Take Care Before Jumping Onto Chongqing Taiji Industry(Group) Co.,Ltd (SHSE:600129) Even Though It's 27% Cheaper

Chongqing Taiji Industry(Group) Co.,Ltd (SHSE:600129) shares have had a horrible month, losing 27% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 48% in that time.

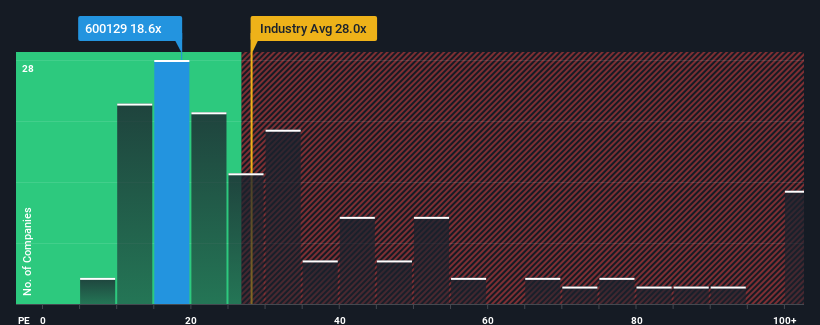

Since its price has dipped substantially, Chongqing Taiji Industry(Group)Ltd's price-to-earnings (or "P/E") ratio of 18.6x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 29x and even P/E's above 54x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Chongqing Taiji Industry(Group)Ltd as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Chongqing Taiji Industry(Group)Ltd

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Chongqing Taiji Industry(Group)Ltd's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 47%. Pleasingly, EPS has also lifted 610% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 23% per year as estimated by the seven analysts watching the company. That's shaping up to be similar to the 25% per year growth forecast for the broader market.

With this information, we find it odd that Chongqing Taiji Industry(Group)Ltd is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Chongqing Taiji Industry(Group)Ltd's P/E?

Chongqing Taiji Industry(Group)Ltd's P/E has taken a tumble along with its share price. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Chongqing Taiji Industry(Group)Ltd currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Chongqing Taiji Industry(Group)Ltd (1 shouldn't be ignored!) that you should be aware of.

Of course, you might also be able to find a better stock than Chongqing Taiji Industry(Group)Ltd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600129

Chongqing Taiji Industry(Group)Ltd

Develops, produces, and sells traditional Chinese and modern medicine products in China and internationally.

Undervalued slight.

Market Insights

Community Narratives