Aodong Pharmaceutical Group

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, Jilin Aodong Pharmaceutical Group increased the number of shares on issue by 6.4% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Jilin Aodong Pharmaceutical Group's historical EPS growth by clicking on this link.

How Is Dilution Impacting Jilin Aodong Pharmaceutical Group's Earnings Per Share (EPS)?

Jilin Aodong Pharmaceutical Group's net profit dropped by 25% per year over the last three years. And even focusing only on the last twelve months, we see profit is down 34%. Like a sack of potatoes thrown from a delivery truck, EPS fell harder, down 36% in the same period. So you can see that the dilution has had a bit of an impact on shareholders.

If Jilin Aodong Pharmaceutical Group's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Jilin Aodong Pharmaceutical Group.

How Do Unusual Items Influence Profit?

Alongside that dilution, it's also important to note that Jilin Aodong Pharmaceutical Group's profit was boosted by unusual items worth CN¥76m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. Jilin Aodong Pharmaceutical Group had a rather significant contribution from unusual items relative to its profit to September 2024. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On Jilin Aodong Pharmaceutical Group's Profit Performance

In its last report Jilin Aodong Pharmaceutical Group benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. Considering all this we'd argue Jilin Aodong Pharmaceutical Group's profits probably give an overly generous impression of its sustainable level of profitability. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. You'd be interested to know, that we found 2 warning signs for Jilin Aodong Pharmaceutical Group and you'll want to know about these.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000623

Jilin Aodong Pharmaceutical Group

Jilin Aodong Pharmaceutical Group Co., Ltd.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)