Why Nantong JiangTian Chemical's (SZSE:300927) Shaky Earnings Are Just The Beginning Of Its Problems

A lackluster earnings announcement from Nantong JiangTian Chemical Co., Ltd. (SZSE:300927) last week didn't sink the stock price. However, we believe that investors should be aware of some underlying factors which may be of concern.

Check out our latest analysis for Nantong JiangTian Chemical

A Closer Look At Nantong JiangTian Chemical's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

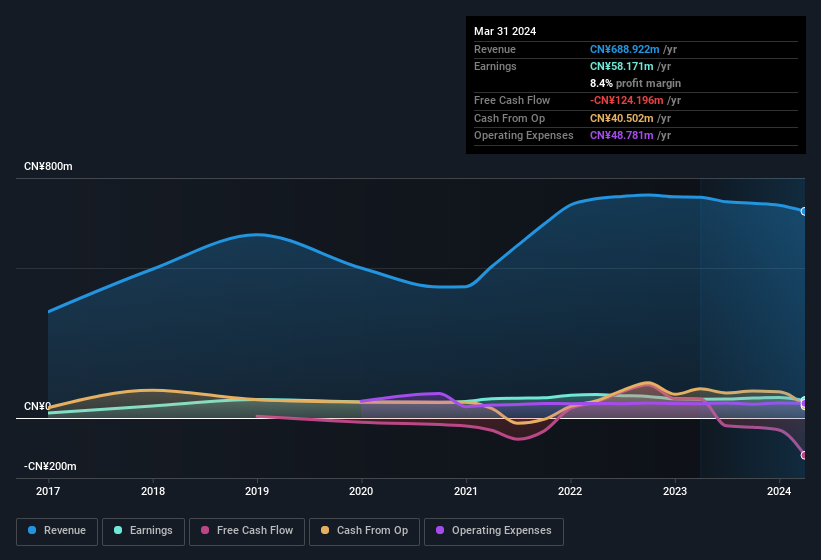

Nantong JiangTian Chemical has an accrual ratio of 0.46 for the year to March 2024. As a general rule, that bodes poorly for future profitability. And indeed, during the period the company didn't produce any free cash flow whatsoever. Over the last year it actually had negative free cash flow of CN¥124m, in contrast to the aforementioned profit of CN¥58.2m. We saw that FCF was CN¥63m a year ago though, so Nantong JiangTian Chemical has at least been able to generate positive FCF in the past. One positive for Nantong JiangTian Chemical shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. As a result, some shareholders may be looking for stronger cash conversion in the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Nantong JiangTian Chemical.

Our Take On Nantong JiangTian Chemical's Profit Performance

As we have made quite clear, we're a bit worried that Nantong JiangTian Chemical didn't back up the last year's profit with free cashflow. For this reason, we think that Nantong JiangTian Chemical's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. Sadly, its EPS was down over the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So while earnings quality is important, it's equally important to consider the risks facing Nantong JiangTian Chemical at this point in time. For instance, we've identified 3 warning signs for Nantong JiangTian Chemical (1 shouldn't be ignored) you should be familiar with.

This note has only looked at a single factor that sheds light on the nature of Nantong JiangTian Chemical's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you're looking to trade Nantong JiangTian Chemical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nantong JiangTian Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300927

Nantong JiangTian Chemical

Manufactures and sells chemical products in China and internationally.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives