- China

- /

- Semiconductors

- /

- SHSE:688120

3 Stocks With Estimated Valuations Below Their Intrinsic Worth

Reviewed by Simply Wall St

As global markets navigate a period marked by inflation concerns and political uncertainties, investors are keenly observing the performance of various indices, with U.S. equities experiencing notable declines amid choppy trading conditions. Amidst this volatility, identifying stocks that are potentially undervalued can offer intriguing opportunities for investors looking to align their portfolios with intrinsic value rather than market sentiment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.18 | TRY78.31 | 50% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1115.85 | ₹2228.29 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP290.00 | CLP578.96 | 49.9% |

| MLG Oz (ASX:MLG) | A$0.62 | A$1.14 | 45.6% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Dino Polska (WSE:DNP) | PLN433.60 | PLN863.86 | 49.8% |

| Cicor Technologies (SWX:CICN) | CHF59.60 | CHF118.58 | 49.7% |

| Shinko Electric Industries (TSE:6967) | ¥5870.00 | ¥11691.00 | 49.8% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥13.99 | CN¥27.78 | 49.6% |

| Prodways Group (ENXTPA:PWG) | €0.608 | €1.21 | 49.9% |

Here's a peek at a few of the choices from the screener.

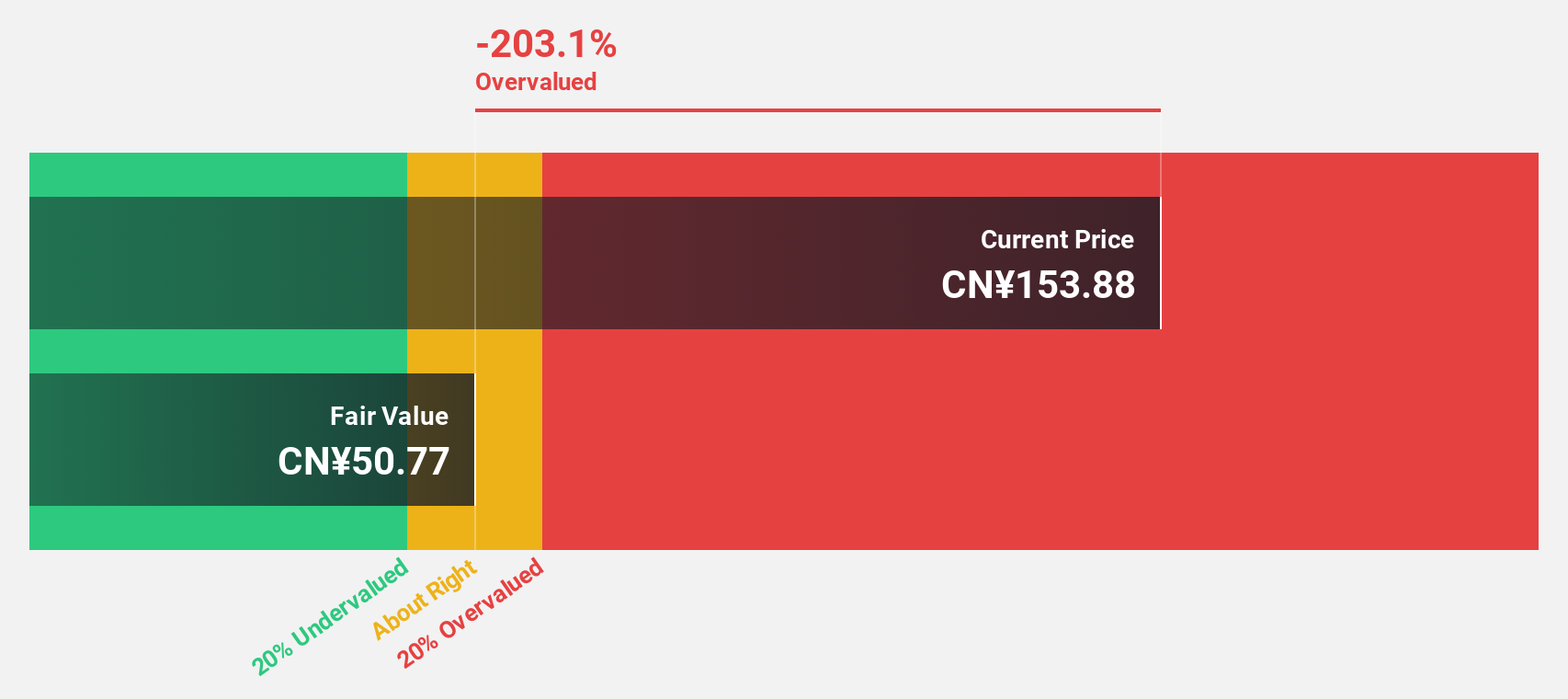

Hwatsing Technology (SHSE:688120)

Overview: Hwatsing Technology Co., Ltd. is a Chinese company that manufactures semiconductor equipment products, with a market cap of CN¥36.54 billion.

Operations: The company's revenue primarily comes from its semiconductor equipment and services segment, totaling CN¥3.12 billion.

Estimated Discount To Fair Value: 34.2%

Hwatsing Technology is trading at CN¥156.89, significantly below the estimated fair value of CN¥238.27, indicating it may be undervalued based on cash flows. The company reported a revenue increase to CN¥2.45 billion for the nine months ending September 2024, up from CN¥1.84 billion a year ago, with net income rising to CN¥720.7 million from CN¥563.93 million, demonstrating strong financial performance and potential for growth in earnings and revenue above market averages.

- In light of our recent growth report, it seems possible that Hwatsing Technology's financial performance will exceed current levels.

- Take a closer look at Hwatsing Technology's balance sheet health here in our report.

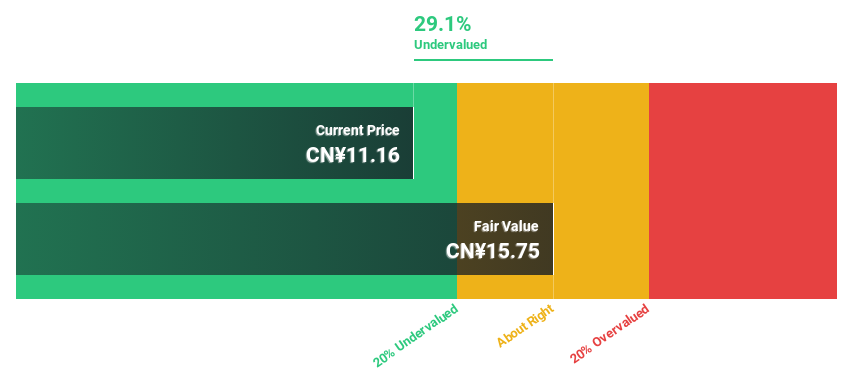

Wanda Film Holding (SZSE:002739)

Overview: Wanda Film Holding Co., Ltd. operates movie theaters in China, Australia, and New Zealand, with a market cap of CN¥24.10 billion.

Operations: Wanda Film Holding Co., Ltd. generates revenue through its investment, construction, and operation of movie theaters across China, Australia, and New Zealand.

Estimated Discount To Fair Value: 29.1%

Wanda Film Holding is trading at CN¥11.16, below its estimated fair value of CN¥15.75, suggesting undervaluation based on cash flows. Despite a decline in nine-month revenue to CN¥9.85 billion from the previous year's CN¥11.35 billion and net income dropping to CN¥168.69 million, earnings are projected to grow significantly at 75.41% annually, with profitability expected in three years—above average market growth—indicating potential for future financial improvement amidst recent board changes.

- Our expertly prepared growth report on Wanda Film Holding implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Wanda Film Holding.

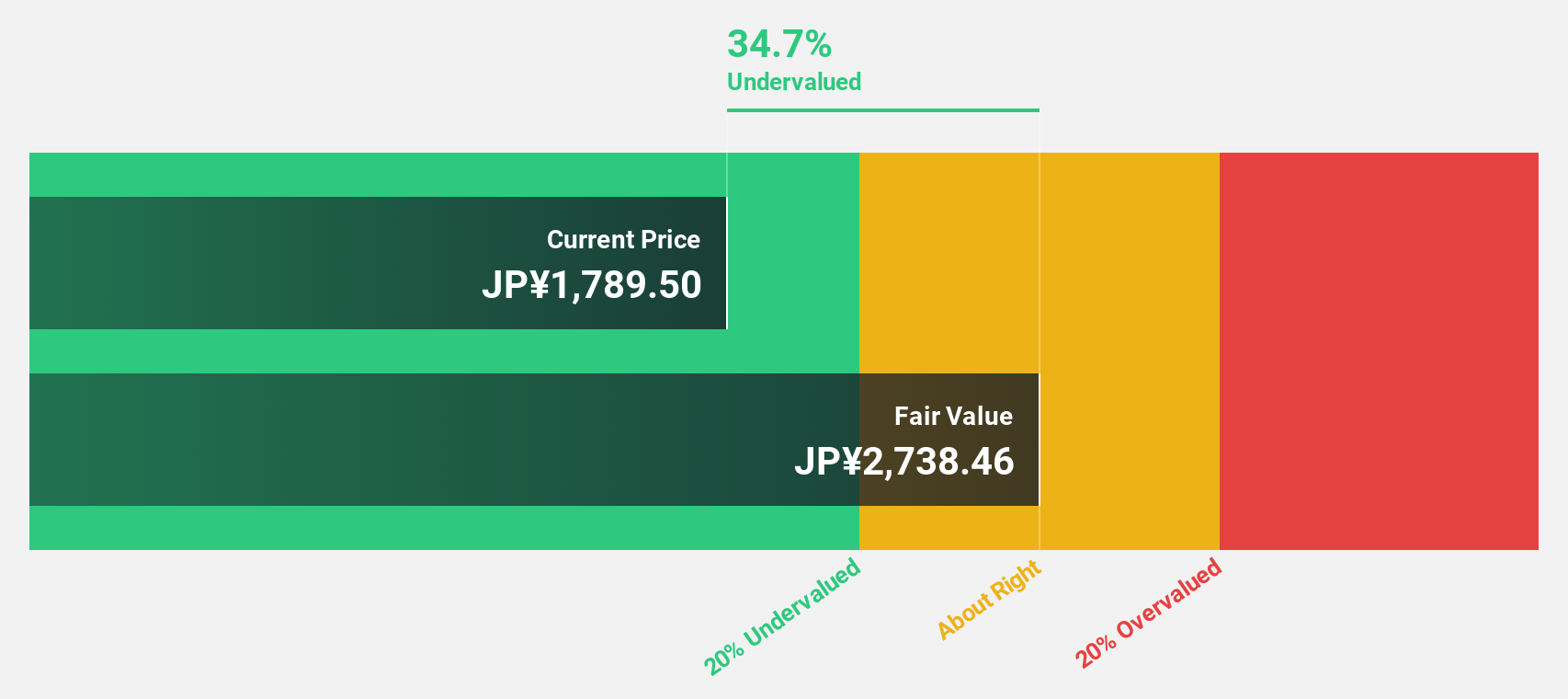

Rorze (TSE:6323)

Overview: Rorze Corporation designs, develops, manufactures, and sells automation systems for semiconductor and flat panel display production globally, with a market cap of ¥275.38 billion.

Operations: Revenue Segments (in millions of ¥): Semiconductor production automation systems: ¥63,500; Flat panel display production automation systems: ¥25,300.

Estimated Discount To Fair Value: 41.7%

Rorze Corporation is trading at ¥1689, significantly below its estimated fair value of ¥2899.47, highlighting undervaluation based on cash flows. Despite high share price volatility recently, earnings grew by 38.3% last year and are expected to grow 8% annually—slower than the Japanese market's average growth rate. Rorze offers good relative value compared to peers and industry standards, with a projected high return on equity of 20.9% in three years.

- Our growth report here indicates Rorze may be poised for an improving outlook.

- Navigate through the intricacies of Rorze with our comprehensive financial health report here.

Next Steps

- Click through to start exploring the rest of the 877 Undervalued Stocks Based On Cash Flows now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hwatsing Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688120

Hwatsing Technology

Manufactures semiconductor equipment products in China.

Flawless balance sheet with high growth potential.