China Resources Chemical Innovative Materials Co., Ltd. (SZSE:301090) Surges 28% Yet Its Low P/S Is No Reason For Excitement

China Resources Chemical Innovative Materials Co., Ltd. (SZSE:301090) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 35% over that time.

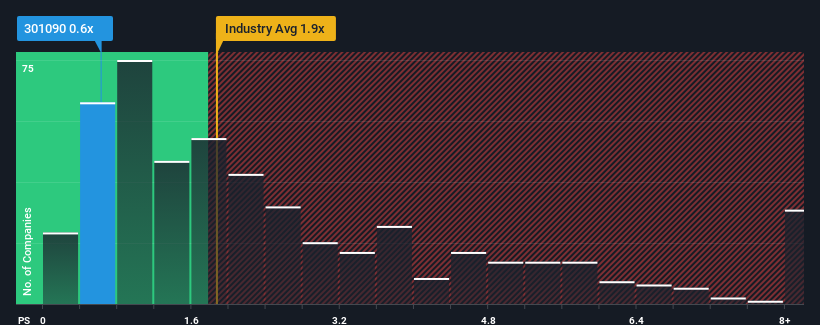

In spite of the firm bounce in price, China Resources Chemical Innovative Materials may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.6x, considering almost half of all companies in the Chemicals industry in China have P/S ratios greater than 1.9x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for China Resources Chemical Innovative Materials

What Does China Resources Chemical Innovative Materials' P/S Mean For Shareholders?

China Resources Chemical Innovative Materials could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on China Resources Chemical Innovative Materials.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, China Resources Chemical Innovative Materials would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.4%. Even so, admirably revenue has lifted 35% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 3.3% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 23%, which is noticeably more attractive.

With this information, we can see why China Resources Chemical Innovative Materials is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

China Resources Chemical Innovative Materials' stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of China Resources Chemical Innovative Materials' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for China Resources Chemical Innovative Materials with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of China Resources Chemical Innovative Materials' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade China Resources Chemical Innovative Materials, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301090

China Resources Chemical Innovative Materials

China Resources Chemical Innovative Materials Co., Ltd.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives