- China

- /

- Consumer Durables

- /

- SZSE:300993

Discovering Hidden Gems With Potential On None Exchange December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating consumer confidence and mixed economic indicators, small-cap stocks continue to capture investor interest, with indices like the Russell 2000 showing modest gains amidst broader market volatility. In this environment, identifying hidden gems requires a keen eye for companies with strong fundamentals and the potential to thrive despite economic headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intelligent Wave | NA | 7.39% | 15.42% | ★★★★★★ |

| Jih Lin Technology | 56.44% | 4.23% | 3.89% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wealth First Portfolio Managers | 4.08% | -43.42% | 42.63% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Abans Holdings | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 31.26% | 0.80% | 0.71% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Sichuan Haite High-techLtd (SZSE:002023)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sichuan Haite High-tech Co., Ltd specializes in providing aircraft airborne equipment maintenance services in China with a market cap of CN¥7.82 billion.

Operations: Haite High-tech generates revenue primarily from aircraft airborne equipment maintenance services. The company has a market cap of CN¥7.82 billion, indicating its significant presence in the industry.

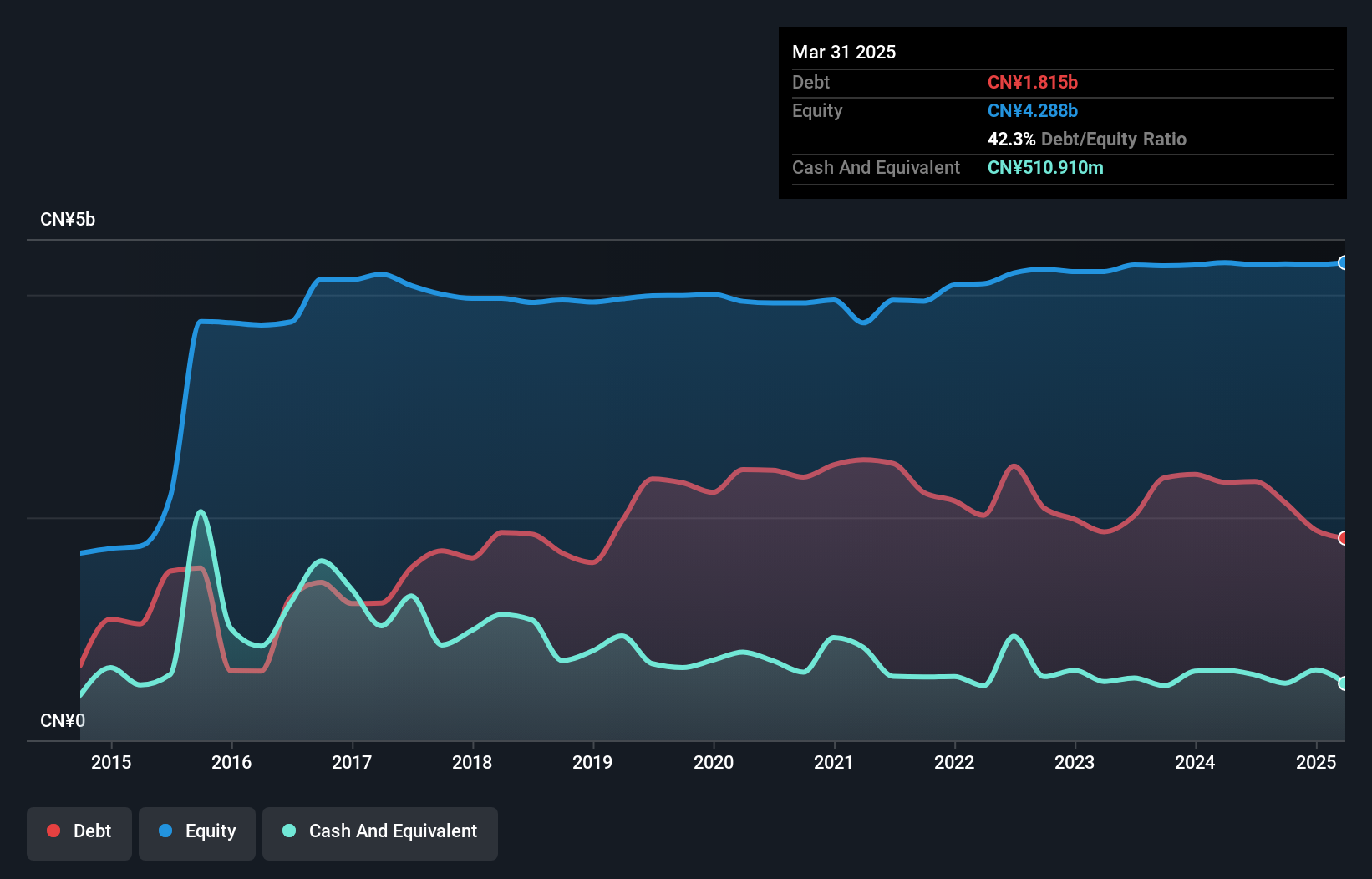

Sichuan Haite High-tech has demonstrated impressive earnings growth of 139% over the past year, significantly outpacing the infrastructure industry's 3.1%. The company's debt-to-equity ratio has improved from 57.9% to 49.9% in five years, indicating prudent financial management, while its net debt to equity stands at a satisfactory 37.9%. Recent earnings for the nine months ending September show sales reaching CNY 911 million compared to last year's CNY 731 million, with net income climbing to CNY 61.9 million from CNY 33.3 million previously. However, interest payments are not well covered by EBIT at a coverage of just 2.2 times.

- Click here to discover the nuances of Sichuan Haite High-techLtd with our detailed analytical health report.

Gain insights into Sichuan Haite High-techLtd's past trends and performance with our Past report.

Shandong Yuma Sun-shading Technology (SZSE:300993)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Yuma Sun-shading Technology Corp., Ltd. focuses on the research, development, production, and sale of functional shading materials in China and has a market cap of approximately CN¥3.20 billion.

Operations: Shandong Yuma generates revenue primarily through the research, development, production, and sales of functional shading materials, amounting to CN¥736.42 million.

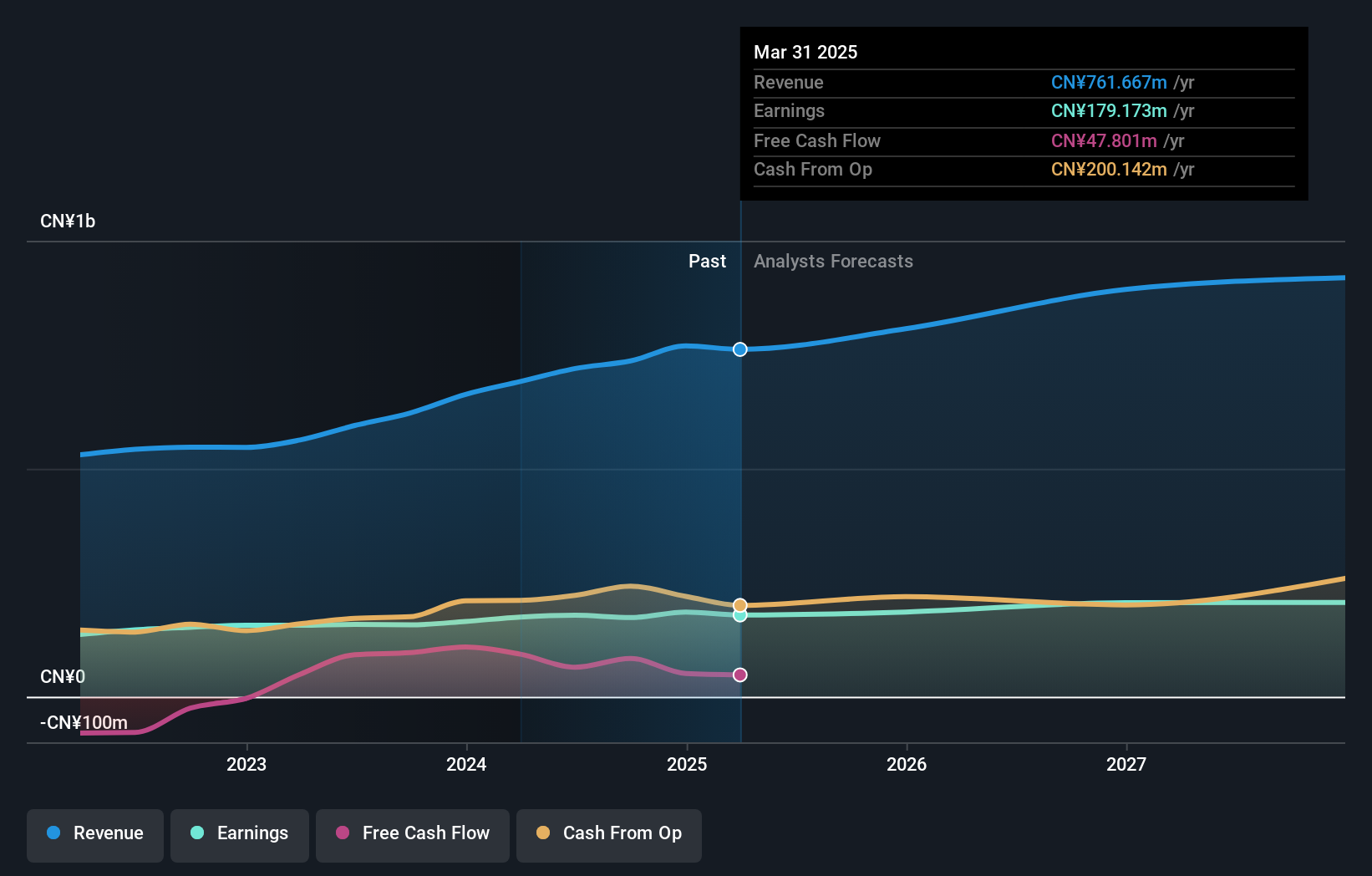

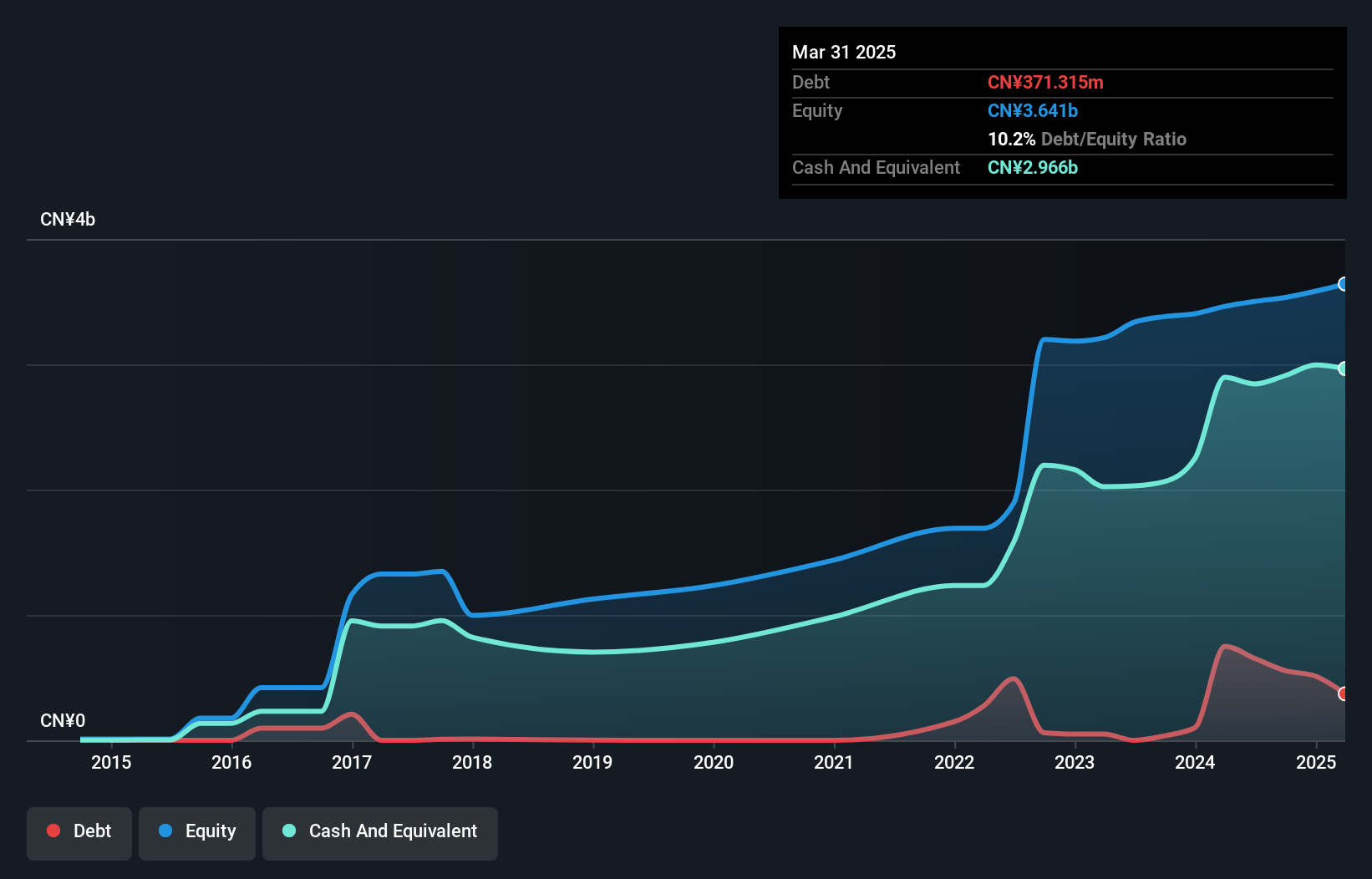

Shandong Yuma shines in the niche market with its robust financial health and no debt, a rarity in today's economic climate. The company's earnings surged by 10%, outpacing the broader Consumer Durables sector, which saw a 0.2% contraction. With a Price-To-Earnings ratio of 20x, it appears undervalued compared to the CN market average of 36x. Recent figures highlight strong performance; sales reached CNY 550.69 million for nine months ending September 2024, up from CNY 477.29 million last year, while net income climbed to CNY 128.07 million from CNY 119.67 million previously, reflecting solid operational efficiency and growth potential moving forward.

Easy Click Worldwide Network Technology (SZSE:301171)

Simply Wall St Value Rating: ★★★★★☆

Overview: Easy Click Worldwide Network Technology Co., Ltd. operates in the digital advertising and promotion services sector, with a market capitalization of CN¥13.43 billion.

Operations: Easy Click generates revenue primarily from its advertising and promotion services, amounting to CN¥2.31 billion.

Easy Click Worldwide Network Technology, a smaller player in the tech space, has demonstrated notable financial activity. Over the past year, earnings grew by 20.1%, outpacing the media industry's -10.2% performance. The company reported net income of CN¥194.98 million for the nine months ending September 2024, up from CN¥180.79 million a year earlier, with basic earnings per share at CN¥0.41 compared to CN¥0.38 previously. Additionally, Easy Click repurchased 735,400 shares for CN¥10.05 million this year and declared dividends of CNY 0.25 per 10 shares recently approved at their extraordinary general meeting in November 2024.

Key Takeaways

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4629 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300993

Shandong Yuma Sun-shading Technology

Engages in the research and development, production, and sale of functional shading materials in China and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives