Xinhua Winshare Publishing and Media And 2 Other Leading Dividend Stocks

Reviewed by Simply Wall St

In a week marked by mixed results in major U.S. stock indexes, with growth stocks significantly outperforming value stocks, investors are keeping a close eye on economic indicators and central bank policies that could influence market trends. Amidst this backdrop of fluctuating indices and geopolitical developments, dividend stocks continue to attract attention for their potential to provide steady income streams, particularly in sectors that show resilience despite broader market volatility. As we explore Xinhua Winshare Publishing and Media alongside two other leading dividend stocks, understanding what makes a strong dividend stock is crucial—typically characterized by consistent earnings performance and the ability to maintain or grow payouts even in uncertain economic climates.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.13% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.98% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.18% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.71% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

Click here to see the full list of 1927 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

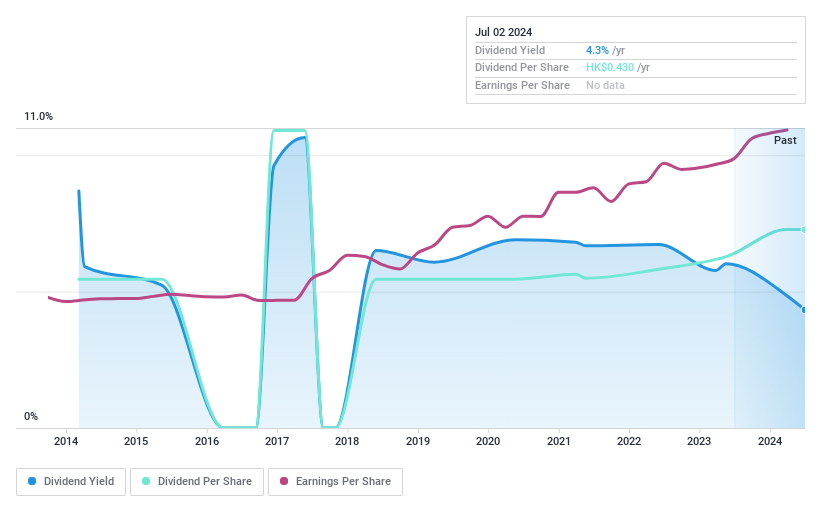

Xinhua Winshare Publishing and Media (SEHK:811)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinhua Winshare Publishing and Media Co., Ltd. operates in the publishing and media industry with a market cap of HK$17.64 billion.

Operations: Xinhua Winshare Publishing and Media Co., Ltd. generates its revenue from various segments within the publishing and media industry.

Dividend Yield: 3.8%

Xinhua Winshare Publishing and Media demonstrates a mixed dividend profile. Despite having a low payout ratio of 47.6% and cash payout ratio of 26%, indicating dividends are well-covered by earnings and cash flows, its dividend history has been volatile with past annual drops over 20%. The recent interim dividend of RMB 0.19 per share highlights ongoing payments, but the yield is lower than top-tier Hong Kong market payers. Earnings have shown slight growth amidst fluctuating net income figures.

- Unlock comprehensive insights into our analysis of Xinhua Winshare Publishing and Media stock in this dividend report.

- Our valuation report unveils the possibility Xinhua Winshare Publishing and Media's shares may be trading at a discount.

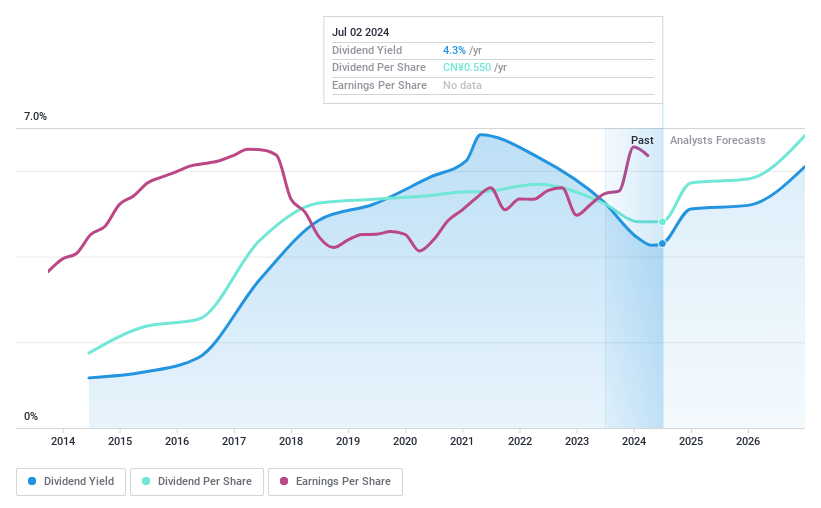

China South Publishing & Media Group (SHSE:601098)

Simply Wall St Dividend Rating: ★★★★★★

Overview: China South Publishing & Media Group Co., Ltd operates in publishing, printing, distribution, media, and financing sectors in China with a market cap of CN¥24.61 billion.

Operations: China South Publishing & Media Group Co., Ltd's revenue is derived from its operations in publishing, printing, distribution, media, and financing within China.

Dividend Yield: 4%

China South Publishing & Media Group offers a stable and attractive dividend yield of 4.01%, ranking in the top 25% of CN market payers. The company has consistently increased dividends over the past decade, supported by a reasonable payout ratio of 74.7% and a low cash payout ratio of 29.9%. Despite recent earnings decline to CNY 956.92 million for the first nine months of 2024, dividends remain well-covered by both earnings and cash flows, ensuring reliability for investors seeking income stability.

- Get an in-depth perspective on China South Publishing & Media Group's performance by reading our dividend report here.

- The analysis detailed in our China South Publishing & Media Group valuation report hints at an deflated share price compared to its estimated value.

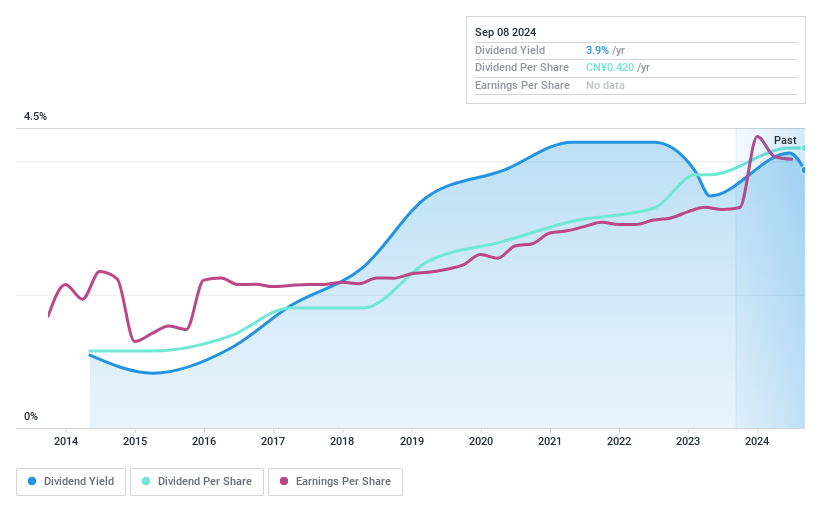

Central China Land MediaLTD (SZSE:000719)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Central China Land Media Co., Ltd. operates in the editing, publishing, printing, marketing, and distribution of various media products including books and electronic audio-visual items, with a market cap of CN¥12.80 billion.

Operations: Central China Land Media Co., Ltd. generates revenue from the editing and publishing, printing and reproduction, marketing and distribution, and material supply of books, periodicals, newspapers, electronic audio-visual products, online publications, and other media products.

Dividend Yield: 3.4%

Central China Land Media offers a high dividend yield of 3.36%, placing it in the top 25% of CN market payers. Despite stable dividends over the past decade, its payout ratio is unsustainable at 422.7%, indicating dividends are not covered by earnings, though cash flow coverage is adequate with a low cash payout ratio of 21.6%. Recent earnings show a decline to CNY 508.2 million for nine months ending September 2024, which may impact future dividend sustainability.

- Dive into the specifics of Central China Land MediaLTD here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Central China Land MediaLTD is trading behind its estimated value.

Where To Now?

- Take a closer look at our Top Dividend Stocks list of 1927 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000719

Central China Land MediaLTD

Engages in the editing and publishing, printing and reproduction, marketing and distribution, and material supply of books, periodicals, newspapers, electronic audio-visual products, online publications, and other media products.

Flawless balance sheet, undervalued and pays a dividend.