Nantong JiangTian Chemical's (SZSE:300927) Returns On Capital Not Reflecting Well On The Business

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after briefly looking over the numbers, we don't think Nantong JiangTian Chemical (SZSE:300927) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Nantong JiangTian Chemical is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = CN¥83m ÷ (CN¥916m - CN¥134m) (Based on the trailing twelve months to September 2023).

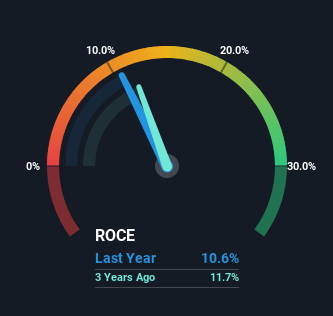

Therefore, Nantong JiangTian Chemical has an ROCE of 11%. In absolute terms, that's a satisfactory return, but compared to the Chemicals industry average of 5.6% it's much better.

Check out our latest analysis for Nantong JiangTian Chemical

Historical performance is a great place to start when researching a stock so above you can see the gauge for Nantong JiangTian Chemical's ROCE against it's prior returns. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Nantong JiangTian Chemical.

What Does the ROCE Trend For Nantong JiangTian Chemical Tell Us?

In terms of Nantong JiangTian Chemical's historical ROCE movements, the trend isn't fantastic. Over the last five years, returns on capital have decreased to 11% from 28% five years ago. On the other hand, the company has been employing more capital without a corresponding improvement in sales in the last year, which could suggest these investments are longer term plays. It may take some time before the company starts to see any change in earnings from these investments.

On a related note, Nantong JiangTian Chemical has decreased its current liabilities to 15% of total assets. So we could link some of this to the decrease in ROCE. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money.

Our Take On Nantong JiangTian Chemical's ROCE

To conclude, we've found that Nantong JiangTian Chemical is reinvesting in the business, but returns have been falling. And in the last three years, the stock has given away 32% so the market doesn't look too hopeful on these trends strengthening any time soon. Therefore based on the analysis done in this article, we don't think Nantong JiangTian Chemical has the makings of a multi-bagger.

If you'd like to know more about Nantong JiangTian Chemical, we've spotted 3 warning signs, and 1 of them shouldn't be ignored.

While Nantong JiangTian Chemical isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nantong JiangTian Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300927

Nantong JiangTian Chemical

Manufactures and sells chemical products in China.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)