Changzhou Tronly New Electronic Materials Co., Ltd.'s (SZSE:300429) 26% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Changzhou Tronly New Electronic Materials Co., Ltd. (SZSE:300429) shares have been powering on, with a gain of 26% in the last thirty days. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

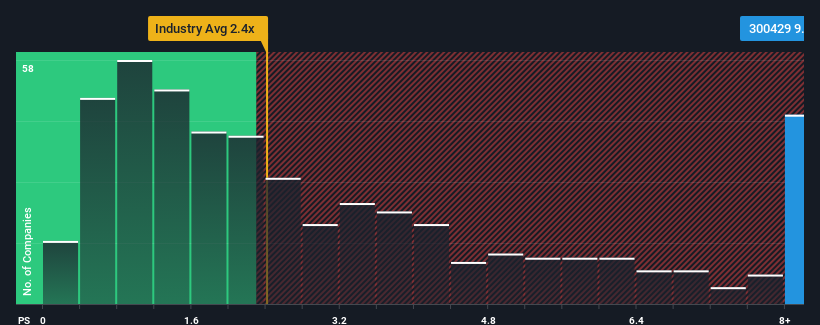

Since its price has surged higher, given around half the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2.4x, you may consider Changzhou Tronly New Electronic Materials as a stock to avoid entirely with its 9.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Changzhou Tronly New Electronic Materials

What Does Changzhou Tronly New Electronic Materials' Recent Performance Look Like?

Revenue has risen firmly for Changzhou Tronly New Electronic Materials recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Changzhou Tronly New Electronic Materials' earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Changzhou Tronly New Electronic Materials?

Changzhou Tronly New Electronic Materials' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 15%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 4.0% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 26% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Changzhou Tronly New Electronic Materials' P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

The strong share price surge has lead to Changzhou Tronly New Electronic Materials' P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Changzhou Tronly New Electronic Materials currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Plus, you should also learn about these 3 warning signs we've spotted with Changzhou Tronly New Electronic Materials (including 2 which make us uncomfortable).

If you're unsure about the strength of Changzhou Tronly New Electronic Materials' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Changzhou Tronly New Electronic Materials, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300429

Changzhou Tronly New Electronic Materials

Changzhou Tronly New Electronic Materials Co., Ltd.

Imperfect balance sheet very low.

Market Insights

Community Narratives