- Taiwan

- /

- Construction

- /

- TWSE:5521

Undiscovered Gems In Global Markets For December 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by the Federal Reserve's recent interest rate cuts and mixed performances across major indices, small-cap stocks have emerged as particularly sensitive to these shifts. With the Russell 2000 Index outperforming its peers, investors are increasingly on the lookout for undiscovered gems that may offer unique opportunities amid evolving economic conditions. Identifying a promising stock often involves assessing its resilience in the face of market volatility and its potential for growth within sectors poised to benefit from current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Chudenko | NA | 4.70% | 23.23% | ★★★★★★ |

| Allmed Medical ProductsLtd | 13.03% | -2.37% | -30.93% | ★★★★★★ |

| Gem-Year IndustrialLtd | NA | -3.47% | -34.40% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Taiyo KagakuLtd | 0.66% | 6.12% | 4.54% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| Anfu CE LINK | 70.49% | 7.92% | -8.47% | ★★★★☆☆ |

| Billion Industrial Holdings | 33.11% | 16.86% | -16.10% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shenzhen Quanxinhao (SZSE:000007)

Simply Wall St Value Rating: ★★★★★☆

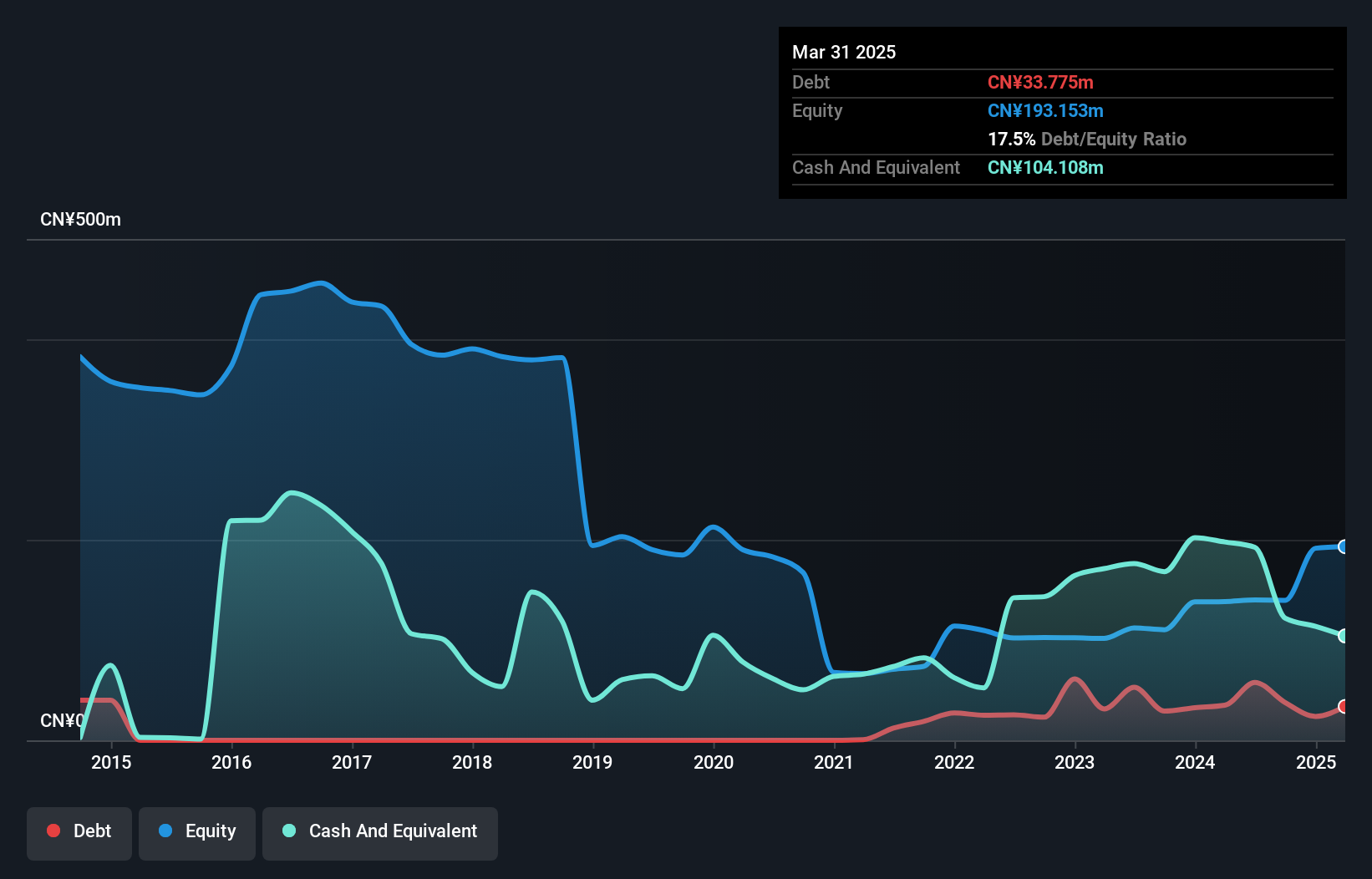

Overview: Shenzhen Quanxinhao Co., Ltd. operates in the property leasing and management sector both domestically in China and internationally, with a market cap of CN¥4.02 billion.

Operations: Shenzhen Quanxinhao generates revenue primarily through its property leasing and management activities. The company's financial performance is influenced by its ability to manage costs effectively within these operations.

Shenzhen Quanxinhao, a relatively small player in its sector, has shown impressive earnings growth of 100.2% over the past year, outpacing the hospitality industry's -5.4%. The company reported sales of CNY 299.85 million for the first nine months of 2025, nearly doubling from CNY 154.23 million a year earlier. Despite a debt to equity ratio rising to 29.1% over five years, its interest payments are comfortably covered by EBIT at 41.6 times coverage. The firm also benefits from having more cash than total debt and trades at an attractive value, being priced significantly below estimated fair value by about 90%.

- Click here and access our complete health analysis report to understand the dynamics of Shenzhen Quanxinhao.

Understand Shenzhen Quanxinhao's track record by examining our Past report.

PhiChem (SZSE:300398)

Simply Wall St Value Rating: ★★★★★★

Overview: PhiChem Corporation specializes in providing high-performance materials solutions and has a market cap of CN¥12.89 billion.

Operations: The company generates revenue primarily from its manufacturing segment, which reported CN¥3.09 billion.

PhiChem, a dynamic player in the chemical sector, showcases robust financial health with a debt-to-equity ratio declining from 32.2% to 18.6% over five years. The company reported revenue of CNY 2.34 billion for the first nine months of 2025, up from CNY 2.17 billion last year, while net income rose to CNY 290.89 million from CNY 205.81 million, highlighting strong growth momentum and high-quality earnings that outpace industry norms by a wide margin of 207%. With free cash flow turning positive and earnings exceeding interest obligations comfortably, PhiChem seems well-positioned for sustained expansion in its niche market space.

- Take a closer look at PhiChem's potential here in our health report.

Evaluate PhiChem's historical performance by accessing our past performance report.

Kung Sing Engineering (TWSE:5521)

Simply Wall St Value Rating: ★★★★★☆

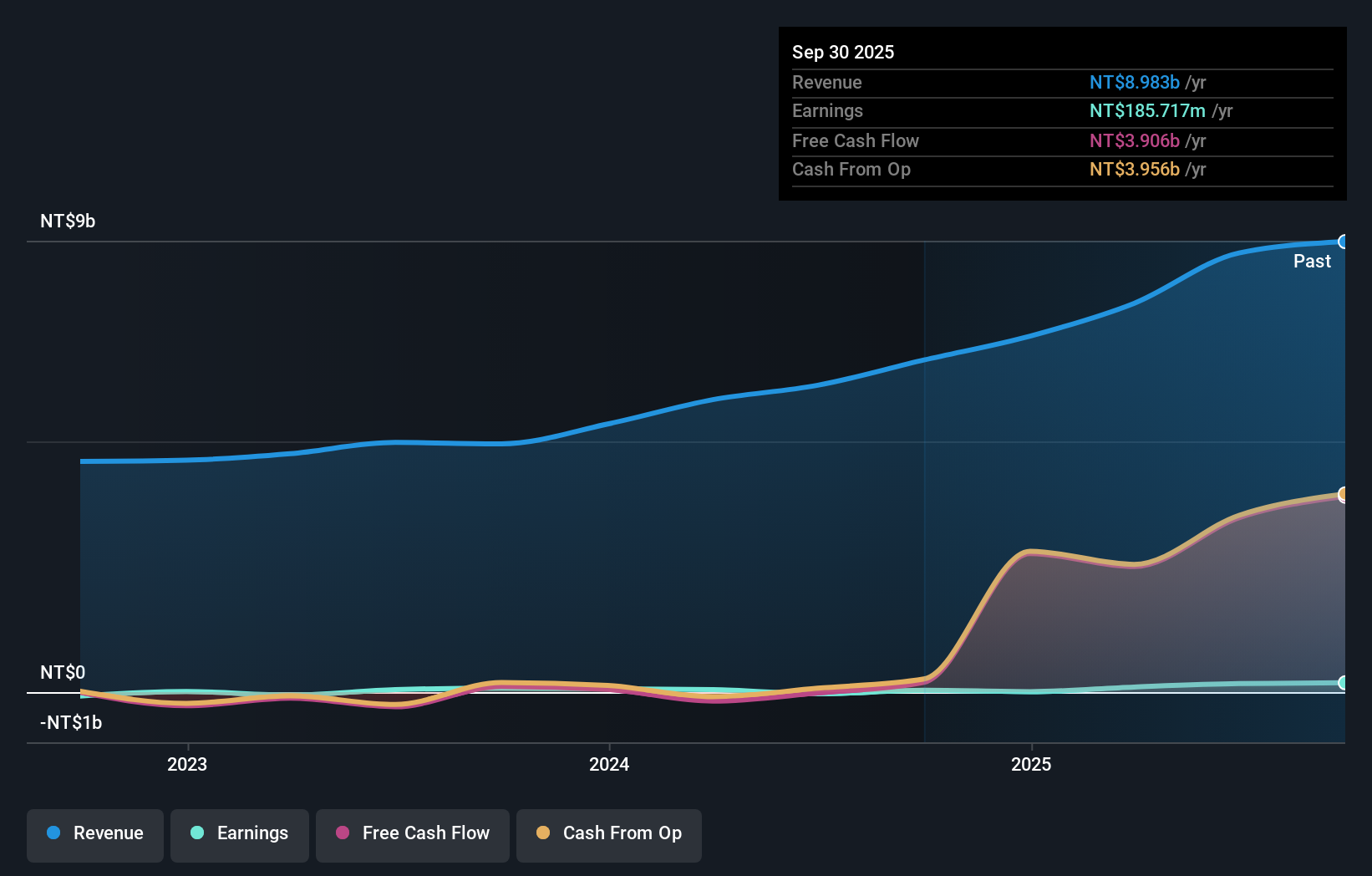

Overview: Kung Sing Engineering Corporation, with a market cap of approximately NT$10.07 billion, operates in the construction industry in Taiwan through its subsidiaries.

Operations: Kung Sing Engineering generates revenue primarily through Kung Sing Engineering Corporation, contributing NT$8.98 billion, and Kung Sing Development Co., Ltd., adding NT$4.49 million.

Kung Sing Engineering, a nimble player in the construction sector, has shown impressive earnings growth of 408.8% over the past year, outpacing its industry peers. Despite a volatile share price recently, it trades at 98.3% below estimated fair value, suggesting potential upside for investors. The company reported third-quarter sales of TWD 2.22 billion and net income of TWD 114.9 million, reflecting solid performance compared to last year’s figures of TWD 1.99 billion and TWD 98.99 million respectively. With more cash than debt and positive free cash flow, Kung Sing appears financially robust amidst industry dynamics.

- Click to explore a detailed breakdown of our findings in Kung Sing Engineering's health report.

Explore historical data to track Kung Sing Engineering's performance over time in our Past section.

Seize The Opportunity

- Take a closer look at our Global Undiscovered Gems With Strong Fundamentals list of 3007 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kung Sing Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:5521

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)