It's A Story Of Risk Vs Reward With Chongqing Taiji Industry(Group) Co.,Ltd (SHSE:600129)

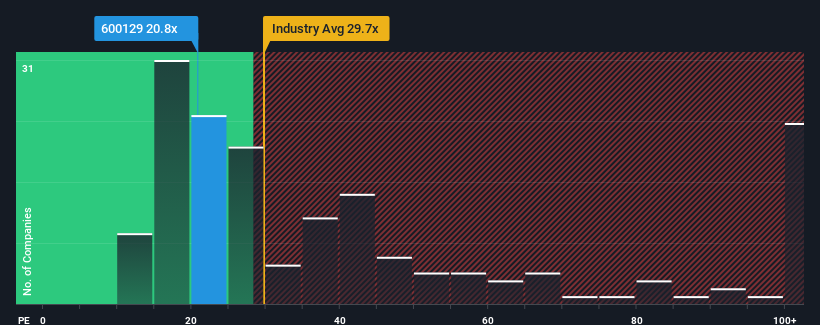

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 34x, you may consider Chongqing Taiji Industry(Group) Co.,Ltd (SHSE:600129) as an attractive investment with its 20.8x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Chongqing Taiji Industry(Group)Ltd has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Chongqing Taiji Industry(Group)Ltd

How Is Chongqing Taiji Industry(Group)Ltd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Chongqing Taiji Industry(Group)Ltd's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 6.0%. Even so, admirably EPS has lifted 479% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 27% per annum during the coming three years according to the seven analysts following the company. That's shaping up to be materially higher than the 19% per annum growth forecast for the broader market.

In light of this, it's peculiar that Chongqing Taiji Industry(Group)Ltd's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Chongqing Taiji Industry(Group)Ltd's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Chongqing Taiji Industry(Group)Ltd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Chongqing Taiji Industry(Group)Ltd (of which 1 makes us a bit uncomfortable!) you should know about.

If you're unsure about the strength of Chongqing Taiji Industry(Group)Ltd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600129

Chongqing Taiji Industry(Group)Ltd

Develops, produces, and sells traditional Chinese and modern medicine products in China and internationally.

Undervalued slight.

Market Insights

Community Narratives