As global markets navigate a mix of rising stock indices and declining consumer confidence, investors are keenly observing the performance of growth stocks, which have recently led market rallies. In this climate, companies with high insider ownership can be particularly appealing as they often indicate strong alignment between management and shareholder interests, potentially providing stability amid economic fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Farsoon Technologies (SHSE:688433)

Simply Wall St Growth Rating: ★★★★★☆

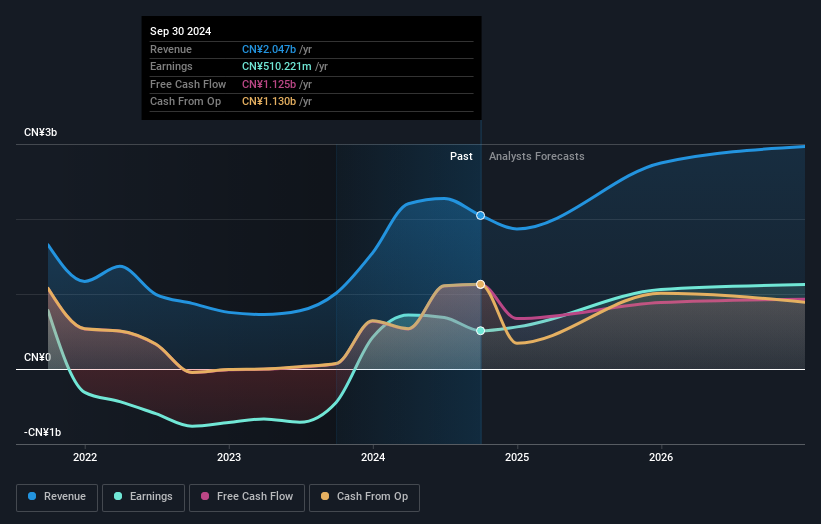

Overview: Farsoon Technologies specializes in providing industrial plastic laser sintering and metal laser melting systems across China, North America, and Europe, with a market cap of CN¥9.35 billion.

Operations: The company's revenue segment includes Machinery & Industrial Equipment, amounting to CN¥579.72 million.

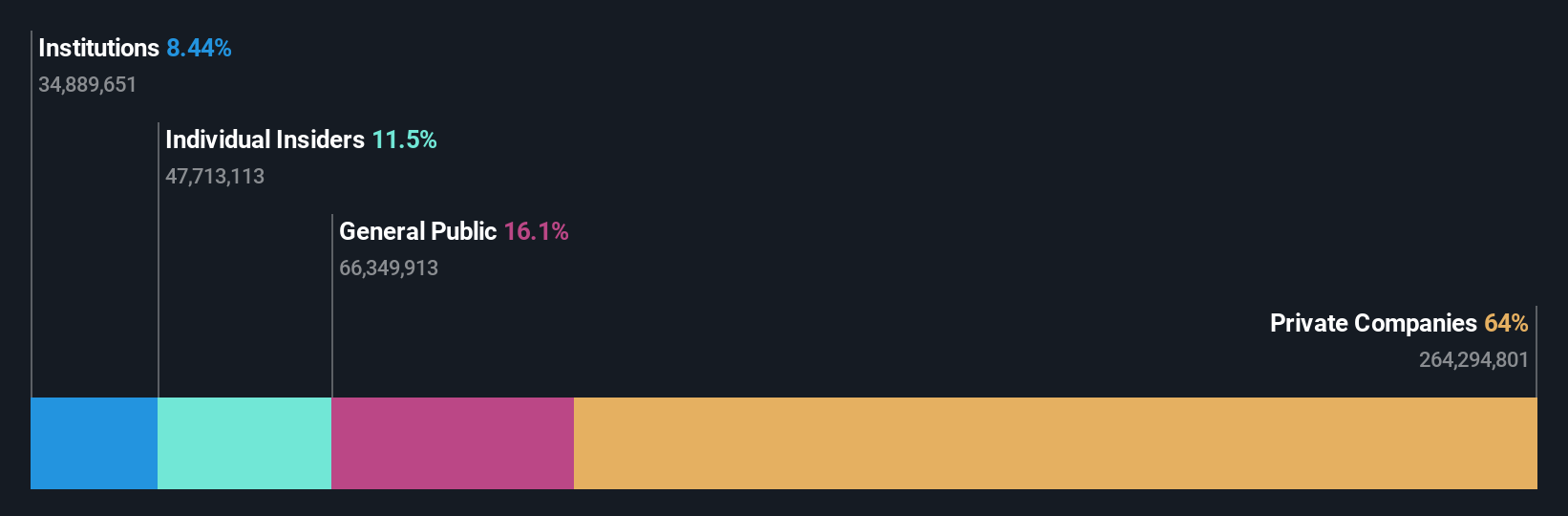

Insider Ownership: 11.5%

Farsoon Technologies shows strong growth potential with forecasted earnings and revenue expected to grow significantly above market rates at 68.36% and 52.3% per year, respectively. Despite this, recent financial results indicate a decline in sales and net income for the first nine months of 2024 compared to the previous year. High insider ownership may align management interests with shareholders, but no substantial insider trading activity has been reported recently.

- Take a closer look at Farsoon Technologies' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Farsoon Technologies shares in the market.

Beijing Enlight Media (SZSE:300251)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Enlight Media Co., Ltd. is involved in the investment, production, and distribution of film and television projects in China with a market cap of CN¥27.89 billion.

Operations: Beijing Enlight Media's revenue is primarily derived from its activities in film and television investment, production, and distribution within China.

Insider Ownership: 12.1%

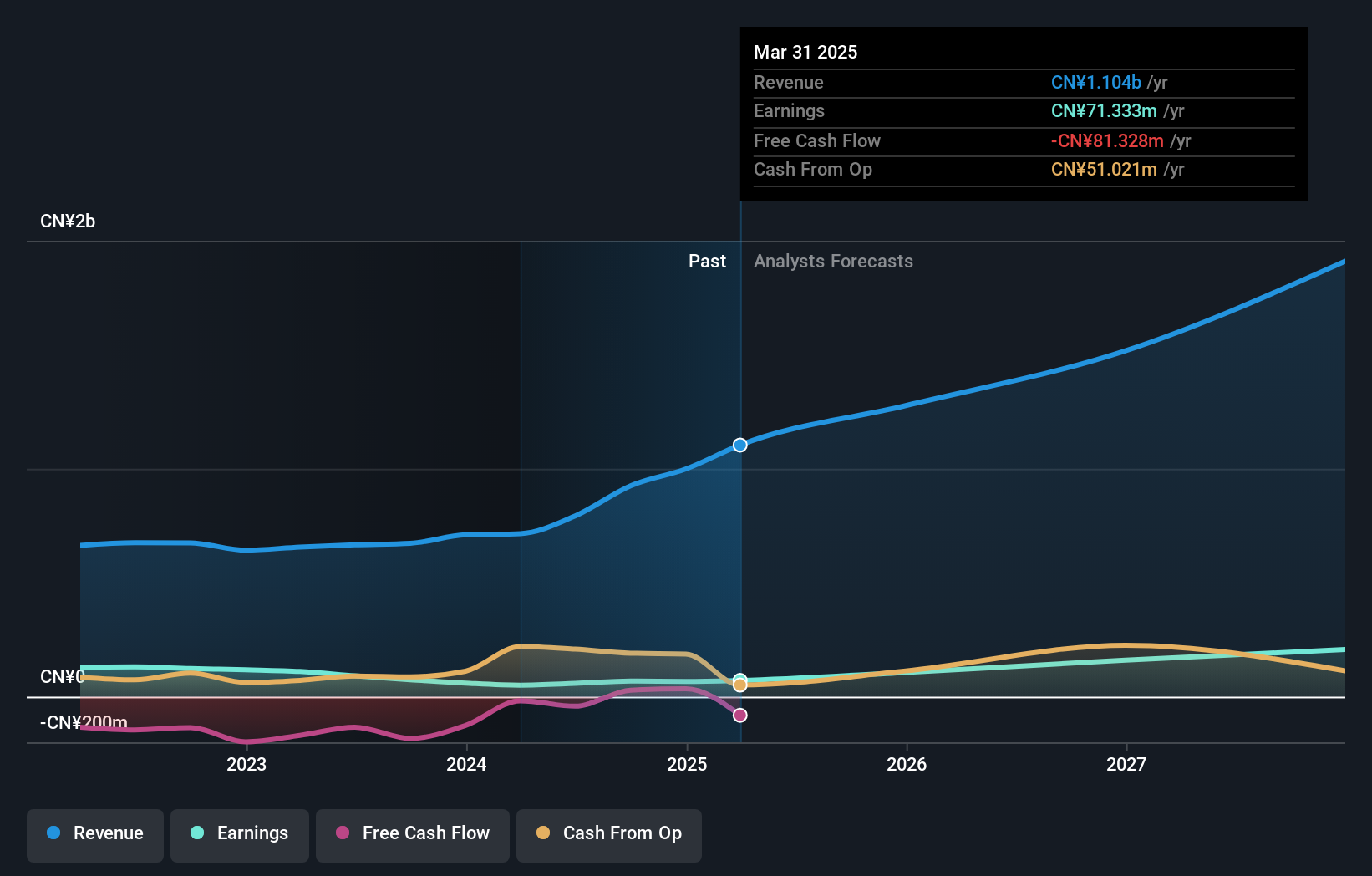

Beijing Enlight Media demonstrates growth potential with earnings forecasted to grow at 37.3% annually, outpacing the Chinese market's average. Recent financial results show a revenue increase to CNY 1.44 billion and net income rising to CNY 460.88 million for the first nine months of 2024 compared to last year. While insider ownership is high, aligning management interests with shareholders, there has been no significant insider trading activity recently reported.

- Delve into the full analysis future growth report here for a deeper understanding of Beijing Enlight Media.

- The analysis detailed in our Beijing Enlight Media valuation report hints at an inflated share price compared to its estimated value.

Advanced Fiber Resources (Zhuhai) (SZSE:300620)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Advanced Fiber Resources (Zhuhai), Ltd. designs and manufactures passive optical components for both domestic and international markets, with a market cap of CN¥12.32 billion.

Operations: The company generates revenue from its Optoelectronic Devices and Other Electronic Devices segment, amounting to CN¥924.78 million.

Insider Ownership: 32.1%

Advanced Fiber Resources (Zhuhai) shows strong growth potential with revenue forecasted to grow at 23.7% annually, surpassing the Chinese market average. Recent earnings report reveals a rise in sales to CNY 738.95 million and net income to CNY 55.81 million for the first nine months of 2024 compared to last year, although profit margins have decreased from 11.1% to 7.4%. Despite high insider ownership, there has been no significant recent insider trading activity reported.

- Unlock comprehensive insights into our analysis of Advanced Fiber Resources (Zhuhai) stock in this growth report.

- Upon reviewing our latest valuation report, Advanced Fiber Resources (Zhuhai)'s share price might be too optimistic.

Taking Advantage

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1507 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688433

Farsoon Technologies

Farsoon Technologies supplies industrial plastic laser sintering and metal laser melting systems in China, North America, and Europe.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives