Is Now The Time To Put Livzon Pharmaceutical Group (SZSE:000513) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Livzon Pharmaceutical Group (SZSE:000513), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Livzon Pharmaceutical Group

How Quickly Is Livzon Pharmaceutical Group Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, Livzon Pharmaceutical Group has grown EPS by 6.4% per year. This may not be setting the world alight, but it does show that EPS is on the upwards trend.

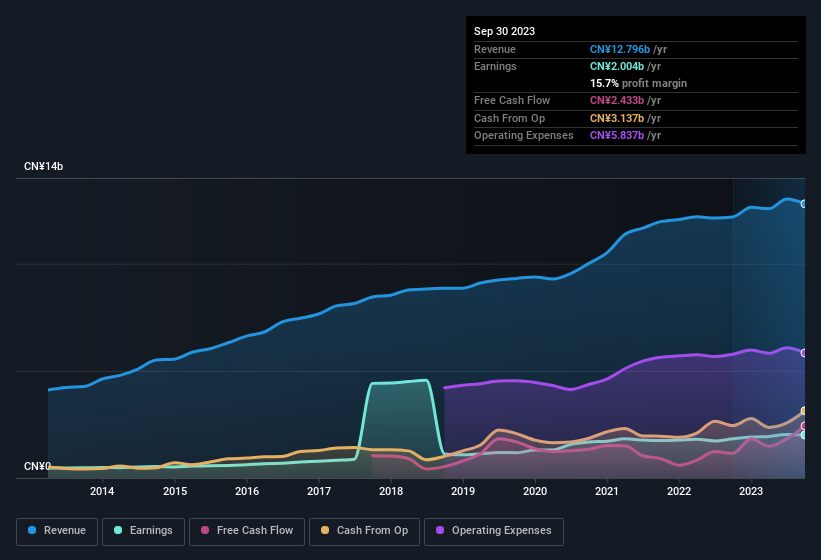

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Livzon Pharmaceutical Group maintained stable EBIT margins over the last year, all while growing revenue 5.0% to CN¥13b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Livzon Pharmaceutical Group's future EPS 100% free.

Are Livzon Pharmaceutical Group Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that Livzon Pharmaceutical Group insiders have a significant amount of capital invested in the stock. As a matter of fact, their holding is valued at CN¥115m. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.4% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Livzon Pharmaceutical Group Deserve A Spot On Your Watchlist?

As previously touched on, Livzon Pharmaceutical Group is a growing business, which is encouraging. To add an extra spark to the fire, significant insider ownership in the company is another highlight. The combination definitely favoured by investors so consider keeping the company on a watchlist. We don't want to rain on the parade too much, but we did also find 1 warning sign for Livzon Pharmaceutical Group that you need to be mindful of.

Although Livzon Pharmaceutical Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000513

Livzon Pharmaceutical Group

Researches, develops, produces, exports, and sells pharmaceutical products, and active pharmaceutical ingredients and intermediates in the People’s Republic of China.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives