As global markets navigate fluctuating economic indicators, with the S&P 500 and Nasdaq Composite showing resilience amid sector-specific shifts, investors are keenly observing growth opportunities. In this climate, companies with high insider ownership often attract attention due to the confidence insiders demonstrate in their business prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Kehua Data (SZSE:002335)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kehua Data Co., Ltd. offers integrated solutions for power protection and energy conservation globally, with a market cap of CN¥10.89 billion.

Operations: Kehua Data's revenue is derived from its integrated solutions for power protection and energy conservation on a global scale.

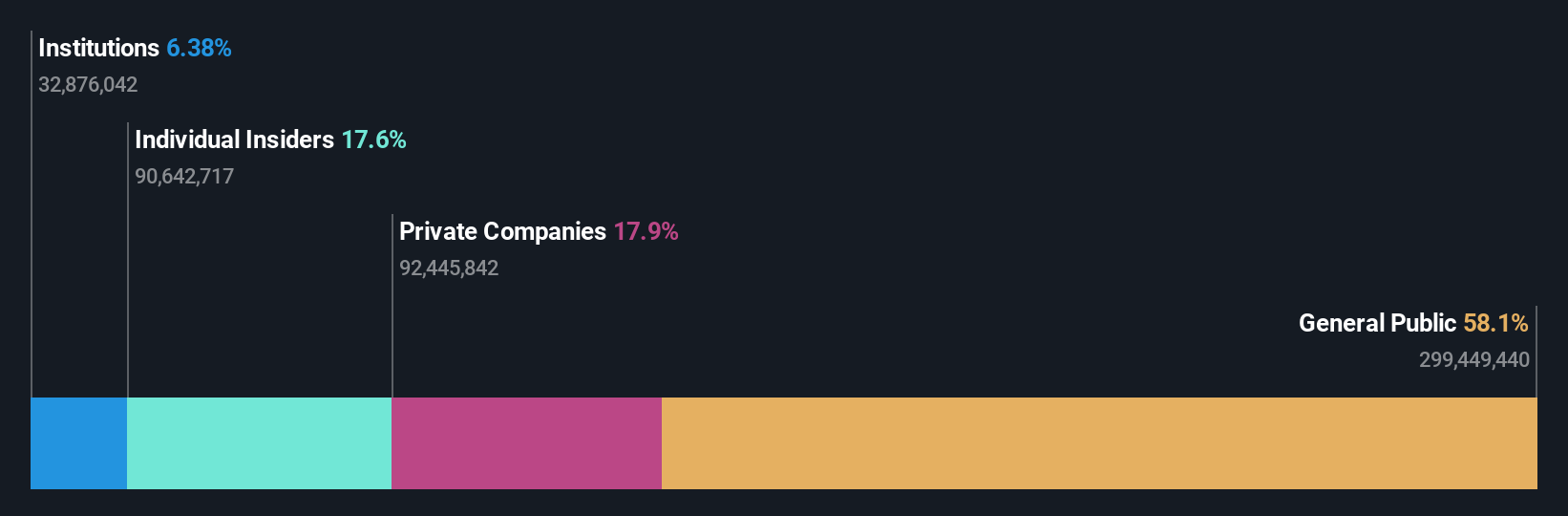

Insider Ownership: 21.5%

Earnings Growth Forecast: 37.7% p.a.

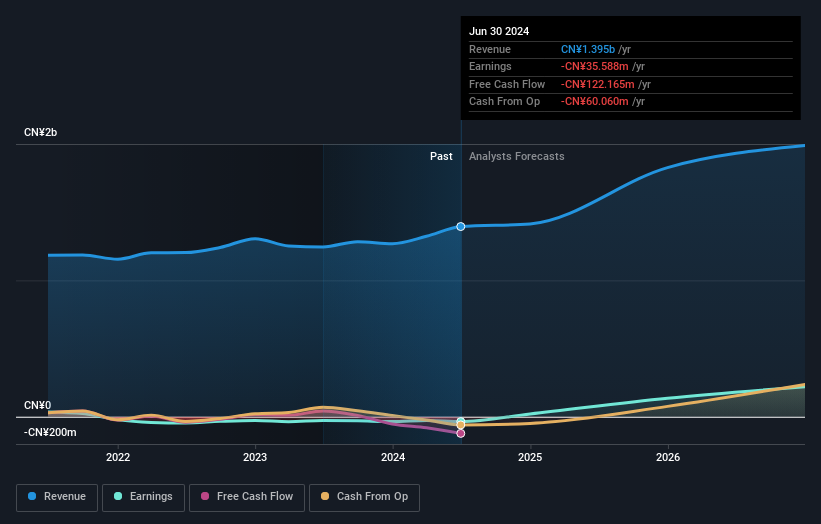

Kehua Data shows strong growth potential, with earnings forecast to grow 37.7% annually and revenue expected to rise 23.9% per year, outpacing the Chinese market. The stock trades at a substantial discount, around 62.6% below its estimated fair value, suggesting good relative value compared to peers. Despite a recent decline in net income for the half-year ending June 2024, the company's growth trajectory remains promising without significant insider trading activity recently reported.

- Unlock comprehensive insights into our analysis of Kehua Data stock in this growth report.

- Our comprehensive valuation report raises the possibility that Kehua Data is priced lower than what may be justified by its financials.

Xiamen Wanli Stone StockLtd (SZSE:002785)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiamen Wanli Stone Stock Co., Ltd specializes in developing, processing, and installing stone products and related items across various international markets, with a market cap of CN¥6.54 billion.

Operations: The company's revenue is primarily derived from the Stone Processing and Manufacturing Industry, which accounts for CN¥1.18 billion, with additional income from the Wholesale of Other Products totaling CN¥215.90 million.

Insider Ownership: 18.9%

Earnings Growth Forecast: 100.4% p.a.

Xiamen Wanli Stone Stock Ltd. is expected to become profitable with earnings forecasted to grow 100.37% annually, outpacing the market average. Revenue is projected to rise by 15.8% per year, faster than the Chinese market's growth rate of 13.5%. Despite past shareholder dilution and a slight decline in net income for H1 2024, insider trading activity remains stable, reflecting potential confidence in its growth trajectory without recent substantial buying or selling.

- Get an in-depth perspective on Xiamen Wanli Stone StockLtd's performance by reading our analyst estimates report here.

- The analysis detailed in our Xiamen Wanli Stone StockLtd valuation report hints at an inflated share price compared to its estimated value.

Shandong Sinocera Functional Material (SZSE:300285)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shandong Sinocera Functional Material Co., Ltd. operates in the functional materials industry and has a market cap of CN¥19.02 billion.

Operations: The company's revenue segments include advanced ceramic materials, catalysts, and other functional materials.

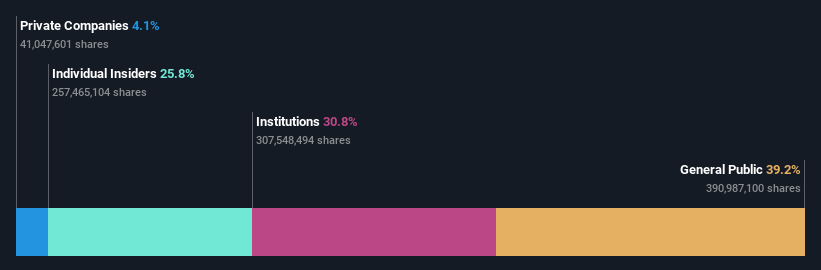

Insider Ownership: 25.8%

Earnings Growth Forecast: 25.5% p.a.

Shandong Sinocera Functional Material is poised for growth, with earnings forecasted to increase by 25.51% annually, surpassing the Chinese market average of 23.8%. Despite a moderate revenue growth rate of 17.4%, it remains above the market's 13.5%. The company completed a share buyback worth CNY 99.99 million and saw insider transactions with Wang Hong acquiring a significant stake, suggesting confidence in its future prospects amidst stable insider trading activity.

- Delve into the full analysis future growth report here for a deeper understanding of Shandong Sinocera Functional Material.

- Our valuation report unveils the possibility Shandong Sinocera Functional Material's shares may be trading at a discount.

Taking Advantage

- Access the full spectrum of 1483 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300285

Shandong Sinocera Functional Material

Shandong Sinocera Functional Material Co., Ltd.

Flawless balance sheet with proven track record.