- Japan

- /

- Trade Distributors

- /

- TSE:8002

Three Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

In the midst of a busy earnings season and mixed economic signals, global markets have shown varied performance, with major indices like the Nasdaq Composite and S&P MidCap 400 experiencing fluctuations. As investors navigate these dynamic conditions, dividend stocks can offer a measure of stability and potential income through regular payouts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.08% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.52% | ★★★★★★ |

| Globeride (TSE:7990) | 4.05% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.12% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.49% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.00% | ★★★★★★ |

Click here to see the full list of 1932 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Hubei Jumpcan Pharmaceutical (SHSE:600566)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hubei Jumpcan Pharmaceutical Co., Ltd. focuses on the research, development, manufacturing, and trading of both traditional Chinese and western medicines as well as health products in China, with a market cap of CN¥28.44 billion.

Operations: Hubei Jumpcan Pharmaceutical Co., Ltd. generates revenue through its activities in the research, development, manufacturing, and trading of Chinese traditional medicines, western medicines, daily use chemical-based Chinese traditional medicines, and Chinese medicine health products within China.

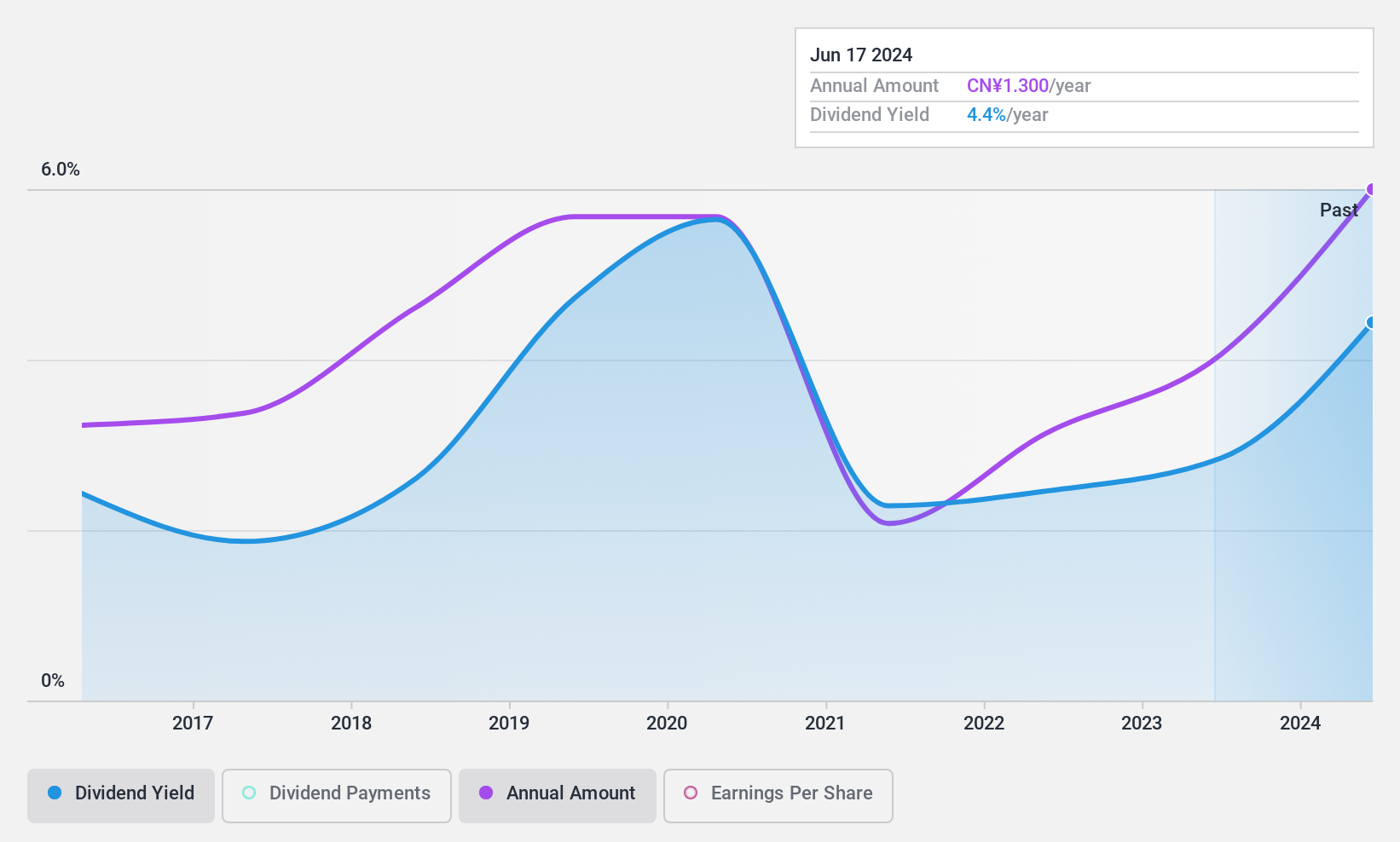

Dividend Yield: 4%

Hubei Jumpcan Pharmaceutical's dividend payments have been volatile over the past decade, yet they remain well-covered by earnings with a payout ratio of 42.9% and cash flows at 56.1%. The company's recent earnings report showed a slight decline in net income to CNY 1.90 billion for the first nine months of 2024, down from CNY 1.94 billion last year. Despite this, its dividend yield is among the top tier in China's market at 4.01%.

- Unlock comprehensive insights into our analysis of Hubei Jumpcan Pharmaceutical stock in this dividend report.

- In light of our recent valuation report, it seems possible that Hubei Jumpcan Pharmaceutical is trading behind its estimated value.

Gansu Energy Chemical (SZSE:000552)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gansu Energy Chemical Co., Ltd. operates in the coal mining industry in China with a market cap of CN¥15.09 billion.

Operations: Gansu Energy Chemical Co., Ltd. generates its revenue primarily from its coal mining operations in China.

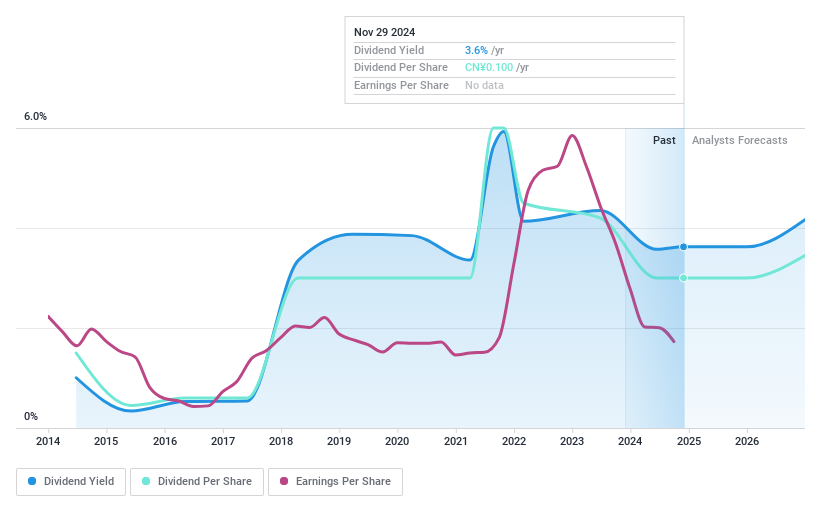

Dividend Yield: 3.4%

Gansu Energy Chemical's dividend yield of 3.41% is among the top 25% in China's market, but its payments have been volatile and not well covered by free cash flows. The payout ratio is a reasonable 43.4%, suggesting dividends are supported by earnings despite recent shareholder dilution and declining profit margins—from 17.5% to 11.6%. Recent earnings showed a drop in net income to CNY 1.03 billion for the first nine months of 2024, compared to CNY 1.56 billion last year.

- Delve into the full analysis dividend report here for a deeper understanding of Gansu Energy Chemical.

- Our valuation report here indicates Gansu Energy Chemical may be overvalued.

Marubeni (TSE:8002)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Marubeni Corporation engages in the purchasing, distribution, and marketing of industrial and consumer goods with a market cap of ¥3.98 trillion.

Operations: Marubeni Corporation's revenue segments include Power (¥396.59 million), Energy (¥801.89 million), Food I (¥907.11 million), Food II (¥1.05 billion), Chemicals (¥584.45 million), Lifestyle (¥203.32 million), IT Solutions (¥390.92 million), Agri Business (¥1.42 billion), Forest Products (¥247.25 million), Aerospace & Ship (¥138.06 million), Infrastructure Project (¥34.50 million), Metals & Mineral Resources (¥579.06 million), Finance, Leasing & Real Estate Business (¥53.35 million) and Construction, Industrial Machinery & Mobility sectors which contribute ¥556.14 million to its operations, along with Next Generation Business Development including parts of Plant at ¥22.95 million.

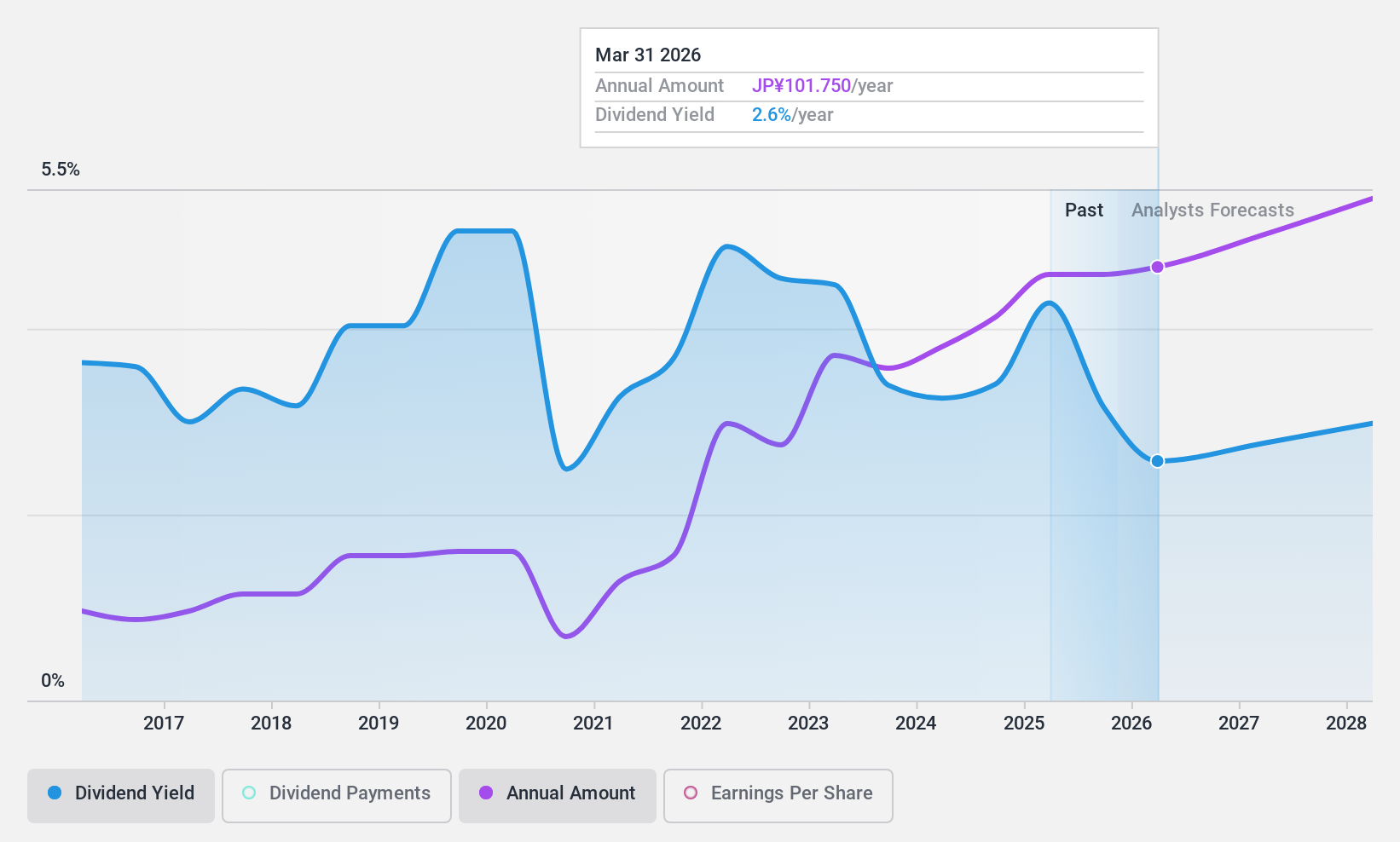

Dividend Yield: 3.6%

Marubeni's dividend yield of 3.6% falls short of the top 25% in Japan, but its payout ratio is a low 32.3%, indicating dividends are well covered by earnings and cash flows (48.5%). Despite a volatile and unreliable dividend history over the past decade, payments have grown during this period. The stock trades at a favorable price-to-earnings ratio of 9x compared to the market average of 13.3x, suggesting good relative value despite some debt coverage concerns with operating cash flow.

- Click here and access our complete dividend analysis report to understand the dynamics of Marubeni.

- Insights from our recent valuation report point to the potential undervaluation of Marubeni shares in the market.

Make It Happen

- Dive into all 1932 of the Top Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8002

Marubeni

Marubeni Corporation purchases, distributes, and markets industrial and consumer goods.

Established dividend payer and good value.