As global markets navigate a landscape marked by cautious Federal Reserve commentary and tempered expectations for monetary policy easing, Asian tech stocks continue to capture investor interest amid evolving economic conditions. In this environment, identifying high-growth opportunities often involves looking at companies that demonstrate robust innovation and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.55% | 44.13% | ★★★★★★ |

| Zhongji Innolight | 28.79% | 30.71% | ★★★★★★ |

| PharmaEssentia | 31.61% | 70.22% | ★★★★★★ |

| Eoptolink Technology | 37.70% | 35.42% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Xiamen Amoytop Biotech (SHSE:688278)

Simply Wall St Growth Rating: ★★★★★★

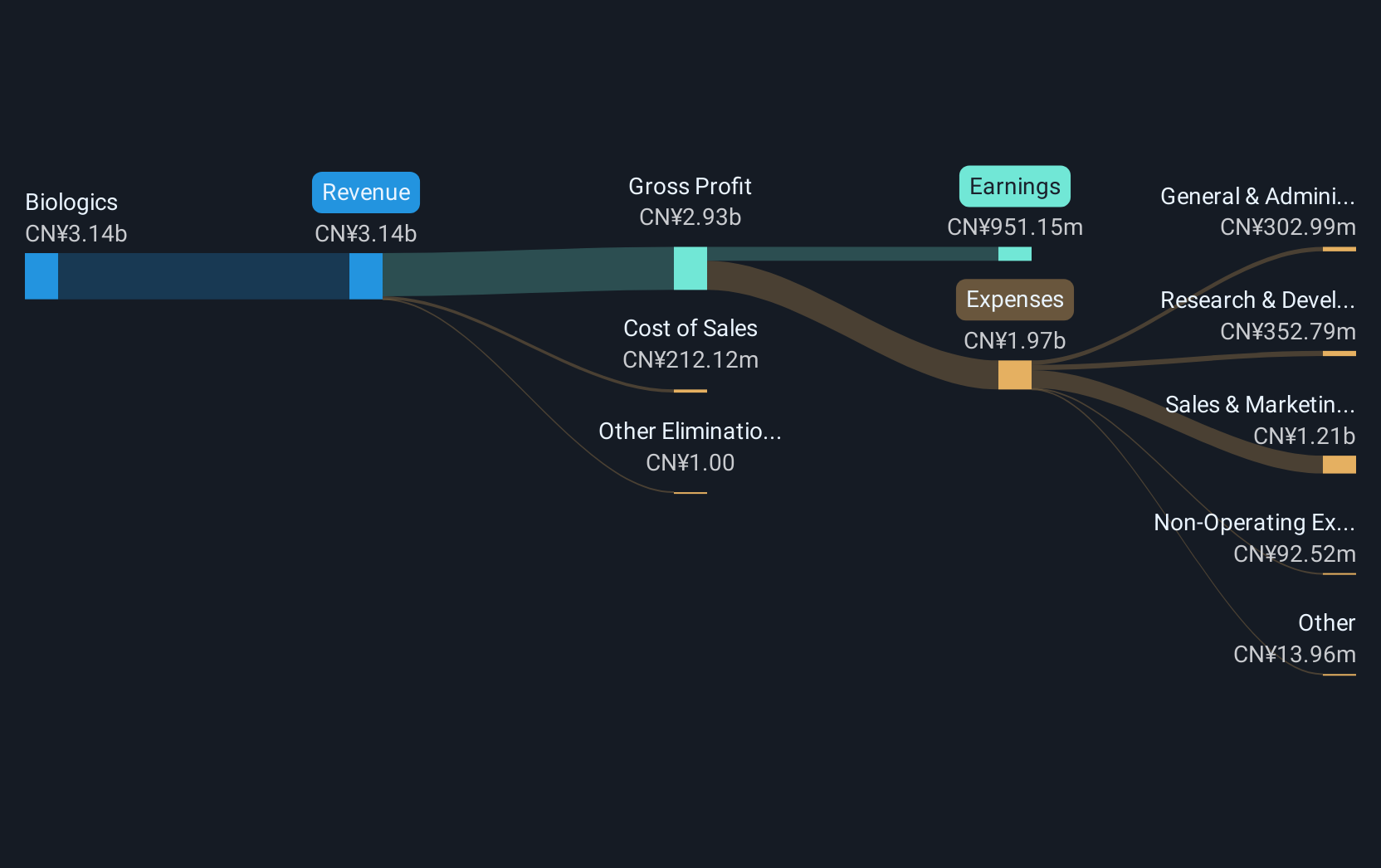

Overview: Xiamen Amoytop Biotech Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs in China with a market cap of CN¥34.08 billion.

Operations: The company generates revenue primarily from its biologics segment, amounting to CN¥3.14 billion.

Xiamen Amoytop Biotech has demonstrated robust growth, with a notable 25.4% annual increase in revenue, outpacing the Chinese market's average of 14.1%. This surge is complemented by a significant earnings growth of 44.6% over the past year, starkly contrasting with the industry’s downturn of -17.5%. The company's strategic maneuvers include a recent acquisition by Tibet Trust-Jintong No. 10 Collective Fund Trust Plan, enhancing its market share and financial stability. Moreover, Xiamen Amoytop maintains a high level of non-cash earnings and anticipates an annual profit growth rate of 30%, suggesting potential for sustained upward trajectory in its financial performance.

- Dive into the specifics of Xiamen Amoytop Biotech here with our thorough health report.

Evaluate Xiamen Amoytop Biotech's historical performance by accessing our past performance report.

Chengdu Zhimingda Electronics (SHSE:688636)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu Zhimingda Electronics Co., Ltd. specializes in providing customized embedded modules and solutions in China, with a market capitalization of CN¥5.61 billion.

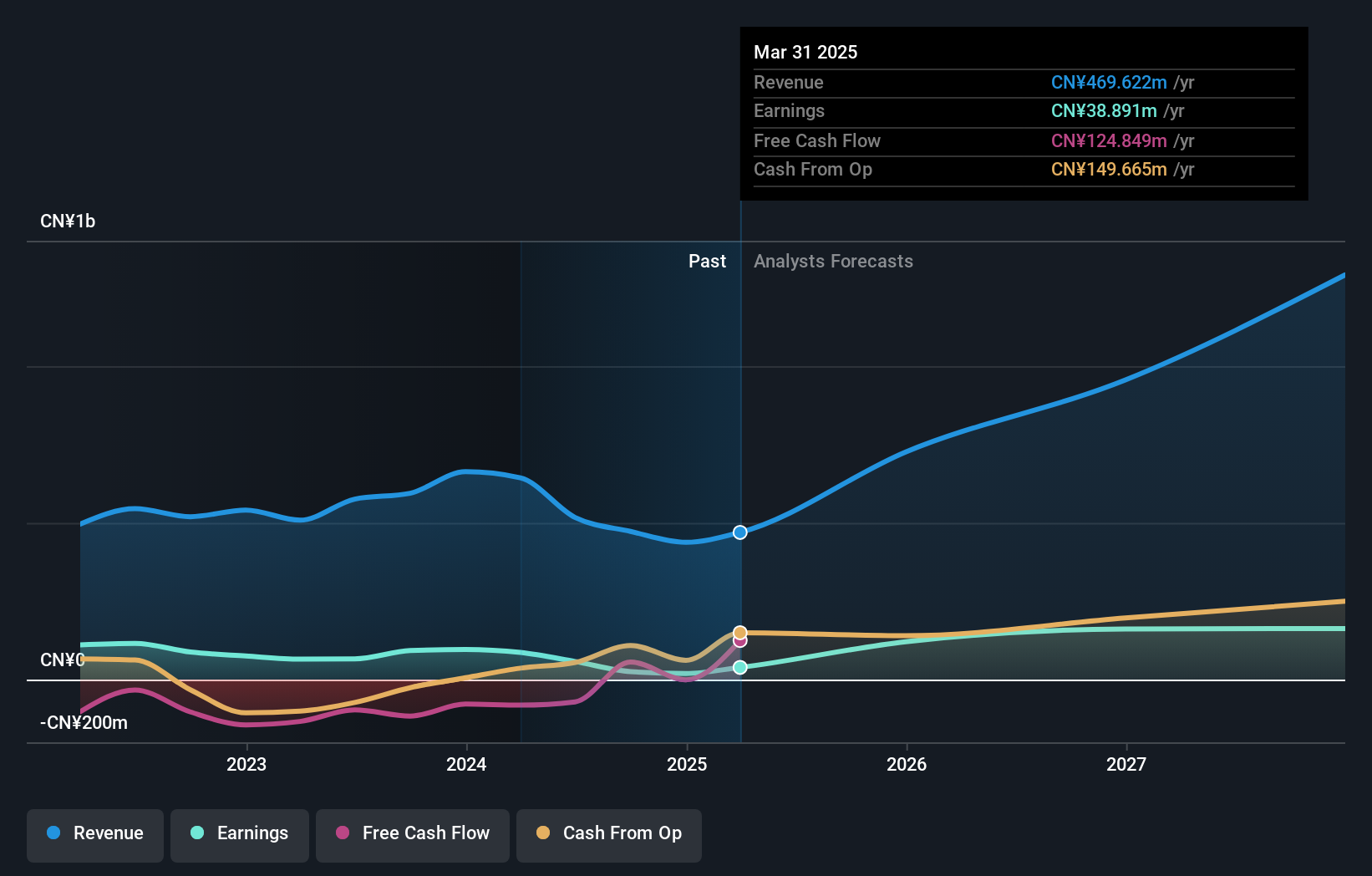

Operations: Zhimingda Electronics generates revenue primarily from its Aerospace & Defense segment, which contributes CN¥573.21 million to its financials.

Chengdu Zhimingda Electronics has showcased a remarkable trajectory, with revenue soaring by 31.6% annually and earnings growth projected at an impressive 43.4% per year, significantly outpacing the broader Chinese market's growth rates of 14.1% and 26.7%, respectively. This performance is underpinned by strategic initiatives such as the significant increase in R&D spending, which has risen to CNY 45 million this year, accounting for approximately 15% of total revenue—a clear indicator of its commitment to innovation and staying ahead in competitive tech landscapes. Recent events like their extraordinary shareholders meeting suggest active engagement with strategic decisions at high levels, potentially steering the company towards sustained growth amidst evolving industry dynamics.

- Navigate through the intricacies of Chengdu Zhimingda Electronics with our comprehensive health report here.

Understand Chengdu Zhimingda Electronics' track record by examining our Past report.

ASROCK Incorporation (TWSE:3515)

Simply Wall St Growth Rating: ★★★★★☆

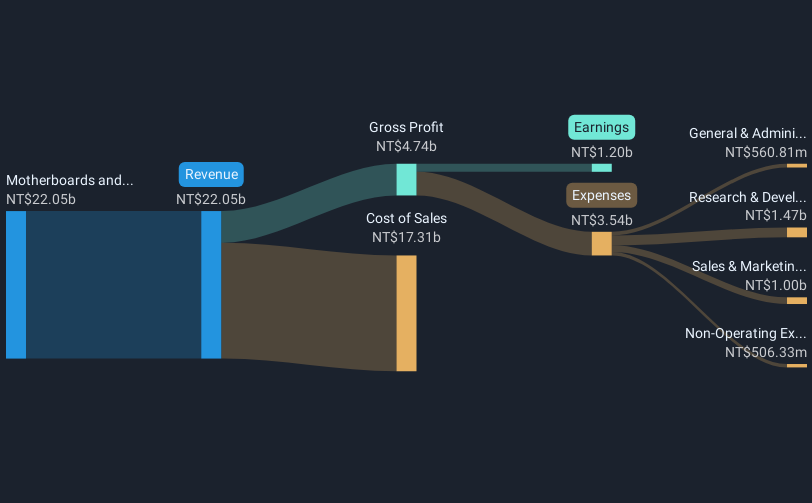

Overview: ASROCK Incorporation is a Taiwanese company that specializes in designing, developing, and selling motherboards, with a market capitalization of NT$32.68 billion.

Operations: ASROCK focuses on the design and sale of motherboards, generating revenue of NT$37.96 billion from its primary product line.

ASROCK Incorporation has demonstrated robust financial performance, more than doubling its sales to TWD 22.48 billion in the first half of 2025, compared to TWD 10.18 billion in the same period last year. This surge aligns with an earnings jump of over 48%, showcasing a significant uptick in profitability with net income reaching TWD 851.88 million. The firm's commitment to innovation is evident from its aggressive revenue and profit growth rates—37.4% and 37.7% annually, respectively—far outpacing the broader Taiwanese market's averages of 10.9% for revenue and 17.3% for earnings growth. These figures not only reflect ASROCK’s capacity to scale effectively amidst competitive tech landscapes but also hint at sustained future growth driven by strategic market positioning and ongoing product development initiatives.

Key Takeaways

- Discover the full array of 188 Asian High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688278

Xiamen Amoytop Biotech

Engages in research, development, production, and sale of recombinant protein drugs in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives