- China

- /

- Electronic Equipment and Components

- /

- SZSE:301391

Exploring High Growth Tech Stocks Including Beijing Vastdata Technology

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating consumer confidence and mixed economic indicators, the technology sector continues to capture investor attention, with indices like the Nasdaq Composite showcasing notable activity. In this environment, identifying high-growth tech stocks such as Beijing Vastdata Technology requires a focus on innovation potential and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1270 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Beijing Vastdata Technology (SHSE:603138)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Vastdata Technology Co., Ltd. offers data technology services in China with a market capitalization of approximately CN¥4.01 billion.

Operations: Vastdata Technology generates revenue primarily from its Software and Information Technology Services segment, amounting to CN¥365.24 million. The company operates within the data technology sector in China, focusing on providing specialized services to its clients.

Beijing Vastdata Technology's trajectory in the tech sector is underscored by a robust annual revenue growth rate of 41.8%, significantly outpacing the broader Chinese market's average of 13.7%. Despite current unprofitability, the company is on a path to profitability with earnings expected to surge by approximately 119.67% annually over the next three years. Recent developments have seen its exclusion from the S&P Global BMI Index, yet it demonstrated resilience with a notable reduction in net losses to CNY 43.59 million from CNY 85.35 million year-over-year and an increase in sales reaching CNY 266.87 million for the nine months ending September 2024, up from CNY 163.46 million in the previous period.

- Take a closer look at Beijing Vastdata Technology's potential here in our health report.

Gain insights into Beijing Vastdata Technology's past trends and performance with our Past report.

Wanda Film Holding (SZSE:002739)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wanda Film Holding Co., Ltd. focuses on the investment, construction, and operation of movie theaters across China, Australia, and New Zealand with a market cap of CN¥27.05 billion.

Operations: Wanda Film Holding Co., Ltd. generates revenue primarily through its extensive network of movie theaters located in China, Australia, and New Zealand. The company leverages its strategic investments in theater construction and operations to drive income from ticket sales, concessions, and related services.

Wanda Film Holding's recent executive reshuffling and strategic board meetings hint at a pivotal restructuring, potentially steering the company towards more innovative horizons. Despite a downturn in revenue to CNY 9.85 billion, down from CNY 11.35 billion year-over-year, and a significant drop in net income from CNY 1.11 billion to CNY 168.69 million, the firm is poised for recovery with projected annual earnings growth of 72.2%. This forecast aligns with an aggressive R&D investment strategy aimed at revitalizing its entertainment technology offerings, ensuring Wanda remains competitive in a rapidly evolving industry landscape.

- Click here and access our complete health analysis report to understand the dynamics of Wanda Film Holding.

Explore historical data to track Wanda Film Holding's performance over time in our Past section.

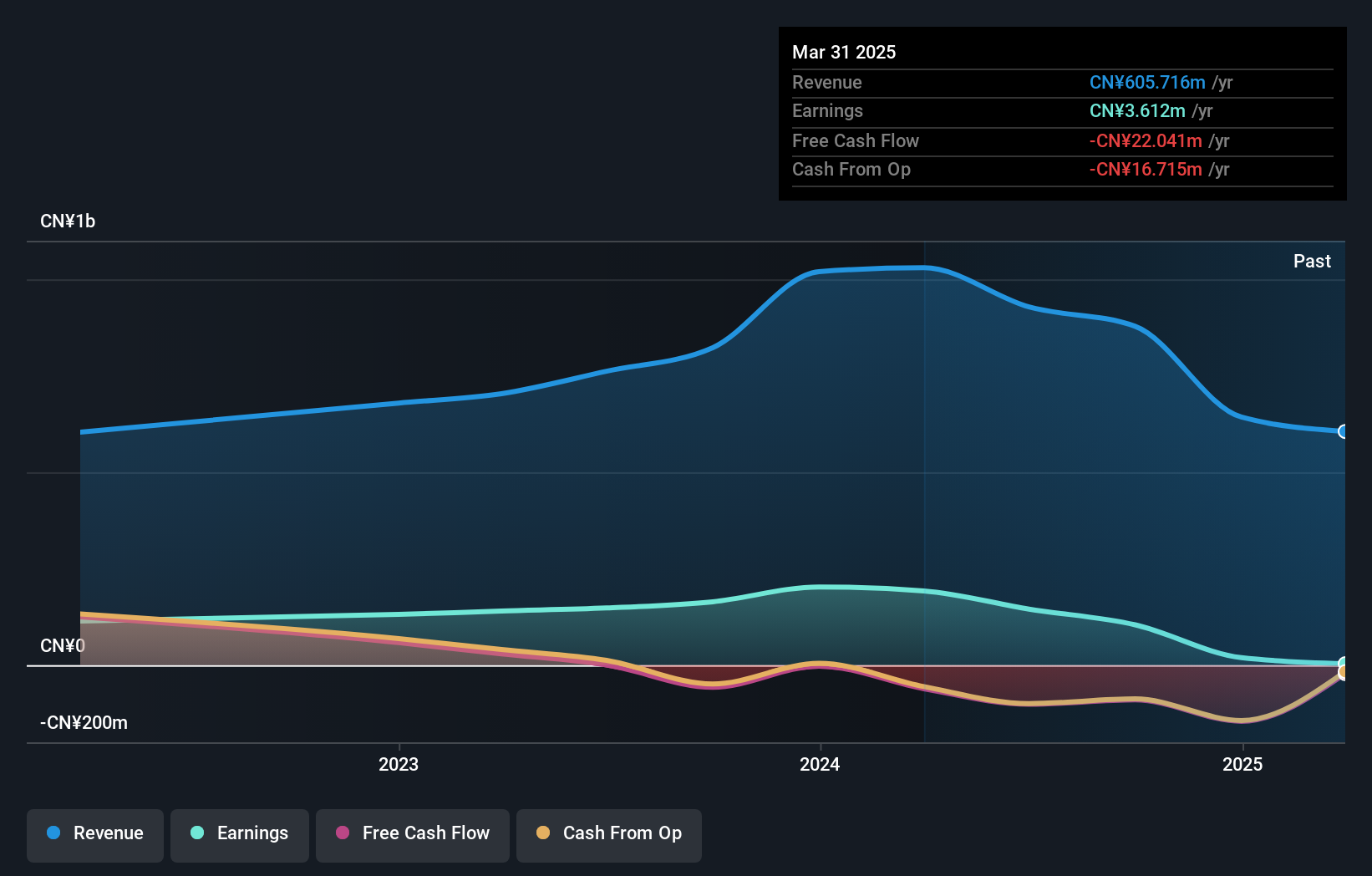

Colorlight Cloud Tech (SZSE:301391)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Colorlight Cloud Tech Ltd specializes in the R&D, manufacturing, and sales of LED display control systems and related video processing equipment globally, with a market cap of CN¥3.70 billion.

Operations: The company generates revenue primarily from the sales of LED display control system equipment, amounting to CN¥878.11 million.

Despite recent setbacks, including a drop from the S&P Global BMI Index, Colorlight Cloud Tech is poised for significant growth with projected revenue increases of 36.3% annually. This optimism is underscored by an anticipated surge in earnings, expected to rise by 47.4% per year. However, challenges persist as evidenced by a stark reduction in net income from CNY 109.91 million to CNY 11.7 million over the past nine months, reflecting broader industry pressures and internal inefficiencies that need addressing to harness full growth potential and improve its competitive stance in the tech sector. In response to these financial dynamics, Colorlight Cloud Tech has actively engaged stakeholders through special meetings aimed at strategic cash management and auditing processes enhancement—initiatives critical for stabilizing operations and fostering innovation within its technological offerings. These efforts are crucial as they navigate through a transformative phase aiming not only to rebound but also to capitalize on emerging market opportunities driven by robust demand for advanced cloud technologies and AI solutions.

Key Takeaways

- Access the full spectrum of 1270 High Growth Tech and AI Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301391

Colorlight Cloud Tech

Engages in the research and development, manufacture, and sale of LED display control systems, video processing equipment, play servers, and cloud network players worldwide.

High growth potential with adequate balance sheet.