- China

- /

- Electronic Equipment and Components

- /

- SHSE:688378

High Growth Tech And 2 Other Exciting Stocks With Potential

Reviewed by Simply Wall St

In a week marked by mixed performances across major U.S. stock indexes, the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite reached record highs while the Russell 2000 Index saw a decline following two weeks of outperformance against larger-cap peers. Amid this backdrop of diverging market trends and economic indicators such as robust job growth in November, investors are increasingly focused on growth stocks within sectors like consumer discretionary and information technology that have shown resilience. When considering high-growth tech stocks and other promising opportunities, it is important to evaluate how well these companies can leverage current market dynamics to sustain their momentum in an ever-evolving economic landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| CD Projekt | 24.93% | 27.00% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1292 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Jilin OLED Material Tech (SHSE:688378)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jilin OLED Material Tech Co., Ltd. focuses on the research, development, production, and sale of organic electroluminescent materials and equipment for China's new display industry, with a market cap of CN¥5.27 billion.

Operations: Jilin OLED Material Tech Co., Ltd. specializes in the development and sale of organic electroluminescent materials and equipment, serving China's burgeoning display industry. The company leverages its R&D capabilities to cater to the growing demand for advanced display technologies.

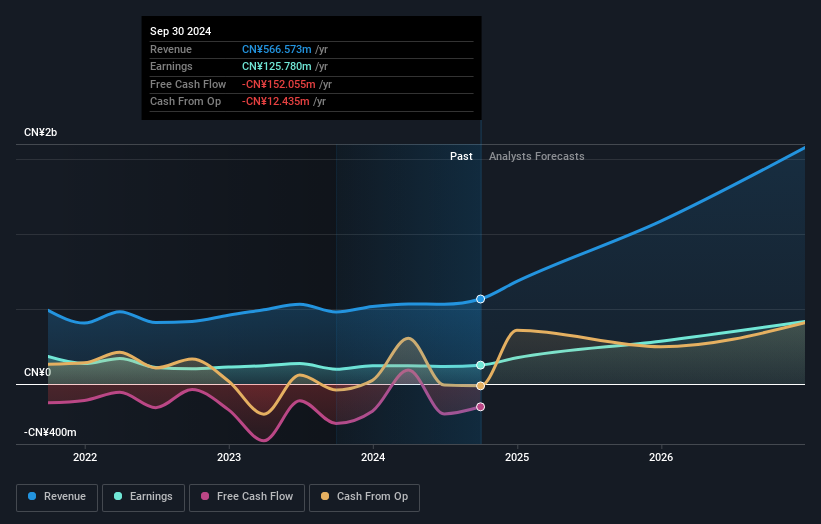

Jilin OLED Material Tech has demonstrated a robust performance with a notable 45.1% expected annual revenue growth, outpacing the broader Chinese market's 13.7%. This growth trajectory is complemented by an even more impressive forecast in earnings, set to expand at 49.9% annually, significantly ahead of the market average of 25.9%. The company's commitment to innovation is evident from its R&D investments which are strategically aligned with its core operations in OLED materials—a sector critical for advancements in display technology and electronic devices. Despite challenges like a highly volatile share price and a one-off gain of CN¥75.7M skewing recent financial results, Jilin's strategic focus on high-demand sectors positions it well for sustained growth amidst evolving tech landscapes.

- Click here and access our complete health analysis report to understand the dynamics of Jilin OLED Material Tech.

Learn about Jilin OLED Material Tech's historical performance.

China Leadshine Technology (SZSE:002979)

Simply Wall St Growth Rating: ★★★★★☆

Overview: China Leadshine Technology Co., Ltd. designs, manufactures, and sells motion control equipment and components in China, with a market capitalization of CN¥10.64 billion.

Operations: Leadshine focuses on the design, manufacturing, and sale of motion control equipment and components in China. The company operates with a market capitalization of CN¥10.64 billion.

China Leadshine Technology Co., Ltd. has shown a promising trajectory with its recent financial performance, reporting a significant revenue increase to CNY 1.16 billion from CNY 1.05 billion year-over-year and an impressive growth in net income from CNY 92.28 million to CNY 144.28 million. The company's strategic emphasis on R&D is evident, aligning with its robust earnings forecast which anticipates a growth of 28.6% per annum, outpacing the broader Chinese market's projection of 25.9%. Despite not engaging in share repurchases this quarter, the firm’s commitment to innovation and substantial investment in research and development—21.1% of its revenue—positions it well within the competitive tech landscape for sustained advancement and market relevance.

- Click to explore a detailed breakdown of our findings in China Leadshine Technology's health report.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★★☆

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan with a market capitalization of ¥190.85 billion.

Operations: The company focuses on its platform business, generating revenue of ¥27.09 billion through cloud-based solutions for accounting and HR in Japan.

Freee K.K. is navigating the competitive landscape with a strategic focus on R&D, dedicating a significant portion of its budget to innovation. In its recent earnings call, the company highlighted an 18.3% forecasted annual revenue growth, outpacing Japan's market average of 4.1%. Despite current unprofitability, Freee K.K.'s commitment to research is robust, with R&D expenses comprising 74% of their revenue, positioning them for future profitability and industry leadership in software solutions. This approach suggests potential for substantial growth as they aim to turn forecasts into reality over the next three years.

- Get an in-depth perspective on freee K.K's performance by reading our health report here.

Assess freee K.K's past performance with our detailed historical performance reports.

Next Steps

- Reveal the 1292 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688378

Jilin OLED Material Tech

Engages in the research and development, production, and sale of organic electroluminescent materials and equipment for the new display industry in China.

High growth potential with excellent balance sheet.