As global markets navigate a complex landscape marked by dovish Federal Reserve signals and subdued inflation in Europe, investors are keenly observing opportunities that may arise from these shifting dynamics. In this environment, identifying undervalued stocks becomes crucial, as they can offer potential value when market sentiment is dominated by broader economic concerns.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN129.80 | PLN256.05 | 49.3% |

| Truecaller (OM:TRUE B) | SEK23.30 | SEK46.25 | 49.6% |

| STI (KOSDAQ:A039440) | ₩25900.00 | ₩51536.01 | 49.7% |

| PVA TePla (XTRA:TPE) | €22.18 | €44.14 | 49.8% |

| Mo-BRUK (WSE:MBR) | PLN304.00 | PLN598.65 | 49.2% |

| Japan Eyewear Holdings (TSE:5889) | ¥1932.00 | ¥3847.22 | 49.8% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.388 | €0.77 | 49.5% |

| Esautomotion (BIT:ESAU) | €3.06 | €6.09 | 49.8% |

| China Beststudy Education Group (SEHK:3978) | HK$4.68 | HK$9.30 | 49.7% |

| B&S Group (ENXTAM:BSGR) | €5.94 | €11.83 | 49.8% |

Let's dive into some prime choices out of the screener.

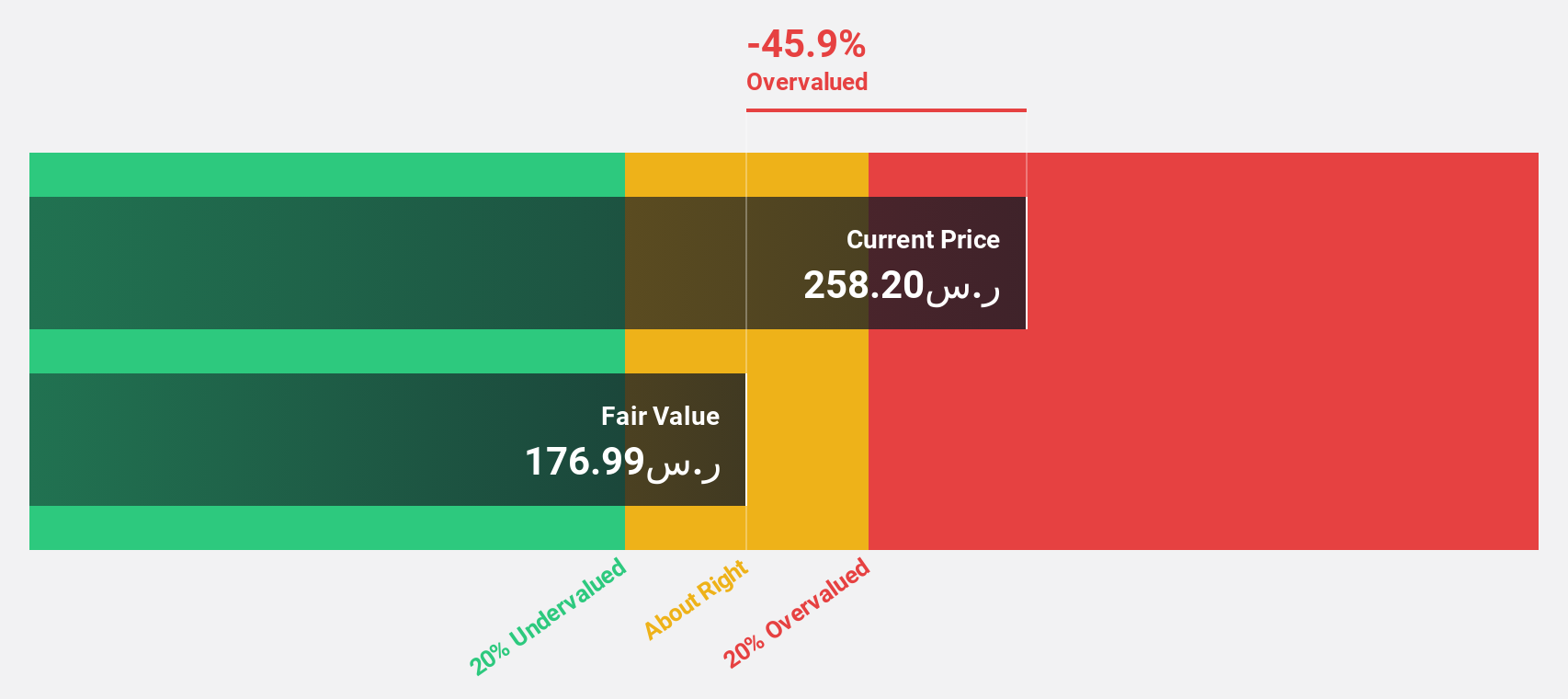

Dr. Sulaiman Al Habib Medical Services Group (SASE:4013)

Overview: Dr. Sulaiman Al Habib Medical Services Group Company offers private health and ancillary services, with a market cap of SAR85.12 billion.

Operations: The company's revenue segments include SAR2.73 billion from pharmacies and SAR10.17 billion from hospitals and healthcare facilities.

Estimated Discount To Fair Value: 11.5%

Dr. Sulaiman Al Habib Medical Services Group is trading at SAR 243.2, below its fair value estimate of SAR 274.65, indicating potential undervaluation based on cash flows. Despite high debt levels, earnings are forecast to grow at 17.21% annually, outpacing the SA market's growth rate of 9%. Recent expansions include a new hospital project in Dammam and contracts for managing hospitals in the Red Sea area, potentially enhancing future revenue streams and supporting cash flow growth.

- Our expertly prepared growth report on Dr. Sulaiman Al Habib Medical Services Group implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Dr. Sulaiman Al Habib Medical Services Group with our comprehensive financial health report here.

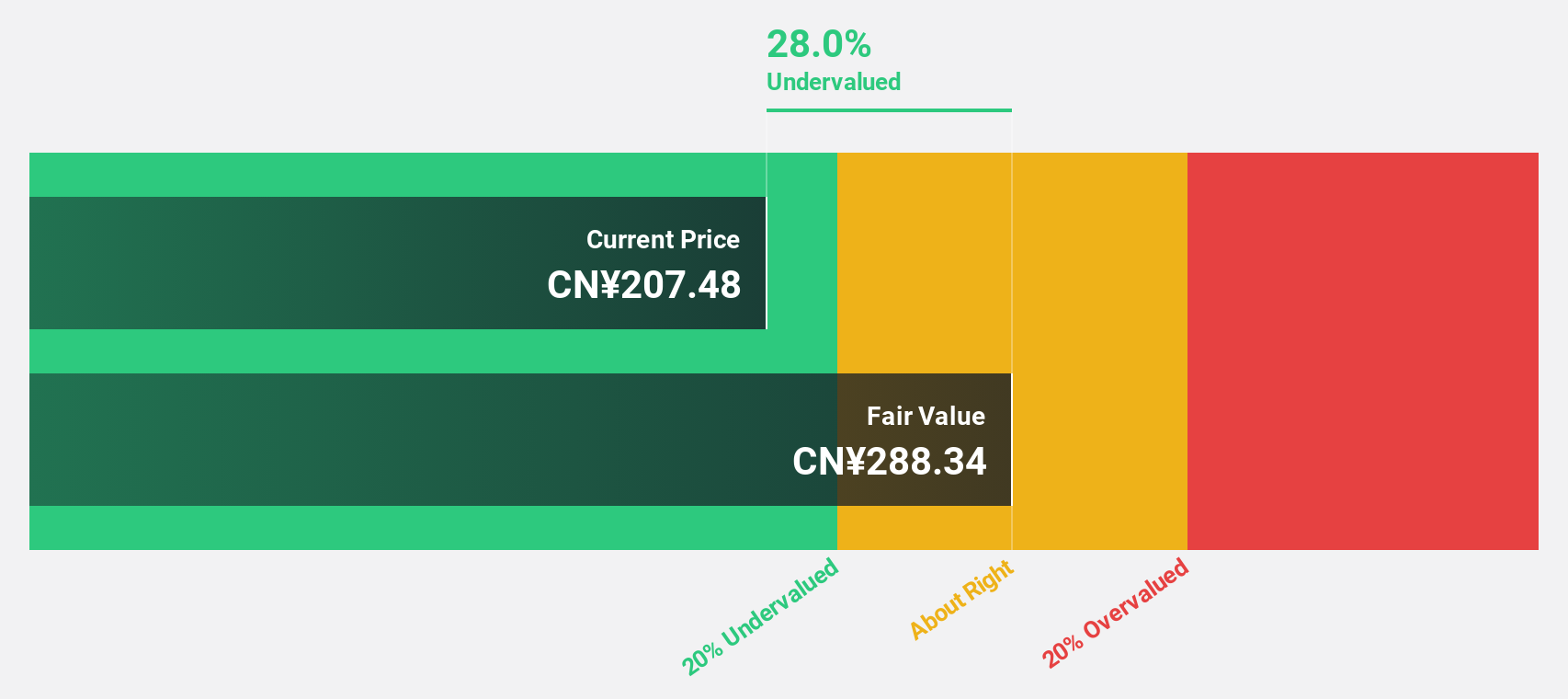

Beijing Roborock Technology (SHSE:688169)

Overview: Beijing Roborock Technology Co., Ltd. specializes in the design, research and development, production, and sales of intelligent sweeping robots in China, with a market cap of CN¥39.92 billion.

Operations: The company's revenue primarily comes from its Intelligent Cleaning Products segment, which generated CN¥17.00 billion.

Estimated Discount To Fair Value: 46.7%

Beijing Roborock Technology is trading at CNY 160.46, significantly below its estimated fair value of CNY 301.16, suggesting undervaluation based on cash flows. Despite a drop in net income to CNY 1.04 billion from the previous year's CNY 1.47 billion, revenue surged to CNY 12.07 billion from CNY 7 billion year-over-year. Earnings are forecasted to grow significantly at over 31% annually, outpacing the broader Chinese market growth rate of approximately 28%.

- According our earnings growth report, there's an indication that Beijing Roborock Technology might be ready to expand.

- Unlock comprehensive insights into our analysis of Beijing Roborock Technology stock in this financial health report.

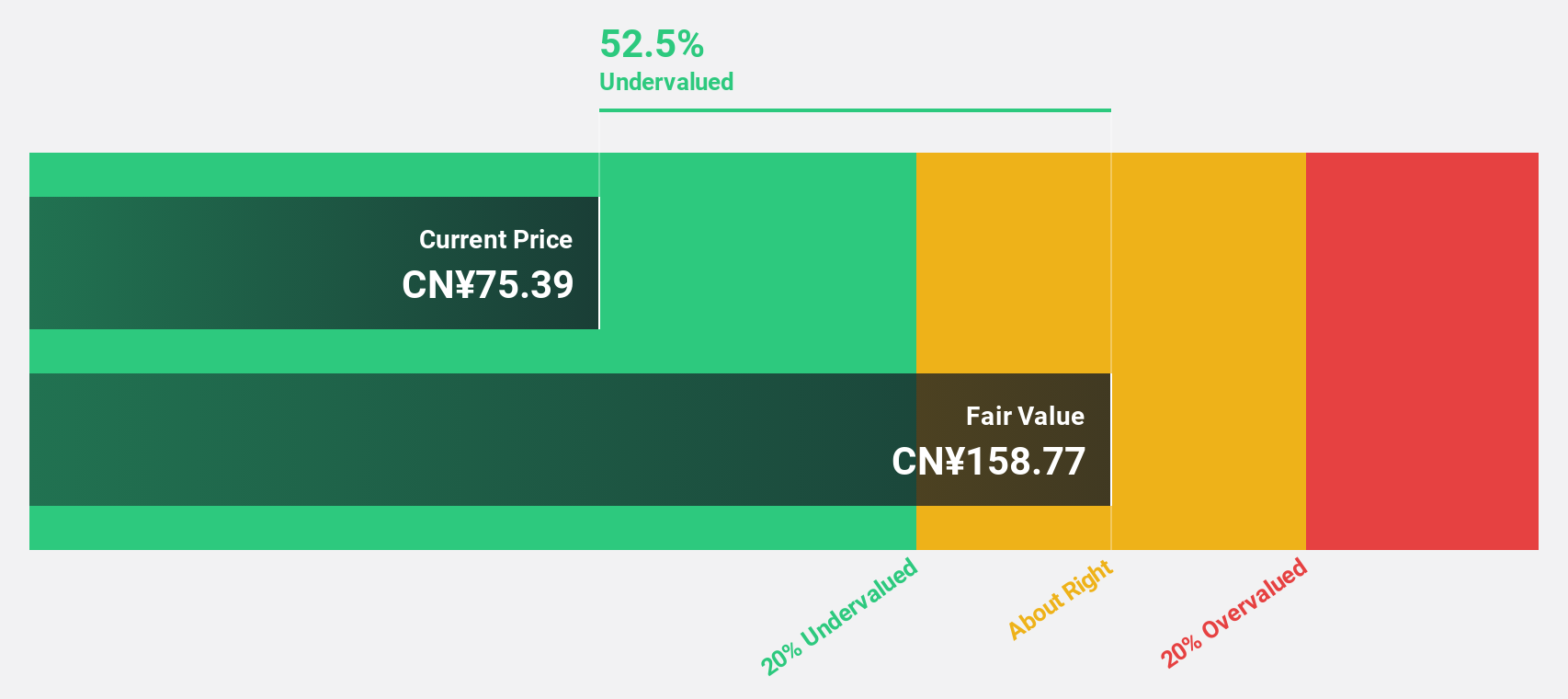

Xiamen Amoytop Biotech (SHSE:688278)

Overview: Xiamen Amoytop Biotech Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs both in China and internationally, with a market cap of CN¥32.79 billion.

Operations: The company's revenue is primarily derived from its biologics segment, which generated CN¥3.34 billion.

Estimated Discount To Fair Value: 49.1%

Xiamen Amoytop Biotech is trading at CN¥82.62, well below its fair value estimate of CN¥162.29, highlighting potential undervaluation based on cash flows. Recent earnings for the nine months ended September 2025 show sales rising to CN¥2.48 billion from CN¥1.95 billion year-over-year, with net income increasing to CN¥666.12 million from CN¥554.15 million previously. Earnings are projected to grow over 34% annually, surpassing the Chinese market's growth rate of 27.6%.

- Our earnings growth report unveils the potential for significant increases in Xiamen Amoytop Biotech's future results.

- Dive into the specifics of Xiamen Amoytop Biotech here with our thorough financial health report.

Summing It All Up

- Get an in-depth perspective on all 505 Undervalued Global Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688278

Xiamen Amoytop Biotech

Engages in research, development, production, and sale of recombinant protein drugs in China and internationally.

Exceptional growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026