- China

- /

- Entertainment

- /

- SZSE:002306

Even after rising 15% this past week, Cloud Live Technology GroupLtd (SZSE:002306) shareholders are still down 20% over the past year

This week we saw the Cloud Live Technology Group Co.,Ltd. (SZSE:002306) share price climb by 15%. But in truth the last year hasn't been good for the share price. In fact the stock is down 20% in the last year, well below the market return.

While the last year has been tough for Cloud Live Technology GroupLtd shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

See our latest analysis for Cloud Live Technology GroupLtd

Given that Cloud Live Technology GroupLtd only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Cloud Live Technology GroupLtd's revenue didn't grow at all in the last year. In fact, it fell 19%. That's not what investors generally want to see. The stock price has languished lately, falling 20% in a year. That seems pretty reasonable given the lack of both profits and revenue growth. It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

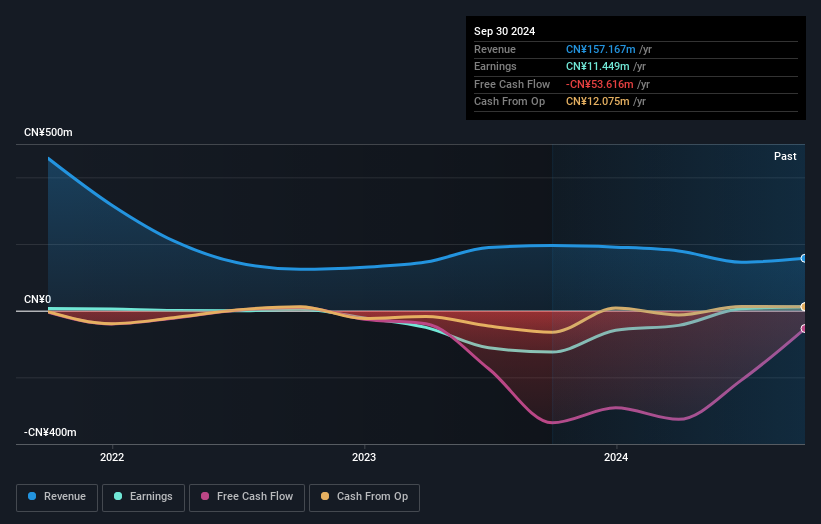

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Cloud Live Technology GroupLtd's financial health with this free report on its balance sheet.

A Different Perspective

Cloud Live Technology GroupLtd shareholders are down 20% for the year, but the market itself is up 15%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 0.8%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Cloud Live Technology GroupLtd that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002306

Cloud Live Technology GroupLtd

Engages in the catering and Internet games businesses in China.

Low with questionable track record.

Market Insights

Community Narratives