- China

- /

- Tech Hardware

- /

- SHSE:600734

3 Promising Penny Stocks With Market Caps Over US$400M

Reviewed by Simply Wall St

Global markets have been experiencing volatility, with U.S. equities declining due to inflation concerns and political uncertainty, while small-cap stocks continue to underperform. Despite these challenges, investors may still find opportunities in penny stocks—companies that are often smaller or newer but can offer surprising value when backed by strong financial health. This article explores several penny stocks that demonstrate financial resilience and potential for growth amidst the current market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.75 | MYR443.74M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.976 | £744.58M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.30 | THB2.58B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$140.36M | ★★★★☆☆ |

| Starflex (SET:SFLEX) | THB2.56 | THB1.99B | ★★★★☆☆ |

Click here to see the full list of 5,716 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Allied Group (SEHK:373)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Allied Group Limited is an investment holding company involved in property investment and development, as well as financial services across Hong Kong, the People's Republic of China, the United Kingdom, and Australia, with a market cap of approximately HK$4.99 billion.

Operations: The company generates revenue from various segments, including Consumer Finance (HK$3.17 billion), Property Investment (HK$911.5 million), Property Management (HK$348.3 million), Property Development (HK$1.10 billion), Elderly Care Services (HK$180.2 million), and Investment and Finance (HK$944.4 million).

Market Cap: HK$4.99B

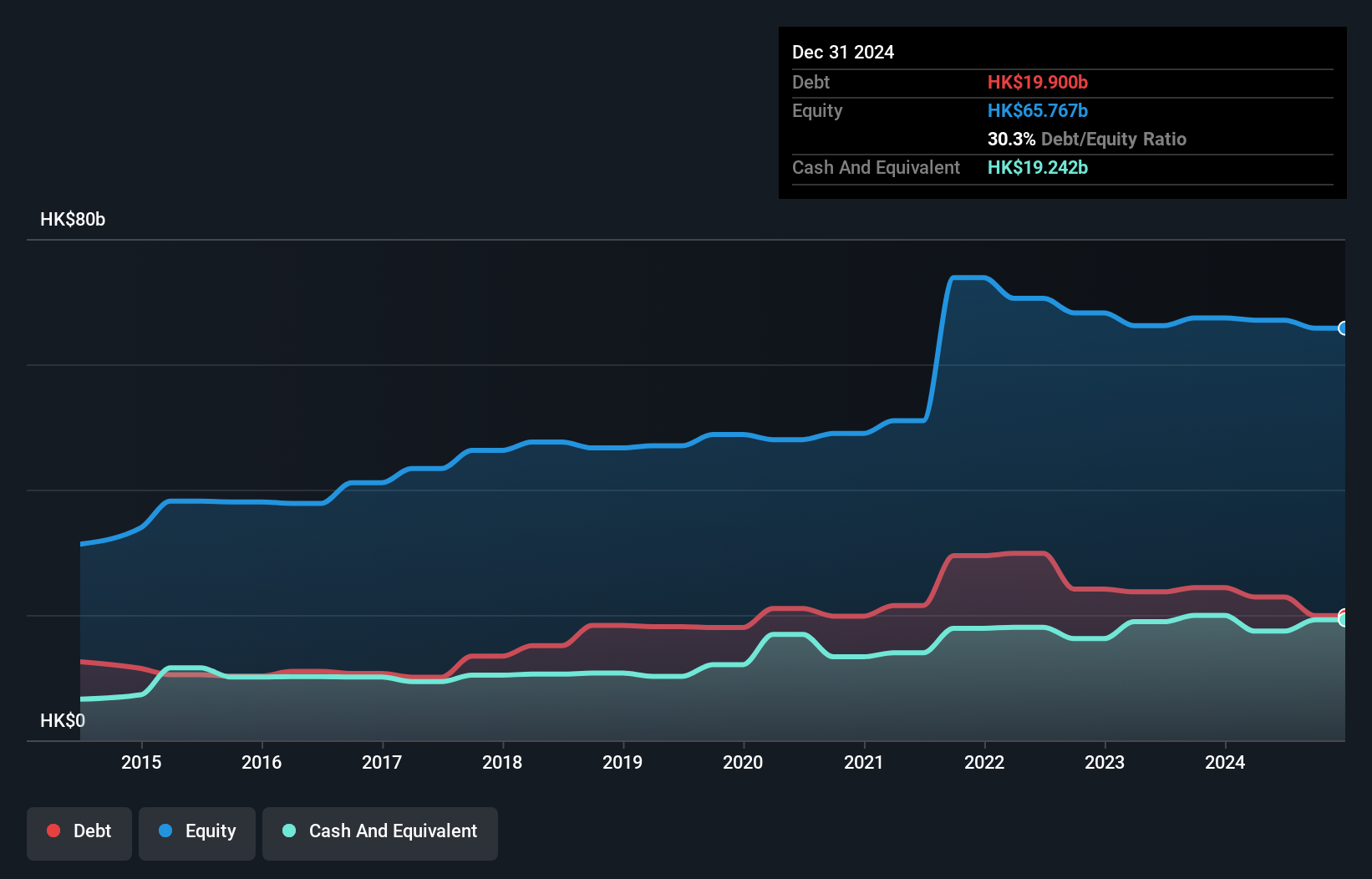

Allied Group's market cap is approximately HK$4.99 billion, with diverse revenue streams across property and financial services sectors. Despite its seasoned management team, the company remains unprofitable with increasing losses over five years and a negative return on equity. While short-term assets significantly exceed liabilities, suggesting strong liquidity, operating cash flow covers only 10% of debt, indicating potential cash flow constraints. The net debt to equity ratio is satisfactory at 8.1%, showing controlled leverage levels. Although the board has extensive experience, earnings have consistently declined by 28.2% annually over five years without meaningful shareholder dilution recently noted.

- Click here to discover the nuances of Allied Group with our detailed analytical financial health report.

- Assess Allied Group's previous results with our detailed historical performance reports.

Fujian Start GroupLtd (SHSE:600734)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fujian Start Group Co. Ltd operates in China, specializing in anti-intrusion detection systems, with a market capitalization of CN¥7.78 billion.

Operations: Fujian Start Group Co. Ltd has not reported any specific revenue segments.

Market Cap: CN¥7.78B

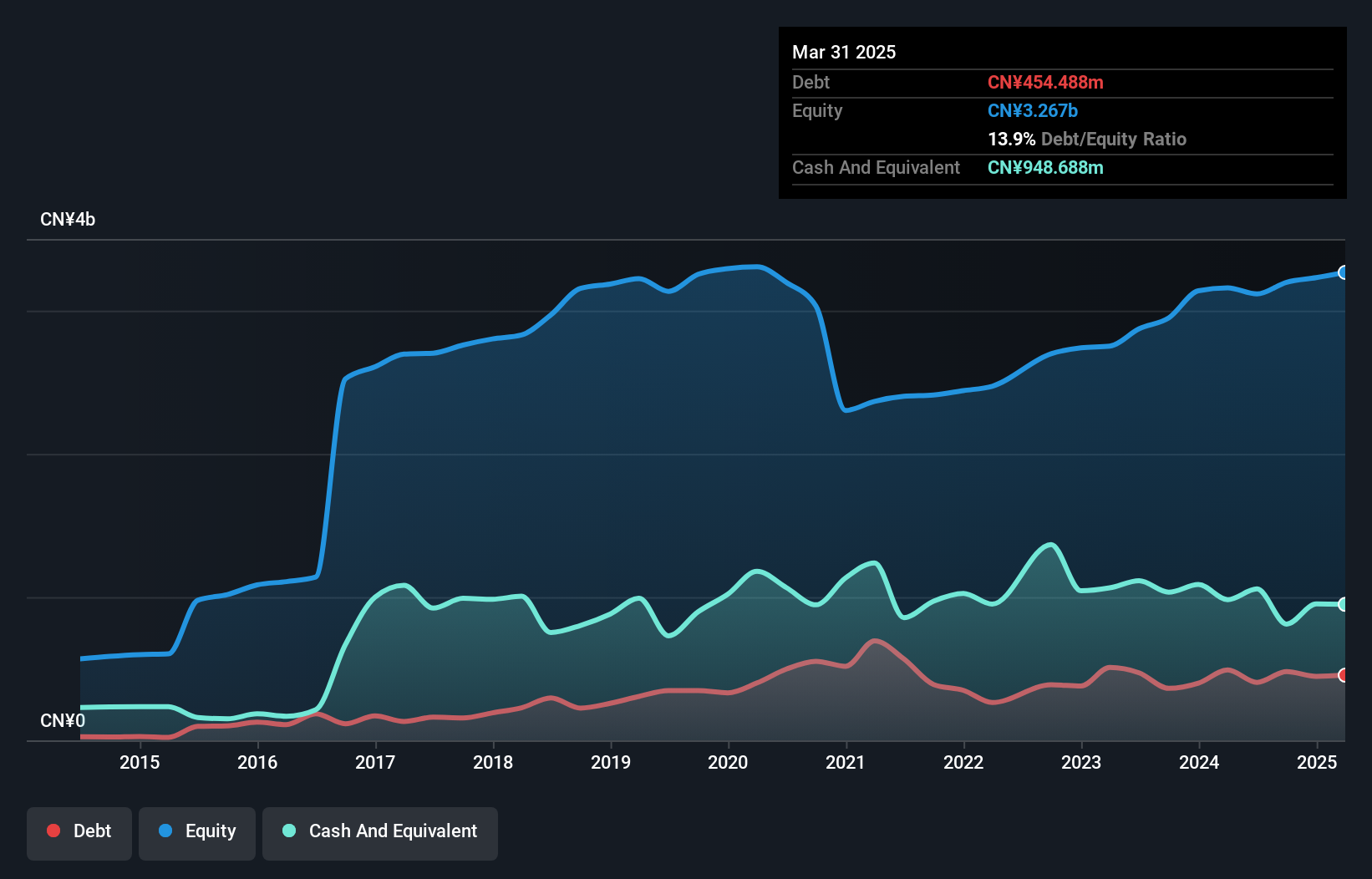

Fujian Start Group Co. Ltd, with a market cap of CN¥7.78 billion, has shown significant earnings growth of 532.7% over the past year, surpassing both its industry and five-year average growth rates. Despite high non-cash earnings and improved profit margins from 3% to 28.9%, the company faces challenges with negative operating cash flow and insufficient data on interest coverage by EBIT. The board's inexperience is notable with an average tenure of 2.8 years, yet financial stability is supported by more cash than total debt and short-term assets exceeding liabilities significantly, indicating solid liquidity management amidst fluctuating revenues.

- Navigate through the intricacies of Fujian Start GroupLtd with our comprehensive balance sheet health report here.

- Gain insights into Fujian Start GroupLtd's past trends and performance with our report on the company's historical track record.

Shanghai YongLi Belting (SZSE:300230)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shanghai YongLi Belting Co., Ltd is engaged in the development, production, and sale of conveyor belts with a market cap of CN¥3.49 billion.

Operations: Shanghai YongLi Belting Co., Ltd has not reported specific revenue segments.

Market Cap: CN¥3.49B

Shanghai YongLi Belting Co., Ltd, with a market cap of CN¥3.49 billion, has demonstrated robust earnings growth of 63.6% over the past year, outpacing its industry significantly. The company maintains strong liquidity with short-term assets of CN¥2.2 billion surpassing both long-term and short-term liabilities, while its debt is well-covered by operating cash flow at 61.1%. Although the price-to-earnings ratio is attractively low at 9.7x compared to the market average, recent financial results were influenced by a large one-off gain of CN¥157.8 million, suggesting potential volatility in future earnings stability without such gains.

- Take a closer look at Shanghai YongLi Belting's potential here in our financial health report.

- Review our historical performance report to gain insights into Shanghai YongLi Belting's track record.

Summing It All Up

- Access the full spectrum of 5,716 Penny Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600734

Fujian Start GroupLtd

Provides anti-intrusion detection systems in China.

Adequate balance sheet with weak fundamentals.

Market Insights

Community Narratives