Simei Media Co.,Ltd.'s (SZSE:002712) Share Price Boosted 46% But Its Business Prospects Need A Lift Too

Simei Media Co.,Ltd. (SZSE:002712) shares have continued their recent momentum with a 46% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 6.2% over the last year.

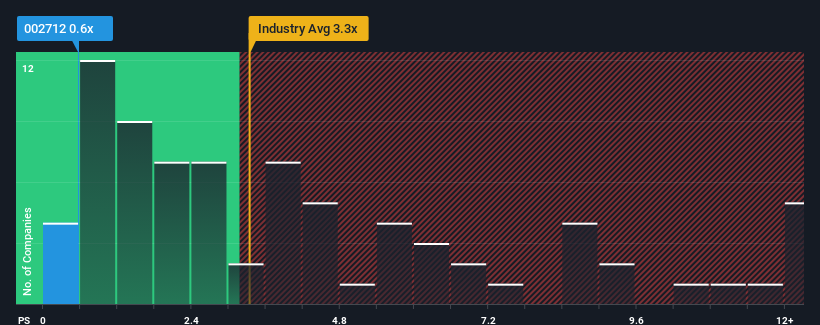

Even after such a large jump in price, Simei MediaLtd may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.6x, since almost half of all companies in the Media industry in China have P/S ratios greater than 3.3x and even P/S higher than 7x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Simei MediaLtd

How Has Simei MediaLtd Performed Recently?

Simei MediaLtd has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Simei MediaLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Simei MediaLtd's is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. The solid recent performance means it was also able to grow revenue by 20% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 15% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Simei MediaLtd's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What We Can Learn From Simei MediaLtd's P/S?

Shares in Simei MediaLtd have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

In line with expectations, Simei MediaLtd maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Simei MediaLtd (at least 1 which is concerning), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Simei MediaLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002712

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives