3 Growth Companies With High Insider Ownership Seeing Up To 85% Earnings Growth

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating consumer confidence and mixed economic indicators, major stock indexes in the U.S. have shown moderate gains, with large-cap growth stocks leading the charge before a mid-week reversal. In this environment of cautious optimism, investors often look for growth companies with strong insider ownership as these can indicate management's confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Wuxi HyatechLtd (SHSE:688510)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Hyatech Co., Ltd. is engaged in the research, development, manufacturing, and sale of aero-engine parts and forged medical orthopedic implants both in China and internationally, with a market cap of CN¥4.42 billion.

Operations: The company generates revenue from two main segments: aero-engine parts and forged medical orthopedic implants.

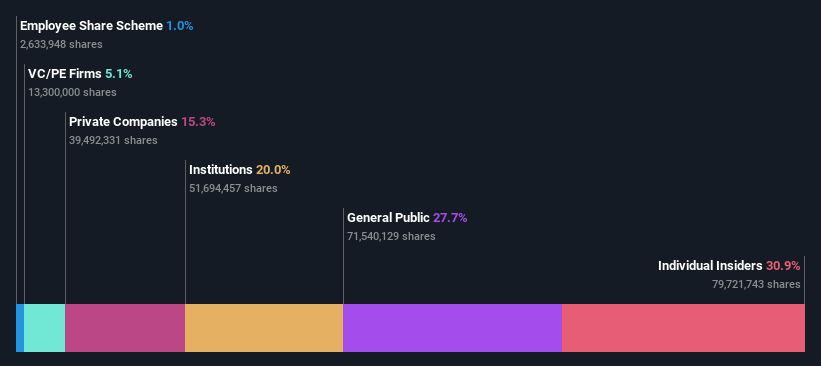

Insider Ownership: 29.7%

Earnings Growth Forecast: 30.1% p.a.

Wuxi Hyatech Ltd. demonstrates strong growth potential with revenue and earnings forecasted to grow significantly faster than the Chinese market, at 23.8% and 30.1% per year respectively. Recent earnings results show a substantial increase in net income to CNY 92.75 million for the nine months ended September 2024, up from CNY 69.48 million a year ago. Despite high non-cash earnings, insider trading activity has been minimal recently, suggesting stable internal confidence in growth prospects.

- Navigate through the intricacies of Wuxi HyatechLtd with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Wuxi HyatechLtd's shares may be trading at a premium.

Shijiazhuang Yiling Pharmaceutical (SZSE:002603)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shijiazhuang Yiling Pharmaceutical Co., Ltd. operates in the pharmaceutical industry, focusing on the research, development, and production of traditional Chinese medicine products, with a market cap of CN¥27.25 billion.

Operations: The company generates revenue of CN¥8.11 billion from its pharmaceutical manufacturing segment.

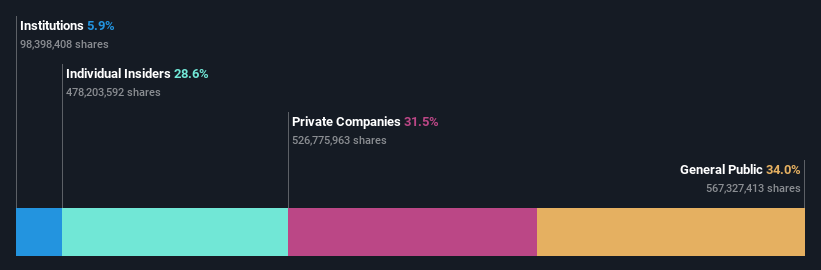

Insider Ownership: 28.6%

Earnings Growth Forecast: 48.6% p.a.

Shijiazhuang Yiling Pharmaceutical's insider ownership aligns with its growth potential, as earnings are projected to rise significantly by 48.6% annually over the next three years, outpacing the Chinese market average. However, recent financials show a decline in net income to CNY 554.78 million for the nine months ended September 2024 from CNY 1,758.68 million a year ago. The dividend yield of 1.82% is not well-supported by current earnings or cash flows, indicating potential sustainability issues.

- Click here to discover the nuances of Shijiazhuang Yiling Pharmaceutical with our detailed analytical future growth report.

- Our expertly prepared valuation report Shijiazhuang Yiling Pharmaceutical implies its share price may be lower than expected.

Ta Chen Stainless Pipe (TWSE:2027)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ta Chen Stainless Pipe Co., Ltd. is involved in the manufacturing, processing, and sale of stainless steel pipes, plates, fittings, and venetian blinds across Taiwan, the United States, China, and other international markets with a market cap of NT$64.32 billion.

Operations: The company's revenue is primarily derived from its Stainless Steel and Aluminum Products Department, generating NT$75.84 billion, followed by the Screws and Nuts Segment at NT$21.82 billion, and Aluminum Products Manufacturing at NT$21.68 billion.

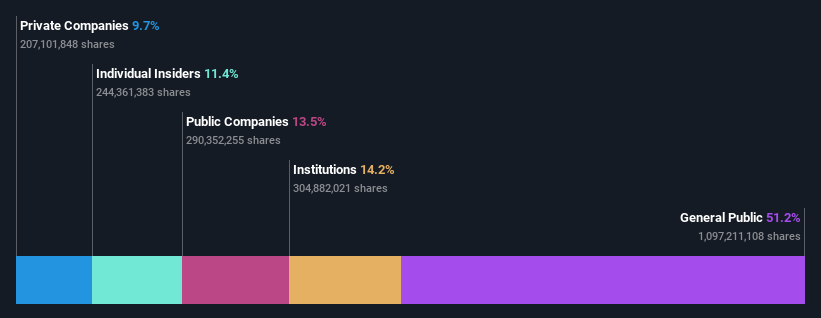

Insider Ownership: 11.4%

Earnings Growth Forecast: 85.3% p.a.

Ta Chen Stainless Pipe's growth prospects are underpinned by expected significant earnings growth of 85.32% annually, surpassing the TW market average. However, recent financials reveal challenges with a decline in net income to TWD 289.59 million for Q3 2024 from TWD 1,264.11 million a year prior. The dividend yield of 3.96% is not well-covered by earnings, pointing to potential sustainability concerns despite the company's high insider ownership and revenue growth outpacing the market average at 14%.

- Dive into the specifics of Ta Chen Stainless Pipe here with our thorough growth forecast report.

- Our valuation report here indicates Ta Chen Stainless Pipe may be overvalued.

Key Takeaways

- Click here to access our complete index of 1510 Fast Growing Companies With High Insider Ownership.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002603

Shijiazhuang Yiling Pharmaceutical

Shijiazhuang Yiling Pharmaceutical Co., Ltd.

Excellent balance sheet with reasonable growth potential.