- China

- /

- Entertainment

- /

- SZSE:002343

Ciwen Media Co.,Ltd. (SZSE:002343) Shares Slammed 26% But Getting In Cheap Might Be Difficult Regardless

Ciwen Media Co.,Ltd. (SZSE:002343) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 30% in that time.

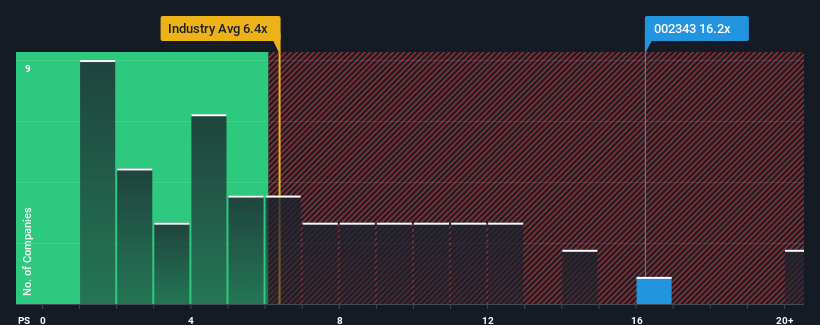

Even after such a large drop in price, Ciwen MediaLtd may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 16.2x, since almost half of all companies in the Entertainment industry in China have P/S ratios under 6.4x and even P/S lower than 3x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Ciwen MediaLtd

How Ciwen MediaLtd Has Been Performing

Ciwen MediaLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Ciwen MediaLtd will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Ciwen MediaLtd?

Ciwen MediaLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 67% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 196% as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 27%, which is noticeably less attractive.

In light of this, it's understandable that Ciwen MediaLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Ciwen MediaLtd's P/S Mean For Investors?

Even after such a strong price drop, Ciwen MediaLtd's P/S still exceeds the industry median significantly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Ciwen MediaLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Entertainment industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you take the next step, you should know about the 2 warning signs for Ciwen MediaLtd (1 is a bit concerning!) that we have uncovered.

If you're unsure about the strength of Ciwen MediaLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002343

Ciwen MediaLtd

Engages in the film, television dramas, game products, channel promotions, and artist management businesses in China and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives