- China

- /

- Interactive Media and Services

- /

- SZSE:301262

Undiscovered Gems with Promising Potential for January 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of persistent inflation fears and political uncertainties, small-cap stocks have notably underperformed, with the Russell 2000 Index recently dipping into correction territory. Amidst this backdrop of volatility and cautious investor sentiment, identifying potential "undiscovered gems" requires a keen eye for companies that demonstrate resilience and adaptability in challenging economic climates.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ha Giang Mineral Mechanics | NA | 23.21% | 43.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chilanga Cement | NA | 13.46% | 35.92% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Namchow Food Group (Shanghai) (SHSE:605339)

Simply Wall St Value Rating: ★★★★★★

Overview: Namchow Food Group (Shanghai) Co., Ltd. focuses on the research, development, production, and sales of baking fats and oils-related products with a market capitalization of approximately CN¥7.02 billion.

Operations: Namchow Food Group (Shanghai) generates revenue primarily from its food processing segment, amounting to approximately CN¥3.10 billion. The company's market capitalization stands at around CN¥7.02 billion.

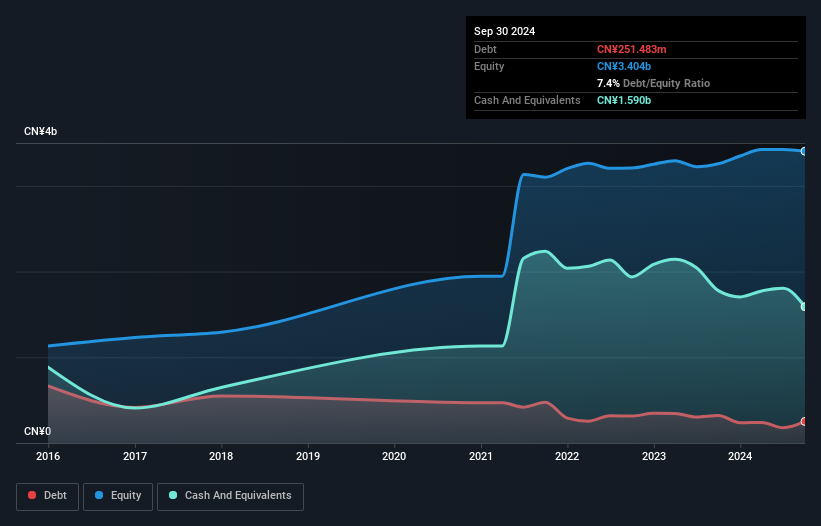

Namchow Food Group, a relatively small player in the market, has shown notable financial resilience. Over the past year, its earnings surged by 68.4%, significantly outpacing the food industry's -4.1% performance. The company also boasts a debt-to-equity ratio that improved from 30% to 7.4% over five years, indicating prudent financial management. Despite an annual earnings decline of 18.2% over five years, Namchow's price-to-earnings ratio of 27x remains attractive compared to the broader CN market at 32x. With free cash flow positive and more cash than debt, Namchow seems well-positioned for future growth opportunities in its sector.

Scantech (HANGZHOU) (SHSE:688583)

Simply Wall St Value Rating: ★★★★★☆

Overview: Scantech (HANGZHOU) Co., Ltd. focuses on the research, development, production, and sale of 3D vision digital products in China with a market cap of CN¥2.28 billion.

Operations: Scantech (HANGZHOU) generates revenue primarily from the sale of 3D vision digital products. The company's financial performance is reflected in its market capitalization of CN¥2.28 billion.

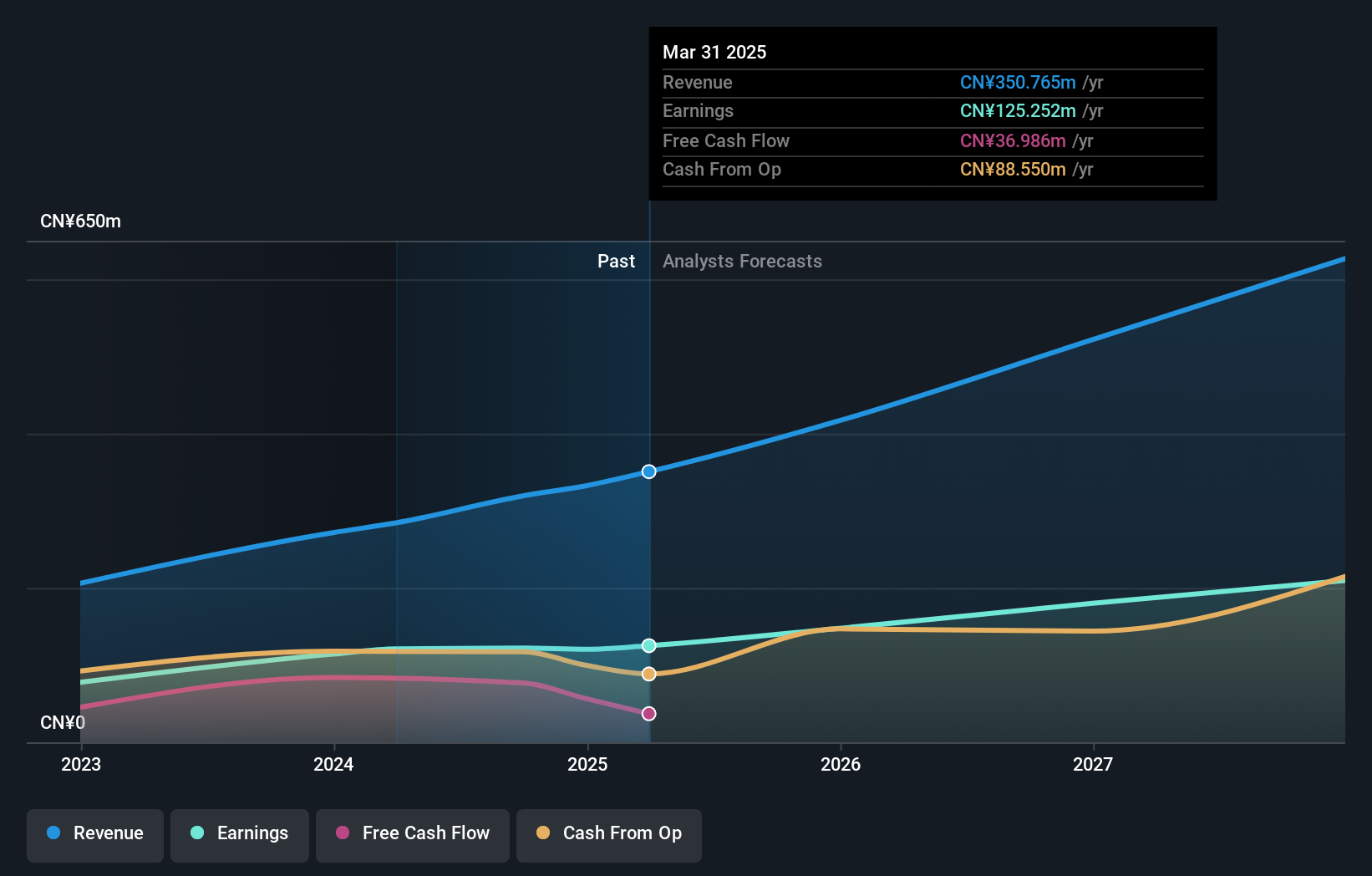

Scantech, a smaller player in the tech space, recently completed an IPO raising CNY 568.82 million, offering over 17 million shares at CNY 33.46 each. With a price-to-earnings ratio of 18.8x, it appears undervalued compared to the broader CN market's average of 31.8x. Notably, earnings surged by 39% last year, outpacing the industry's growth rate of just 3%. The firm boasts high-quality earnings and more cash than total debt on its books; however, its shares are highly illiquid which could pose challenges for potential investors seeking liquidity in their investments.

- Dive into the specifics of Scantech (HANGZHOU) here with our thorough health report.

Explore historical data to track Scantech (HANGZHOU)'s performance over time in our Past section.

Hicon Network Technology (Shandong)Ltd (SZSE:301262)

Simply Wall St Value Rating: ★★★★★★

Overview: Hicon Network Technology (Shandong) Ltd, with a market cap of CN¥10.07 billion, specializes in providing network technology solutions.

Operations: Hicon Network Technology (Shandong) Ltd primarily generates revenue through its network technology solutions. The company's net profit margin is a key financial metric to watch, reflecting its ability to convert revenue into actual profit after covering all expenses.

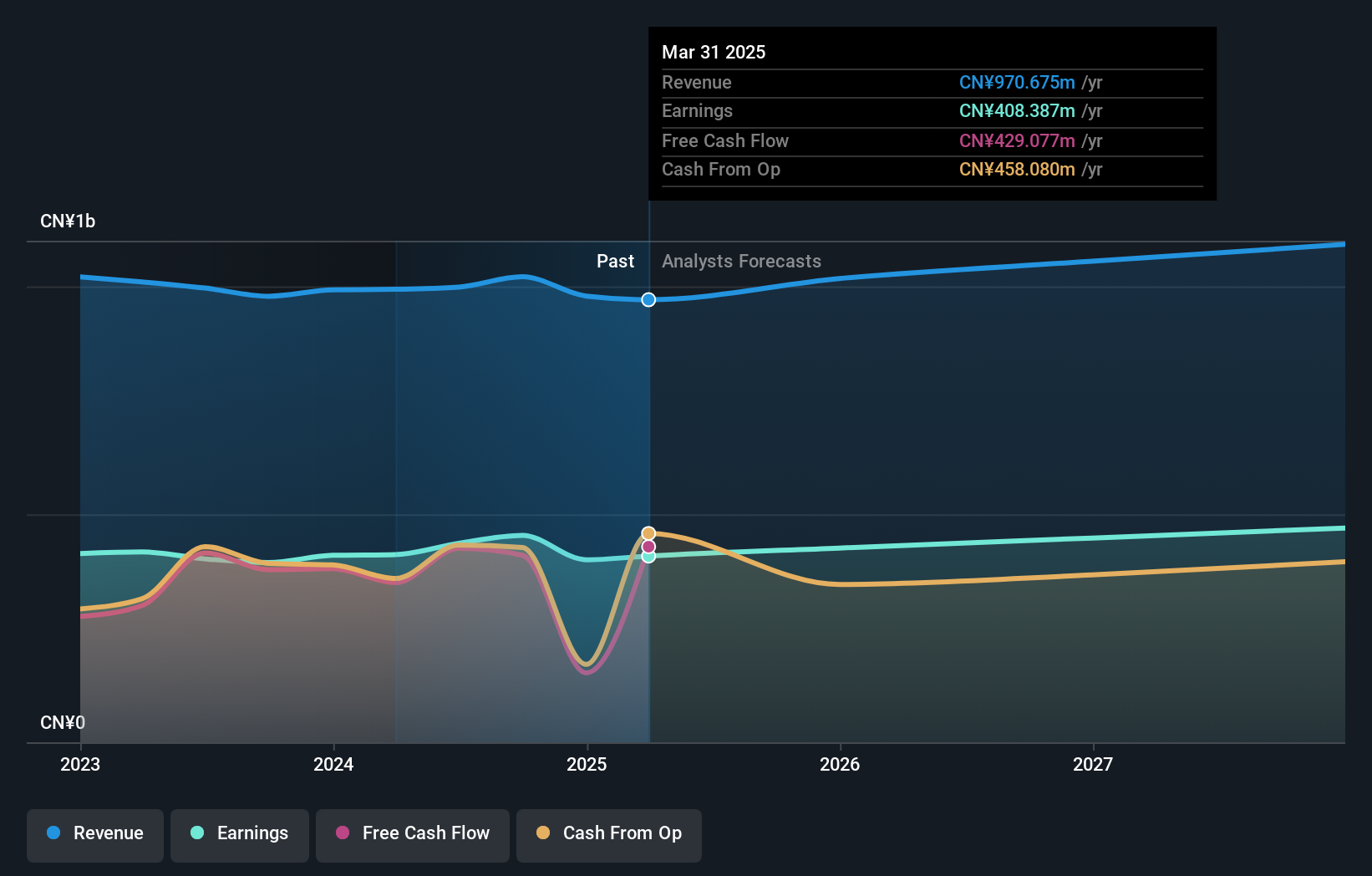

Hicon Network Technology (Shandong) Ltd. showcases intriguing potential, with its earnings growth of 15% surpassing the Interactive Media and Services industry average of 2%. The company is debt-free, reinforcing its financial stability over the past five years. It also boasts a favorable price-to-earnings ratio of 22.2x compared to the broader CN market's 31.8x, suggesting good value prospects. Recent earnings for nine months ending September 2024 revealed net income rising to CNY 329 million from CNY 285 million previously, alongside a cash dividend approval of CNY 3.50 per ten shares for Q3 2024 at their recent meeting.

Taking Advantage

- Access the full spectrum of 4510 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hicon Network Technology (Shandong)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301262

Hicon Network Technology (Shandong)Ltd

Hicon Network Technology (Shandong) Co.,Ltd.

Flawless balance sheet with solid track record.