DREAMTECH And 2 Other Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic indicators, investors are increasingly seeking opportunities in small-cap stocks that may offer growth potential despite broader market fluctuations. With U.S. job growth showing signs of cooling and manufacturing activity expanding for the first time in over two years, identifying undiscovered gems like DREAMTECH can provide a strategic edge to enhance your portfolio amidst these evolving conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Ohashi Technica | NA | 4.58% | -14.04% | ★★★★★★ |

| Otec | 8.17% | 3.43% | 1.06% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Komori | 9.28% | 8.79% | 64.70% | ★★★★★☆ |

| CMC | 1.42% | 1.60% | 10.14% | ★★★★★☆ |

| Marusan Securities | 5.46% | 0.83% | 4.55% | ★★★★★☆ |

| Nippon Ski Resort DevelopmentLtd | 43.84% | 7.58% | 32.78% | ★★★★★☆ |

| Mr Max Holdings | 54.12% | 0.97% | 4.23% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

DREAMTECH (KOSE:A192650)

Simply Wall St Value Rating: ★★★★★☆

Overview: DREAMTECH Co., Ltd. is involved in the design, development, and manufacture of modules both domestically in South Korea and internationally, with a market capitalization of approximately ₩545.87 billion.

Operations: DREAMTECH generates revenue primarily from IT & Mobile Communications and Compact Camera Modules, contributing ₩455.56 billion and ₩441.55 billion respectively. The Biometrics, Healthcare & Convergence segment adds another ₩230.61 billion to its revenue streams.

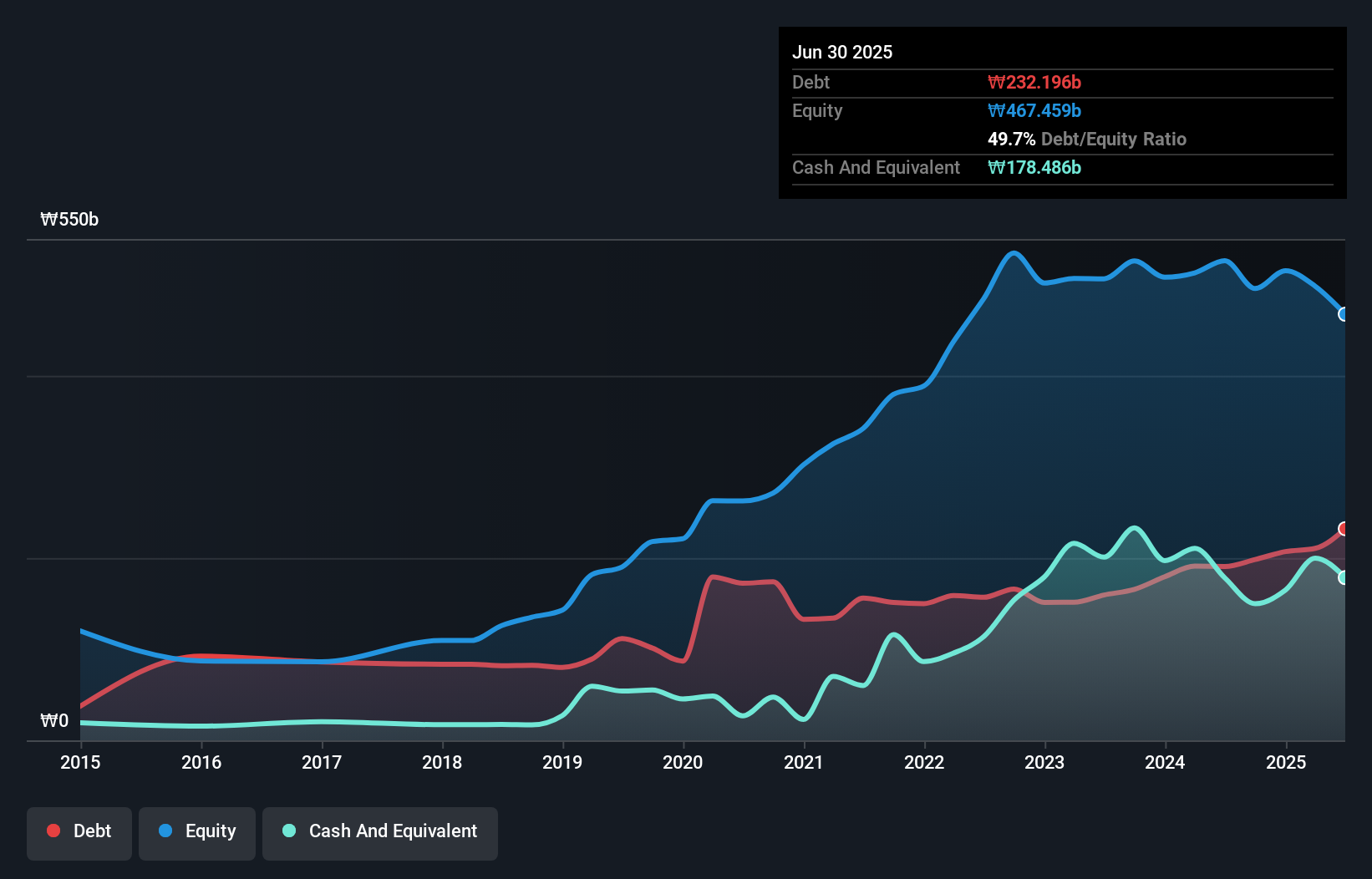

DREAMTECH, a promising player in the electronics sector, has shown impressive earnings growth of 33.8%, outpacing the industry's -3% performance. The company has made strides in reducing its debt to equity ratio from 46.4% to 40% over five years, indicating prudent financial management. Interest payments are well covered by EBIT at 5.5 times, suggesting robust operational efficiency. Despite not being free cash flow positive recently, DREAMTECH trades at a significant discount of 69.9% below its estimated fair value, presenting potential upside for investors seeking undervalued opportunities with high-quality earnings and strong growth prospects.

- Unlock comprehensive insights into our analysis of DREAMTECH stock in this health report.

Gain insights into DREAMTECH's past trends and performance with our Past report.

Suzhou Sunmun Technology (SZSE:300522)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Sunmun Technology Co., Ltd. is involved in the research, production, and sale of nano-coloring materials, functional nano-dispersions, special additives, intelligent color matching systems, and electronic chemicals in China with a market cap of CN¥4.57 billion.

Operations: Suzhou Sunmun Technology generates revenue primarily through the sale of nano-coloring materials, functional nano-dispersions, special additives, intelligent color matching systems, and electronic chemicals. The company's financial performance is highlighted by a net profit margin trend that has shown notable fluctuations over recent periods.

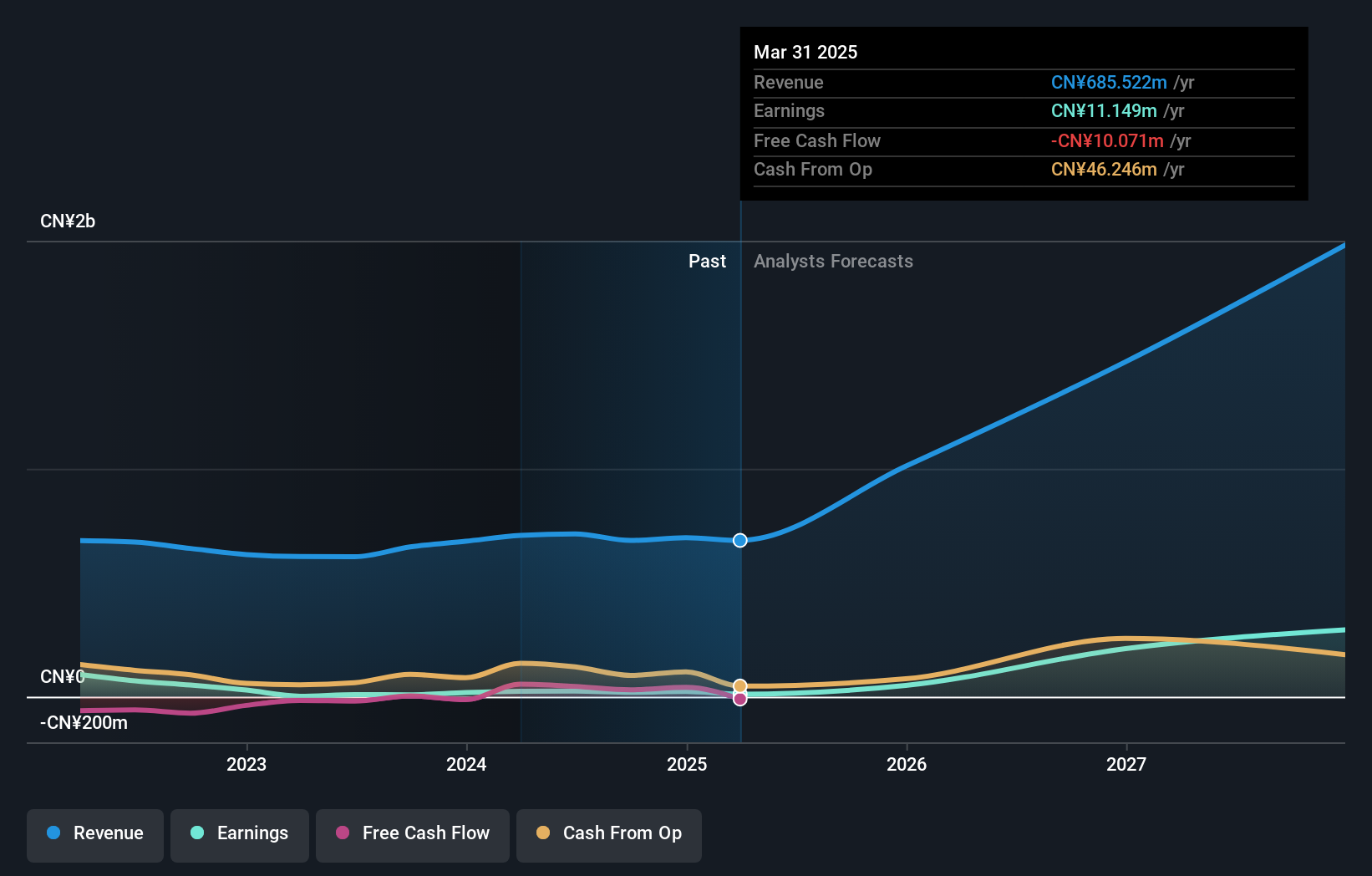

Suzhou Sunmun Technology, a smaller player in the tech space, is making waves with impressive earnings growth of 124% over the past year, outpacing its industry peers. The company demonstrates robust financial health with interest payments well covered by EBIT at 8.8 times and a satisfactory net debt to equity ratio of 7.2%. Despite an increase in its debt to equity ratio from 0% to 19.1% over five years, it remains free cash flow positive and boasts high-quality earnings. This suggests potential for continued growth as it forecasts annual earnings growth of nearly 93%.

- Click to explore a detailed breakdown of our findings in Suzhou Sunmun Technology's health report.

Evaluate Suzhou Sunmun Technology's historical performance by accessing our past performance report.

Shenzhen Jdd Tech New Material (SZSE:301538)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Jdd Tech New Material Co., Ltd specializes in the research, design, development, production, and sale of modified polymer protective materials in China with a market capitalization of CN¥4.34 billion.

Operations: Shenzhen Jdd Tech New Material generates revenue primarily from the sale of modified polymer protective materials. The company's financial performance is highlighted by a market capitalization of CN¥4.34 billion, indicating its valuation in the market.

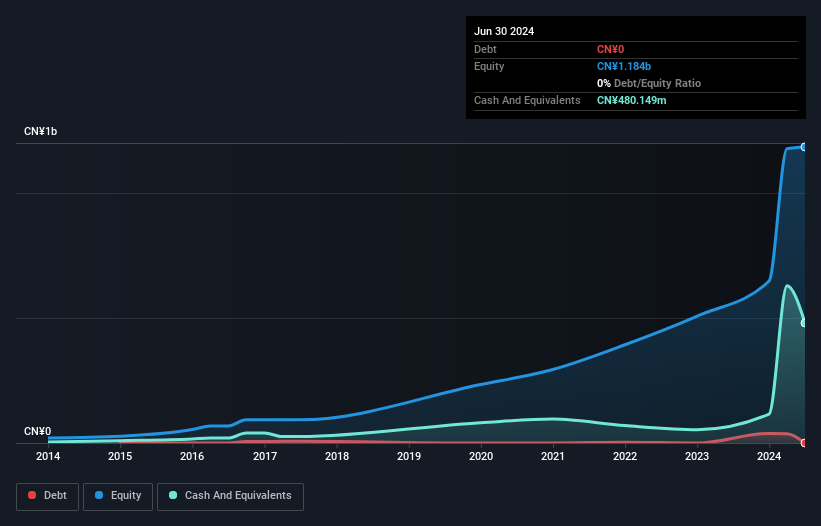

Jdd Tech New Material has been making waves with its impressive earnings growth of 25.1% over the past year, outpacing the Chemicals industry's -5.4%. This growth is supported by a high level of non-cash earnings, indicating quality in its financials. The company stands debt-free, a significant improvement from five years ago when it had a debt-to-equity ratio of 0.3%. Despite not being free cash flow positive recently, its profitability ensures that cash runway isn't an immediate worry. Trading at a price-to-earnings ratio of 26x, it appears undervalued compared to the broader CN market's 36.7x average.

Next Steps

- Investigate our full lineup of 4698 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301538

Shenzhen Jdd Tech New Material

Engages in the research, design, development, production and sale of modified polymer protective materials in China.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives