A Piece Of The Puzzle Missing From Shandong Longhua New Material Co., Ltd.'s (SZSE:301149) 38% Share Price Climb

The Shandong Longhua New Material Co., Ltd. (SZSE:301149) share price has done very well over the last month, posting an excellent gain of 38%. Notwithstanding the latest gain, the annual share price return of 4.9% isn't as impressive.

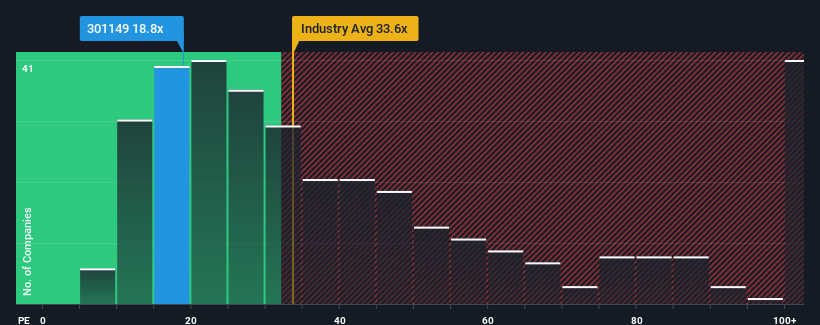

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 34x, you may still consider Shandong Longhua New Material as an attractive investment with its 18.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Shandong Longhua New Material has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Shandong Longhua New Material

Does Growth Match The Low P/E?

Shandong Longhua New Material's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 93% last year. EPS has also lifted 9.7% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 37% per year as estimated by the sole analyst watching the company. That's shaping up to be materially higher than the 19% per annum growth forecast for the broader market.

With this information, we find it odd that Shandong Longhua New Material is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The latest share price surge wasn't enough to lift Shandong Longhua New Material's P/E close to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Shandong Longhua New Material's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Shandong Longhua New Material (1 is a bit concerning) you should be aware of.

If these risks are making you reconsider your opinion on Shandong Longhua New Material, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301149

ShanDong Longhua New MaterialLtd

Engages in the research and development, production, and sale of polyether series products in China.

Adequate balance sheet low.

Market Insights

Community Narratives