3 Growth Companies With High Insider Ownership Growing Revenues At 24%

Reviewed by Simply Wall St

Amidst rising Treasury yields and fluctuating global markets, growth stocks have managed to outperform value stocks, as evidenced by the slight gains in the tech-heavy Nasdaq Composite Index. In this environment, companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those who know the business best and may offer resilience through market volatility.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Pharma Mar (BME:PHM) | 11.8% | 55.1% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's uncover some gems from our specialized screener.

ITM Semiconductor (KOSDAQ:A084850)

Simply Wall St Growth Rating: ★★★★☆☆

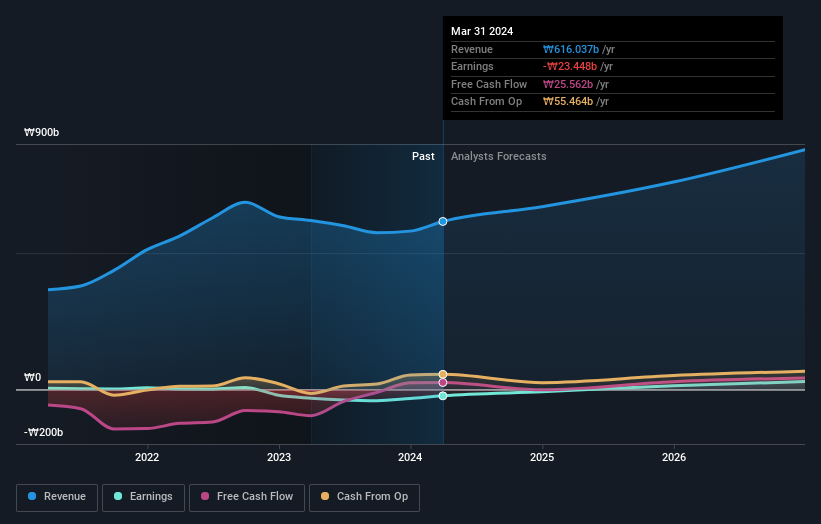

Overview: ITM Semiconductor Co., Ltd. manufactures and sells components for secondary batteries globally, with a market cap of ₩380.67 billion.

Operations: The company's revenue primarily comes from the Parts Division, contributing ₩501.96 billion, followed by the SET Division with ₩142.96 billion.

Insider Ownership: 15%

Revenue Growth Forecast: 13.5% p.a.

ITM Semiconductor shows promising growth potential with forecasted annual earnings growth of 54.78% and revenue expected to grow at 13.5% per year, outpacing the Korean market average. Despite a challenging financial position where interest payments are not well covered by earnings, the company trades at 45.5% below its estimated fair value and is considered a good relative value compared to peers. Recent results indicate strong improvement in profitability, with net income significantly rebounding from previous losses.

- Delve into the full analysis future growth report here for a deeper understanding of ITM Semiconductor.

- Our valuation report here indicates ITM Semiconductor may be undervalued.

Hanwang TechnologyLtd (SZSE:002362)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hanwang Technology Co., Ltd. designs and develops handwriting recognition, optical character recognition, and handwriting input products worldwide, with a market cap of CN¥4.64 billion.

Operations: The company's revenue primarily comes from the Software and Information Technology Service Industry, amounting to CN¥1.51 billion.

Insider Ownership: 28.2%

Revenue Growth Forecast: 24.1% p.a.

Hanwang Technology Ltd. is poised for significant growth, with revenue projected to increase by 24.1% annually, surpassing the Chinese market's average growth rate. Despite currently operating at a net loss of CNY 50.8 million for the first half of 2024, it demonstrates potential for profitability within three years—an above-market expectation. The stock trades at a favorable value compared to industry peers, although its future Return on Equity is anticipated to remain modest at 7.9%.

- Unlock comprehensive insights into our analysis of Hanwang TechnologyLtd stock in this growth report.

- The valuation report we've compiled suggests that Hanwang TechnologyLtd's current price could be quite moderate.

Guangzhou Frontop Digital Creative Technology (SZSE:301313)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Frontop Digital Creative Technology Corporation focuses on digital multimedia display services and technology both in China and internationally, with a market cap of CN¥2.39 billion.

Operations: The company's revenue segments include digital multimedia display services and technology.

Insider Ownership: 36.2%

Revenue Growth Forecast: 20.5% p.a.

Guangzhou Frontop Digital Creative Technology is expected to achieve profitability within three years, with earnings projected to grow 64.98% annually—an impressive rate compared to market averages. Revenue growth is forecast at 20.5% per year, outpacing the broader Chinese market's growth of 13.4%. Despite a recent net loss of CNY 70.01 million for the first half of 2024 and a modest dividend yield, insider ownership remains significant with no recent substantial trading activity reported.

- Navigate through the intricacies of Guangzhou Frontop Digital Creative Technology with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Guangzhou Frontop Digital Creative Technology's share price might be on the expensive side.

Seize The Opportunity

- Gain an insight into the universe of 1501 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301313

Guangzhou Frontop Digital Creative Technology

Engages in the exploration and research of digital multimedia display services and technology in China and internationally.

High growth potential with mediocre balance sheet.