The three-year decline in earnings might be taking its toll on Guangdong Insight Brand Marketing GroupLtd (SZSE:300781) shareholders as stock falls 7.1% over the past week

Share

While Guangdong Insight Brand Marketing Group Co.,Ltd. (SZSE:300781) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 25% in the last quarter. But that doesn't change the fact that the returns over the last three years have been very strong. Indeed, the share price is up a very strong 196% in that time. So the recent fall in the share price should be viewed in that context. Only time will tell if there is still too much optimism currently reflected in the share price.

While the stock has fallen 7.1% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for Guangdong Insight Brand Marketing GroupLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last three years, Guangdong Insight Brand Marketing GroupLtd failed to grow earnings per share, which fell 2.2% (annualized).

Companies are not always focussed on EPS growth in the short term, and looking at how the share price has reacted, we don't think EPS is the most important metric for Guangdong Insight Brand Marketing GroupLtd at the moment. So other metrics may hold the key to understanding what is influencing investors.

Languishing at just 0.09%, we doubt the dividend is doing much to prop up the share price. It could be that the revenue growth of 7.3% per year is viewed as evidence that Guangdong Insight Brand Marketing GroupLtd is growing. In that case, the company may be sacrificing current earnings per share to drive growth, and maybe shareholder's faith in better days ahead will be rewarded.

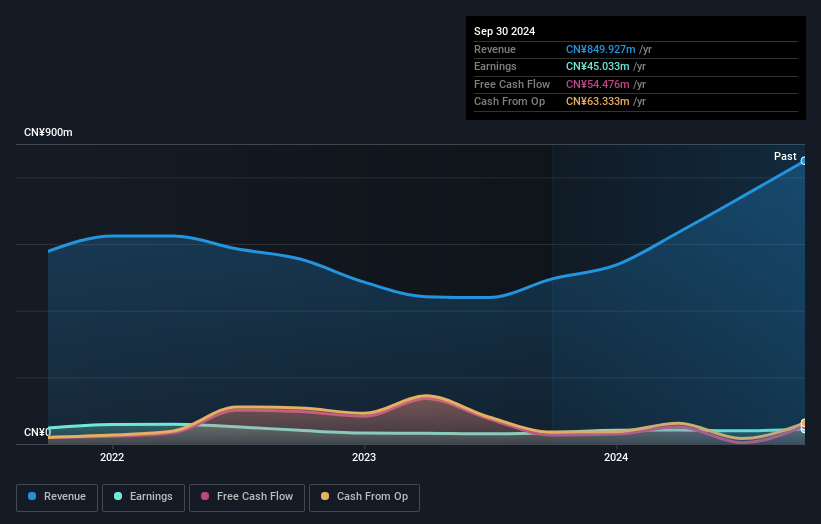

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Guangdong Insight Brand Marketing GroupLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Guangdong Insight Brand Marketing GroupLtd's TSR for the last 3 years was 200%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Investors in Guangdong Insight Brand Marketing GroupLtd had a tough year, with a total loss of 4.1% (including dividends), against a market gain of about 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 24% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Guangdong Insight Brand Marketing GroupLtd (of which 1 is a bit unpleasant!) you should know about.

We will like Guangdong Insight Brand Marketing GroupLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300781

Guangdong Insight Brand Marketing GroupLtd

Guangdong Insight Brand Marketing Group Co.,Ltd.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives