- China

- /

- Auto Components

- /

- SHSE:603730

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, with U.S. equities experiencing declines due to inflation concerns and political uncertainty, investors are increasingly seeking stability amid economic fluctuations. In this environment, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive option for those looking to balance risk in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.27% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.51% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.77% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.10% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.61% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.17% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.14% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

Click here to see the full list of 1994 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Jiangsu Tianmu Lake TourismLtd (SHSE:603136)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Tianmu Lake Tourism Co., Ltd. operates a tourism resort in China with a market cap of CN¥3.02 billion.

Operations: Jiangsu Tianmu Lake Tourism Co., Ltd. generates its revenue from operating a tourism resort in China.

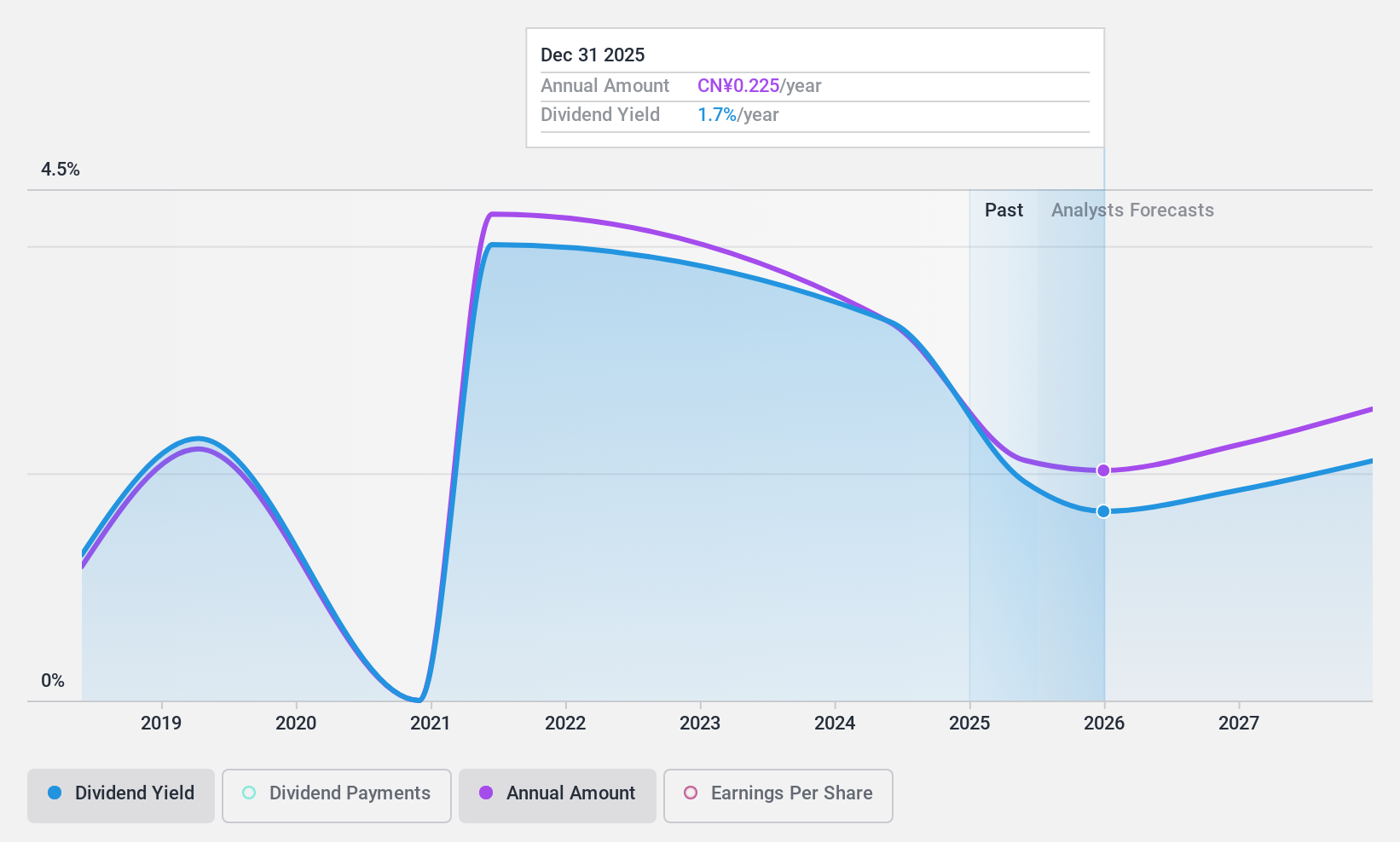

Dividend Yield: 3.3%

Jiangsu Tianmu Lake Tourism Ltd. has a mixed dividend profile with payments covered by earnings and cash flows, evidenced by an 87.3% payout ratio and a 68.8% cash payout ratio. Despite trading below fair value, its dividend history is less stable, having been paid for only seven years with volatility in annual payments. Recent earnings results show decreased net income to CNY 85.42 million, impacting the reliability of future dividends despite a competitive yield in the CN market.

- Dive into the specifics of Jiangsu Tianmu Lake TourismLtd here with our thorough dividend report.

- Our expertly prepared valuation report Jiangsu Tianmu Lake TourismLtd implies its share price may be lower than expected.

Shanghai Daimay Automotive Interior (SHSE:603730)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Daimay Automotive Interior Co., Ltd engages in the research, development, production, and sale of passenger car components for OEMs and automakers both in China and internationally, with a market cap of CN¥14.56 billion.

Operations: Shanghai Daimay Automotive Interior Co., Ltd generates revenue through the production and sale of passenger car components for original equipment manufacturers and automakers across domestic and international markets.

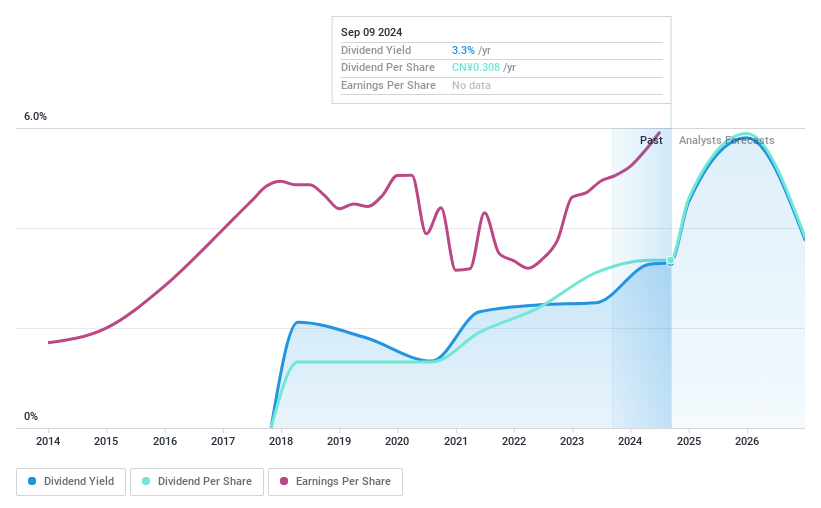

Dividend Yield: 3.5%

Shanghai Daimay Automotive Interior's dividend payments are well-covered, with a 69.7% payout ratio and a 65.3% cash payout ratio, indicating sustainability. The dividend yield of 3.49% is competitive in the Chinese market, and payments have been stable over seven years with consistent growth. Trading significantly below estimated fair value enhances its appeal despite limited historical reliability due to its relatively short dividend history. Recent earnings show increased net income to CNY 623.03 million, supporting future payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Shanghai Daimay Automotive Interior.

- According our valuation report, there's an indication that Shanghai Daimay Automotive Interior's share price might be on the cheaper side.

Beijing Sanlian Hope Shin-Gosen Technical Service (SZSE:300384)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Beijing Sanlian Hope Shin-Gosen Technical Service Co., Ltd. operates in the technical services sector with a market capitalization of CN¥5.24 billion.

Operations: The revenue segments for Beijing Sanlian Hope Shin-Gosen Technical Service Co., Ltd. are not provided in the given text.

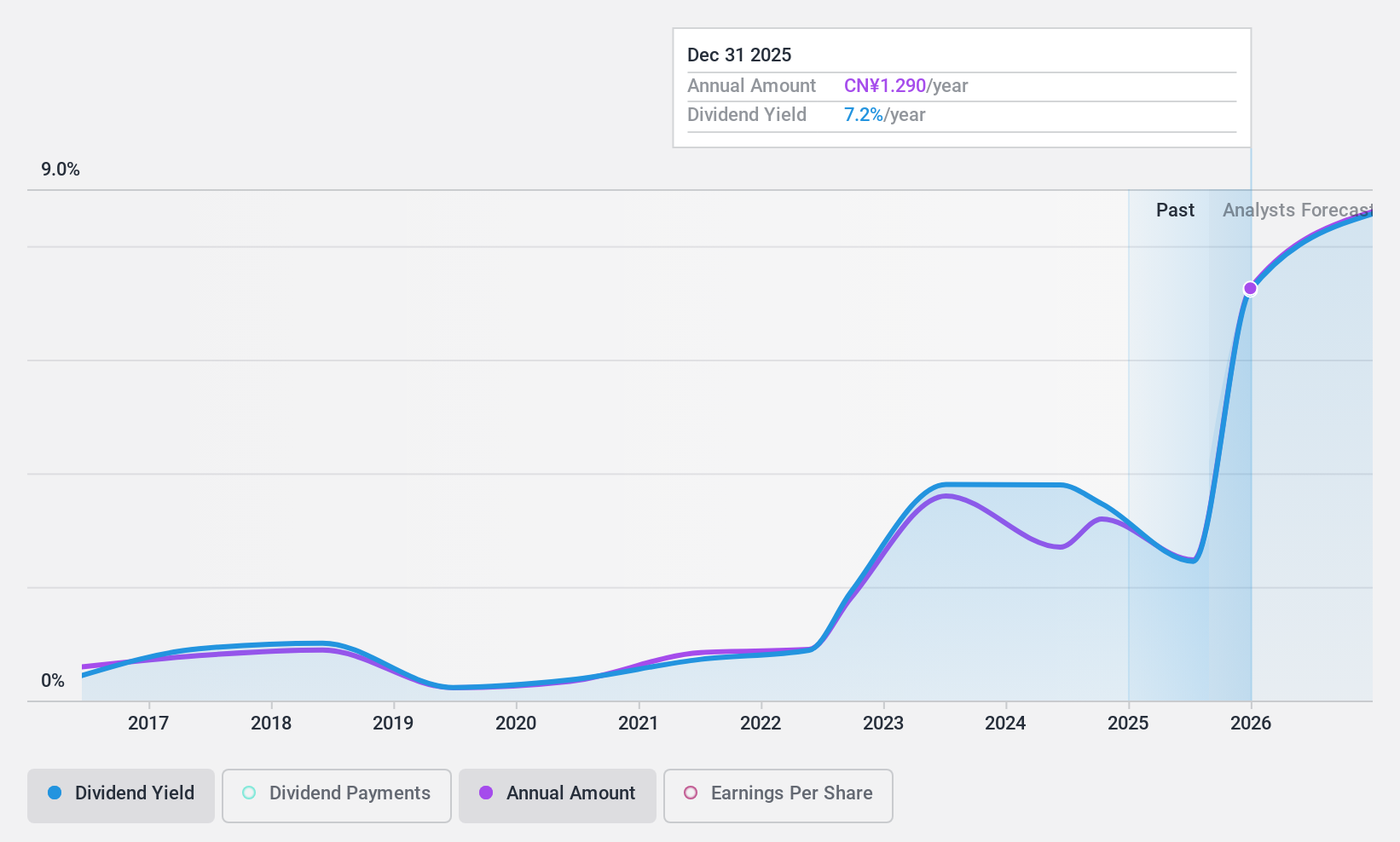

Dividend Yield: 3.5%

Beijing Sanlian Hope Shin-Gosen Technical Service offers a dividend yield of 3.46%, ranking in the top 25% in China, with dividends covered by both earnings (71.7% payout ratio) and cash flow (69.8% cash payout ratio). Despite a favorable price-to-earnings ratio of 15.4x, below the market average, its dividend history is volatile and unreliable over the past decade, though recent earnings growth supports current payouts.

- Take a closer look at Beijing Sanlian Hope Shin-Gosen Technical Service's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Beijing Sanlian Hope Shin-Gosen Technical Service is trading behind its estimated value.

Summing It All Up

- Embark on your investment journey to our 1994 Top Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603730

Shanghai Daimay Automotive Interior

Researches, develops, produces, and sells passenger car components for OEMs and auto makers in China and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives