- China

- /

- Electronic Equipment and Components

- /

- SHSE:688531

Three Undiscovered Gems To Explore This January 2025

Reviewed by Simply Wall St

As the global markets navigate a choppy start to the year, small-cap stocks have particularly felt the pressure, with indices like the Russell 2000 dipping into correction territory amid inflation concerns and political uncertainties. Despite these challenges, investors often find opportunities in undiscovered gems that demonstrate resilience and potential for growth even in turbulent times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Saudi Azm for Communication and Information Technology | 12.21% | 17.40% | 21.14% | ★★★★★☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Sumec (SHSE:600710)

Simply Wall St Value Rating: ★★★★★★

Overview: Sumec Corporation Limited operates in the supply and industrial chain sector in China, with a market cap of approximately CN¥11.50 billion.

Operations: Sumec Corporation Limited generates revenue primarily from its supply and industrial chain business. The company has a market capitalization of approximately CN¥11.50 billion.

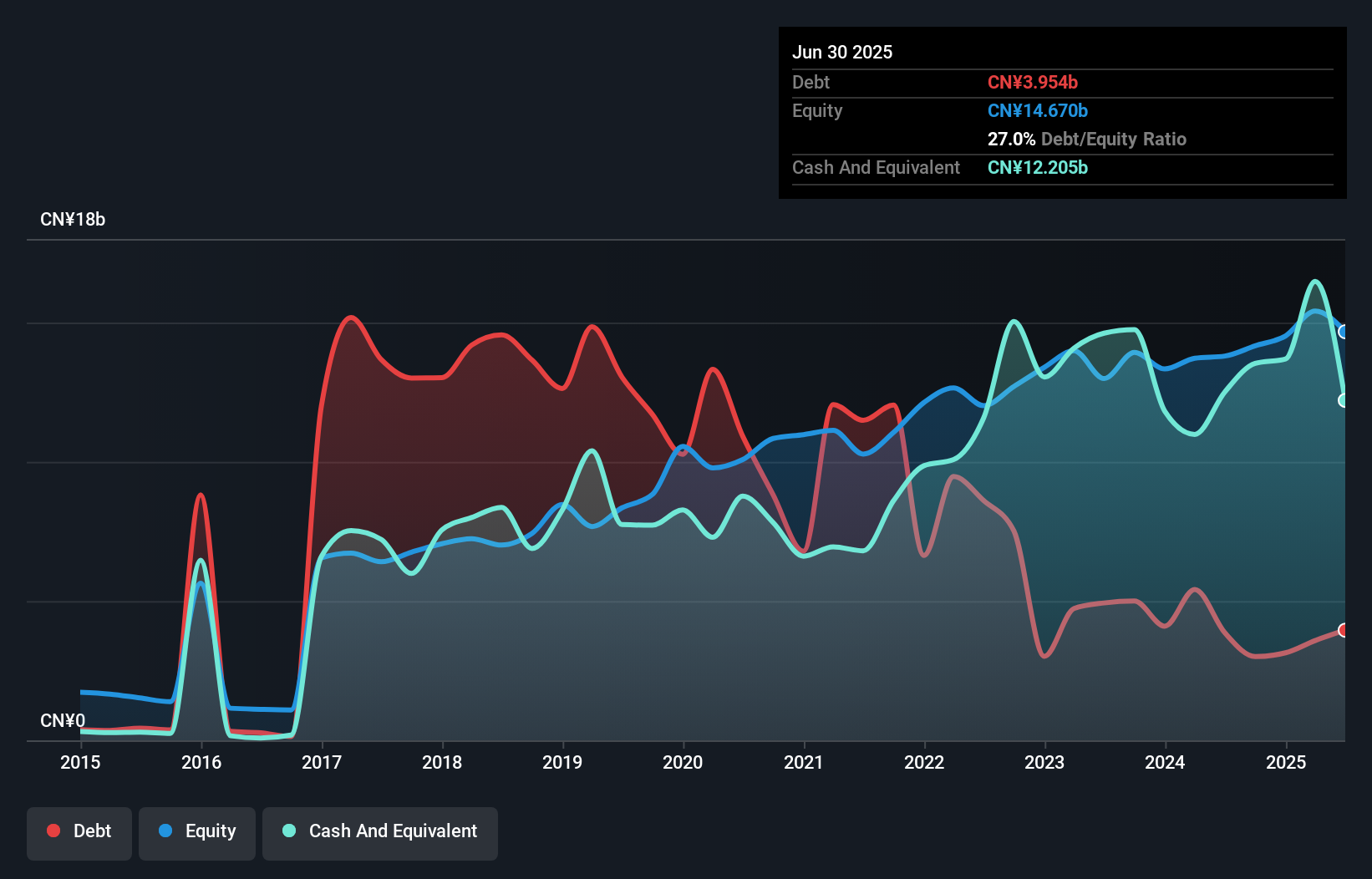

Sumec, a notable player in the market, is trading at 74% below its estimated fair value, offering good relative value compared to peers. Over the past year, earnings grew by 11.5%, outpacing the Trade Distributors industry average of -16.9%. The company has significantly reduced its debt-to-equity ratio from 132.7% to 21.2% over five years and boasts high-quality earnings with more cash than total debt. Recent financials show net income rising to CNY 1 billion from CNY 894 million last year despite a revenue drop to CNY 86.94 billion from CNY 96.06 billion, reflecting strong operational resilience and potential for future growth.

- Click here to discover the nuances of Sumec with our detailed analytical health report.

Understand Sumec's track record by examining our Past report.

Guangzhou Guangri StockLtd (SHSE:600894)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangzhou Guangri Stock Co., Ltd. is engaged in the manufacturing and sale of elevators and related parts in China, with a market capitalization of CN¥10.82 billion.

Operations: Guangri's primary revenue stream comes from the sale of elevators and related parts. The company has a market capitalization of CN¥10.82 billion.

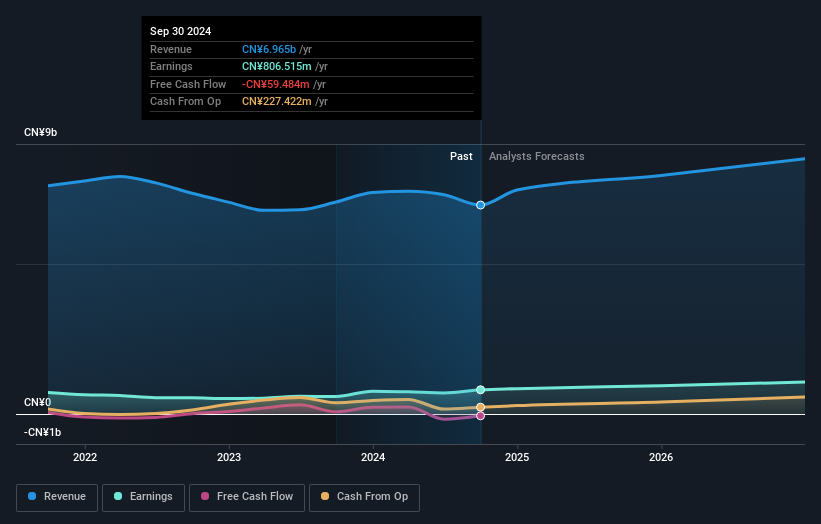

Guangzhou Guangri Stock Ltd. is making waves with its impressive earnings growth of 38.1% over the past year, outpacing the Machinery industry's modest 0.2%. The company shows strong fundamentals, trading at a good value, 17.3% below estimated fair value, and has reduced its debt to equity ratio from 1.2% to just 0.2% in five years, indicating prudent financial management. Despite a sales dip to CNY 4.94 billion from CNY 5.36 billion last year, net income rose to CNY 545 million from CNY 500 million; this reflects high-quality earnings and solid profitability prospects for future growth at about 8.95% annually.

- Get an in-depth perspective on Guangzhou Guangri StockLtd's performance by reading our health report here.

Learn about Guangzhou Guangri StockLtd's historical performance.

Wuxi Unicomp Technology (SHSE:688531)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuxi Unicomp Technology Co., Ltd. focuses on the research, development, manufacture, and sale of X-ray technology and intelligent detection equipment in China with a market cap of CN¥5.19 billion.

Operations: The company generates revenue primarily from the sale of X-ray technology and intelligent detection equipment. It has a market capitalization of CN¥5.19 billion.

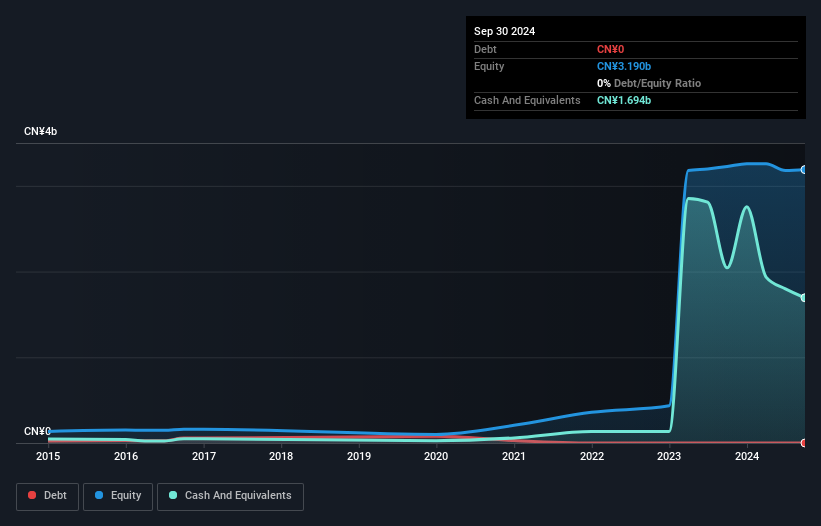

Wuxi Unicomp Technology, a smaller player in the electronics sector, has shown impressive financial resilience with no debt compared to five years ago when its debt-to-equity ratio was 73.2%. The company's earnings grew by 15.5% over the past year, outpacing the industry average of 1.9%, and its price-to-earnings ratio stands at 39.8x, which is favorable against the industry norm of 41.5x. Despite not being free cash flow positive recently, Wuxi's net income for nine months ending September 2024 reached CNY 105 million from CNY 81 million a year prior, reflecting strong operational performance and potential growth prospects ahead.

Make It Happen

- Embark on your investment journey to our 4518 Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Unicomp Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688531

Wuxi Unicomp Technology

Engages in the research, development, manufacture, and sale of X-ray technology and intelligent detection equipment in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives