Discover 3 Growth Companies With Insider Ownership Up To 28%

Reviewed by Simply Wall St

As global markets navigate a mixed start to the year, with U.S. stocks closing out a strong two-year stretch despite recent volatility, investors are increasingly focused on companies that demonstrate resilience and potential for growth. In this context, growth companies with high insider ownership can offer unique insights into management's confidence in their business prospects, making them an attractive consideration for those looking to align with informed insiders amidst fluctuating economic indicators.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Shenzhen JPT Opto-Electronics (SHSE:688025)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen JPT Opto-Electronics Co., Ltd. specializes in the R&D, production, sale, and technical services of laser technology, intelligent equipment, and optical devices with a market cap of CN¥4.27 billion.

Operations: The company's revenue is primarily derived from its Computer Communications and Other Electronic Equipment segment, which generated CN¥1.39 billion.

Insider Ownership: 26.9%

Shenzhen JPT Opto-Electronics demonstrates robust growth potential with forecasted revenue and earnings growth surpassing the Chinese market, at 20.5% and 36% per year respectively. Despite its recent removal from the S&P Global BMI Index, it continues to trade at a favorable value compared to industry peers with a price-to-earnings ratio of 35.7x versus the industry average of 44.3x. However, its dividend yield is not well covered by free cash flows, indicating potential financial constraints in this area.

- Get an in-depth perspective on Shenzhen JPT Opto-Electronics' performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Shenzhen JPT Opto-Electronics is trading behind its estimated value.

Hanwang TechnologyLtd (SZSE:002362)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hanwang Technology Co., Ltd. operates in the field of handwriting recognition, optical character recognition, and handwriting input products both in China and internationally, with a market capitalization of CN¥5.43 billion.

Operations: Revenue Segments (in millions of CN¥): Handwriting recognition products generated CN¥1.20 billion, optical character recognition contributed CN¥800 million, and handwriting input products accounted for CN¥600 million.

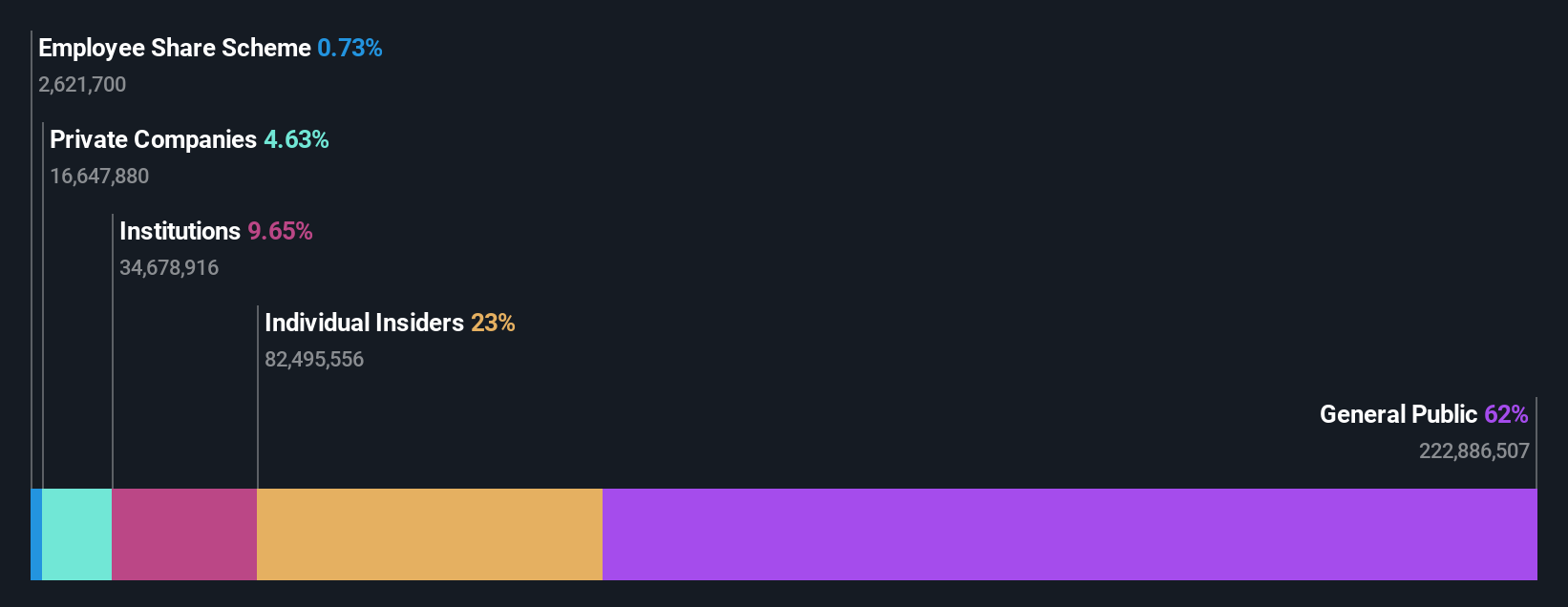

Insider Ownership: 28.2%

Hanwang Technology Ltd. is positioned for significant growth, with forecasted revenue expansion of 25.3% annually and earnings growth at 86.31% per year, outpacing the Chinese market average. Despite a net loss of CNY 75.01 million for nine months ending September 2024, this marks an improvement from the previous year's loss of CNY 89.85 million. The stock trades at a favorable value relative to peers, although its share price has been highly volatile recently.

- Dive into the specifics of Hanwang TechnologyLtd here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Hanwang TechnologyLtd is priced lower than what may be justified by its financials.

Fujian Yuanli Active CarbonLtd (SZSE:300174)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Yuanli Active Carbon Co., Ltd. manufactures and sells activated carbon in China with a market cap of CN¥5.19 billion.

Operations: Revenue Segments (in millions of CN¥):

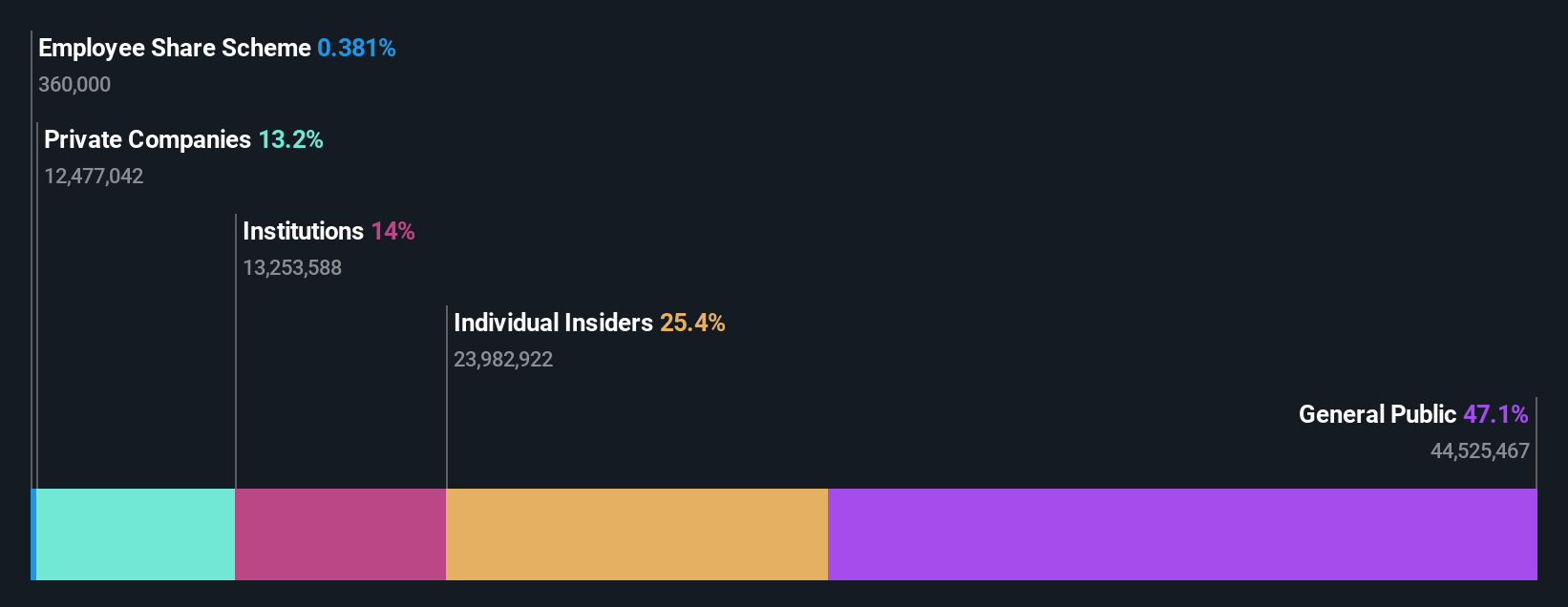

Insider Ownership: 22.8%

Fujian Yuanli Active Carbon Ltd. demonstrates potential for growth with a forecasted revenue increase of 27.1% annually, surpassing the Chinese market average. Despite a decline in sales to CNY 1.40 billion for the nine months ending September 2024, net income rose to CNY 211.97 million from CNY 175.87 million the previous year. The stock is trading at a favorable price-to-earnings ratio of 19.9x compared to the market's 33.4x, although dividend stability remains uncertain.

- Navigate through the intricacies of Fujian Yuanli Active CarbonLtd with our comprehensive analyst estimates report here.

- The analysis detailed in our Fujian Yuanli Active CarbonLtd valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Click through to start exploring the rest of the 1478 Fast Growing Companies With High Insider Ownership now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300174

Fujian Yuanli Active CarbonLtd

Engages in the manufacture and sale of activated carbon in China.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives