- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A338220

3 Growth Companies With High Insider Ownership Expecting 117% Earnings Growth

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes approaching record highs and a strong labor market, investor sentiment remains cautiously optimistic despite geopolitical uncertainties and economic outlooks in Europe and China. In this environment, growth companies with high insider ownership can be particularly appealing, as they often signal confidence from those closest to the business while potentially offering robust earnings growth opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 43.2% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 103.6% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

We're going to check out a few of the best picks from our screener tool.

Vuno (KOSDAQ:A338220)

Simply Wall St Growth Rating: ★★★★★★

Overview: Vuno Inc. is a medical artificial intelligence solution development company with a market cap of ₩391.65 billion.

Operations: Revenue Segments (in millions of ₩):

Insider Ownership: 15.7%

Earnings Growth Forecast: 117.6% p.a.

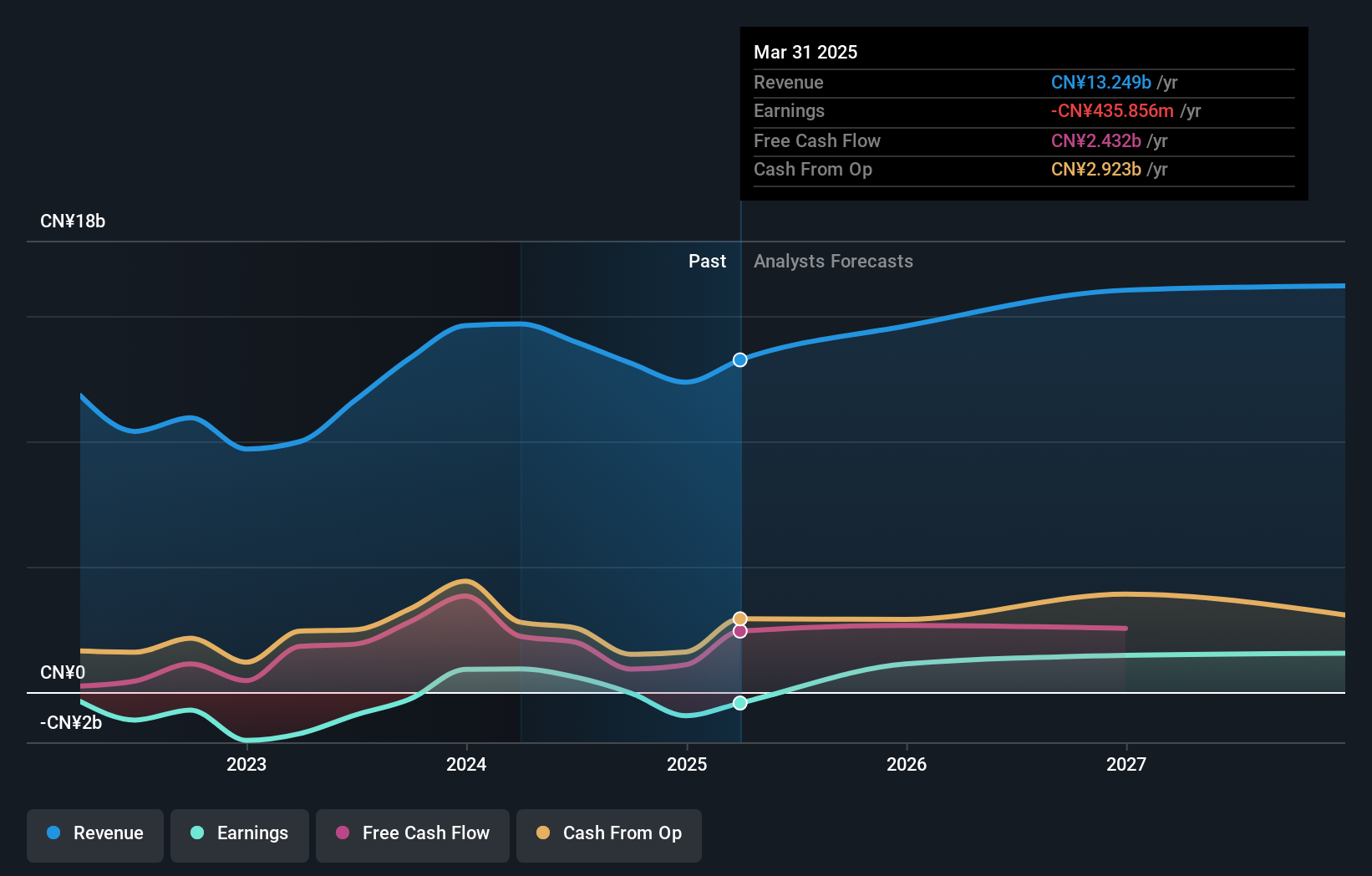

Vuno is forecast to experience robust revenue growth at 44.9% annually, significantly outpacing the Korean market average of 9.2%. Earnings are projected to grow by a substantial 117.58% per year, with profitability expected within three years and a high return on equity anticipated at 140.1%. However, shareholders have faced dilution over the past year, and the company has less than one year of cash runway available. The stock trades at a discount of 17.9% below its estimated fair value.

- Dive into the specifics of Vuno here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Vuno's current price could be inflated.

Beijing Hotgen Biotech (SHSE:688068)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Hotgen Biotech Co., Ltd. focuses on the research, development, manufacture, and sale of in-vitro diagnostic products for medical and public safety inspection within the biomedicine sector, with a market cap of CN¥4.89 billion.

Operations: The company's revenue primarily comes from its Medical Labs & Research segment, generating CN¥520.50 million.

Insider Ownership: 33%

Earnings Growth Forecast: 116.0% p.a.

Beijing Hotgen Biotech is projected to achieve revenue growth of 18.7% annually, surpassing the Chinese market average. Despite recent financial challenges, including a net loss of CNY 40.64 million for the first nine months of 2024, earnings are expected to grow by 115.97% per year with profitability anticipated in three years. The company has initiated a share buyback program worth up to CNY 100 million, aimed at enhancing long-term development and shareholder value protection.

- Take a closer look at Beijing Hotgen Biotech's potential here in our earnings growth report.

- Our valuation report unveils the possibility Beijing Hotgen Biotech's shares may be trading at a premium.

Wanda Film Holding (SZSE:002739)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wanda Film Holding Co., Ltd. invests in, constructs, and operates movie theaters in China, Australia, and New Zealand with a market cap of CN¥26.72 billion.

Operations: Revenue segments for Wanda Film Holding Co., Ltd. include CN¥10.45 billion from box office sales, CN¥3.27 billion from film distribution and production, and CN¥1.98 billion from merchandise sales and other related services.

Insider Ownership: 10.4%

Earnings Growth Forecast: 94.1% p.a.

Wanda Film Holding's recent financial performance shows a decline, with nine-month revenue at CNY 9.85 billion, down from CNY 11.35 billion the previous year, and net income dropping significantly to CNY 168.69 million. Despite these challenges, the company is forecasted for revenue growth of 16.7% annually and profitability within three years, surpassing market averages. Trading at a good value compared to peers and industry benchmarks enhances its investment appeal amidst high insider ownership stability.

- Click here to discover the nuances of Wanda Film Holding with our detailed analytical future growth report.

- Our valuation report unveils the possibility Wanda Film Holding's shares may be trading at a discount.

Seize The Opportunity

- Access the full spectrum of 1514 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A338220

Vuno

Operates as a medical artificial intelligence (AI) solution development company.

Exceptional growth potential with adequate balance sheet.