- China

- /

- Electronic Equipment and Components

- /

- SHSE:688025

High Growth Tech Stocks to Watch in December 2024

Reviewed by Simply Wall St

As global markets navigate a holiday-shortened week, major U.S. stock indexes have experienced moderate gains, led by large-cap growth stocks, despite a dip in consumer confidence and manufacturing indicators. With the Nasdaq Composite and Russell 1000 Growth Index initially outpacing their counterparts before a mid-week reversal, investors are keenly observing how these dynamics might influence high-growth tech stocks. In such an environment, identifying promising tech stocks involves looking for companies with strong innovation potential and robust adaptability to shifting economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1270 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Shenzhen JPT Opto-Electronics (SHSE:688025)

Simply Wall St Growth Rating: ★★★★★☆

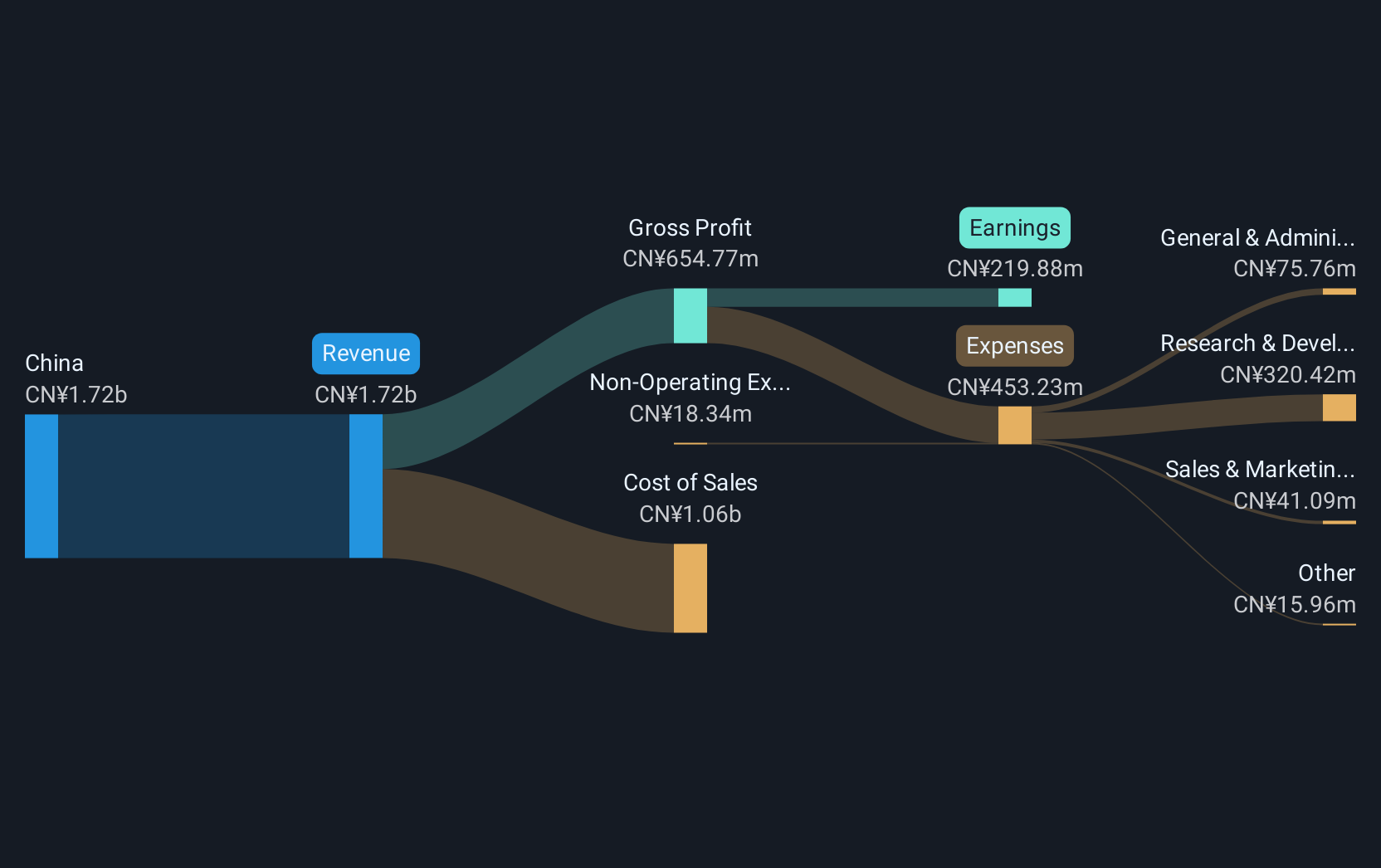

Overview: Shenzhen JPT Opto-Electronics Co., Ltd. focuses on the research and development, production, sale, and technical services of laser, intelligent equipment, and optical devices with a market cap of CN¥4.63 billion.

Operations: The company generates revenue primarily from the Computer Communications and Other Electronic Equipment segment, amounting to CN¥1.39 billion.

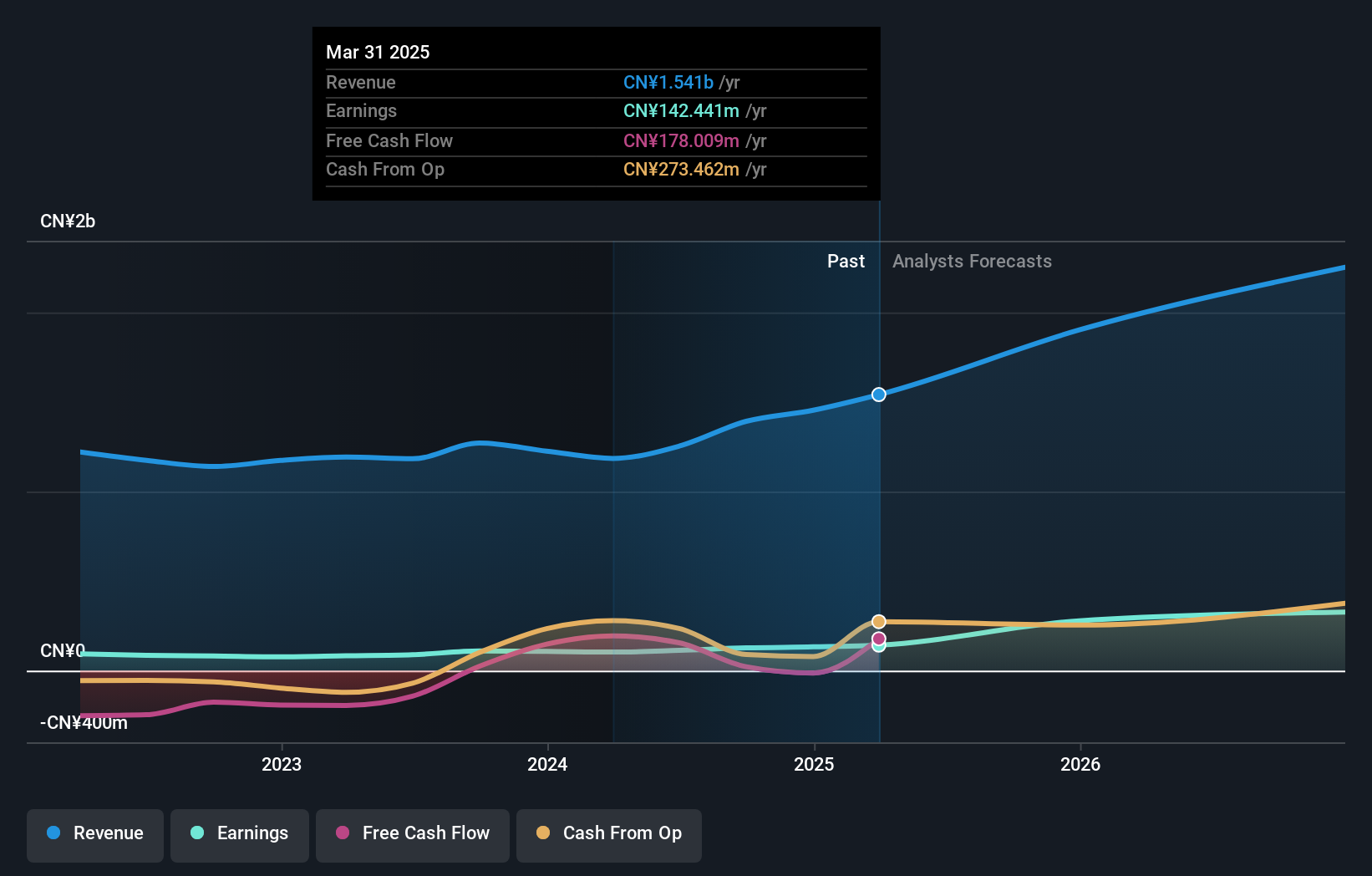

Shenzhen JPT Opto-Electronics has demonstrated robust performance with a 20.5% annual revenue growth and an impressive 36% expected earnings growth over the next three years, outpacing the broader Chinese market's projections. Despite recent setbacks, such as being dropped from the S&P Global BMI Index, the company's commitment to innovation is evident in its R&D investments, which have facilitated above-industry earnings growth of 15.7% this past year compared to the electronic industry's 1.9%. With sustained positive free cash flow and high-quality earnings, Shenzhen JPT Opto-Electronics remains a compelling entity within the tech sector, poised for continued advancement in opto-electronic solutions.

OPT Machine Vision Tech (SHSE:688686)

Simply Wall St Growth Rating: ★★★★★☆

Overview: OPT Machine Vision Tech Co., Ltd. develops and supplies components and software for factory automation worldwide, with a market capitalization of CN¥9.11 billion.

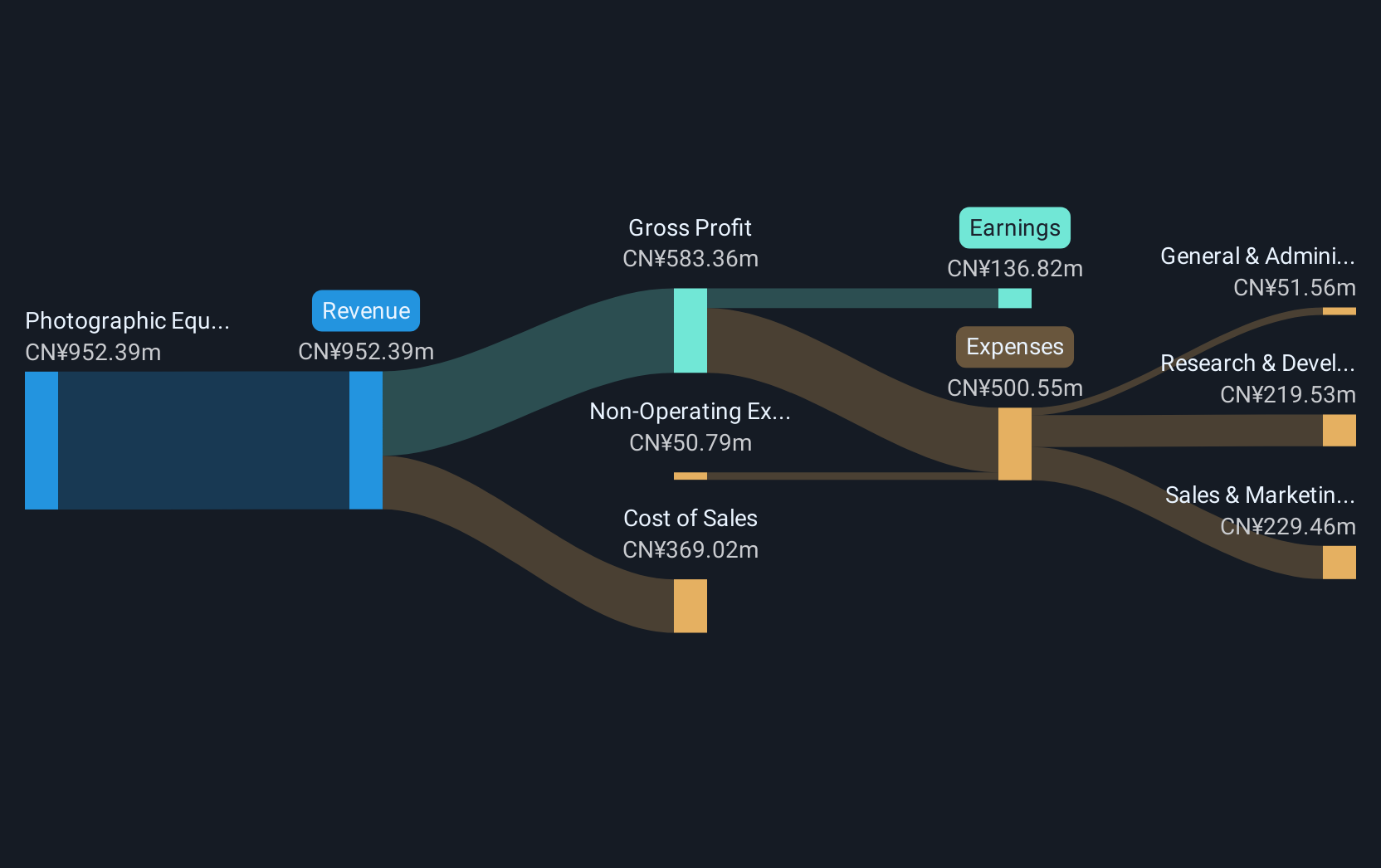

Operations: OPT Machine Vision Tech generates revenue primarily from its Photographic Equipment & Supplies segment, which contributes CN¥831.18 million.

Despite a challenging year with sales dropping to CNY 733.26 million from CNY 845.95 million, OPT Machine Vision Tech has maintained a robust innovation pipeline, evidenced by its notable R&D commitment. This focus on development is crucial as the company navigates through industry shifts and prepares for future demands. Moreover, with earnings expected to surge by an impressive 42.5% annually, OPT is strategically positioning itself to capitalize on market opportunities, enhancing its competitive edge in the tech landscape. This approach is underscored by recent strategic movements including a special shareholders meeting set for November 2024, signaling proactive governance amidst financial recalibrations.

Richinfo Technology (SZSE:300634)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Richinfo Technology Co., Ltd. offers industrial Internet solutions and technical services in China, with a market cap of CN¥10.21 billion.

Operations: Richinfo Technology Co., Ltd. focuses on delivering industrial Internet solutions and technical services within China. The company operates with a market capitalization of approximately CN¥10.21 billion, emphasizing its role in the technology sector.

Richinfo Technology, amid a challenging landscape, reported a revenue increase to CNY 1.21 billion up from CNY 1.09 billion year-over-year, demonstrating resilience and adaptability in its market strategies. Despite a dip in net income from CNY 306.69 million to CNY 195.17 million, the firm sustains shareholder confidence with consistent dividend payouts, recently affirming a cash dividend of CNY 0.426587 per share. This approach is complemented by an aggressive R&D investment strategy aimed at fostering innovation and securing competitive advantage in rapidly evolving tech sectors.

Where To Now?

- Reveal the 1270 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688025

Shenzhen JPT Opto-Electronics

Engages in the research and development, production, sale, and technical services of laser, intelligent equipment, and optical devices.

Flawless balance sheet with high growth potential.