Wuhan Keqian Biology Co.,Ltd (SHSE:688526) Stock Rockets 25% But Many Are Still Ignoring The Company

Wuhan Keqian Biology Co.,Ltd (SHSE:688526) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 23% in the last twelve months.

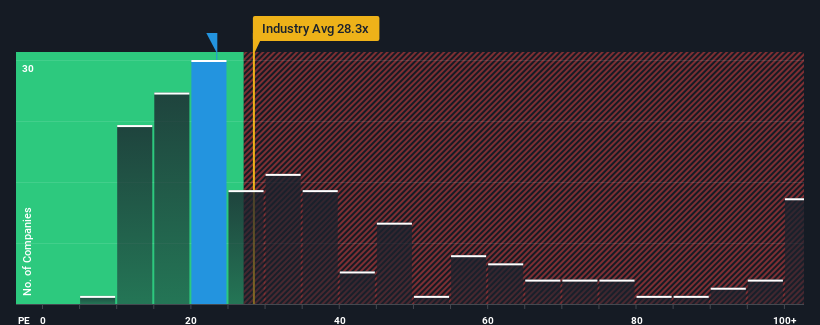

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 32x, you may still consider Wuhan Keqian BiologyLtd as an attractive investment with its 23.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Wuhan Keqian BiologyLtd hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Wuhan Keqian BiologyLtd

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Wuhan Keqian BiologyLtd would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 3.4%. This means it has also seen a slide in earnings over the longer-term as EPS is down 27% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 20% each year during the coming three years according to the seven analysts following the company. With the market predicted to deliver 20% growth each year, the company is positioned for a comparable earnings result.

With this information, we find it odd that Wuhan Keqian BiologyLtd is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Wuhan Keqian BiologyLtd's P/E?

The latest share price surge wasn't enough to lift Wuhan Keqian BiologyLtd's P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Wuhan Keqian BiologyLtd currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 1 warning sign for Wuhan Keqian BiologyLtd that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Keqian BiologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688526

Wuhan Keqian BiologyLtd

Focuses on the research and development, production, sales, and animal epidemic prevention technical services of veterinary biological products in China.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.