3 Growth Companies With High Insider Ownership Showing 27% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration, with sectors like financials and energy gaining from deregulation hopes while others face policy-related challenges, investors are keenly watching for growth opportunities. In this environment, companies with high insider ownership can be particularly appealing as they often indicate strong internal confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

We'll examine a selection from our screener results.

Fujian Yuanli Active CarbonLtd (SZSE:300174)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Yuanli Active Carbon Co., Ltd. manufactures and sells activated carbon in China, with a market capitalization of CN¥6.82 billion.

Operations: The company's revenue segments are not provided in the given text.

Insider Ownership: 22.8%

Revenue Growth Forecast: 27.1% p.a.

Fujian Yuanli Active Carbon Ltd. shows promising growth potential with earnings forecast to grow 22.46% annually, surpassing the broader Chinese market's revenue growth rate of 13.9%. Despite a recent dip in sales, net income rose to CNY 211.97 million for the first nine months of 2024, reflecting improved profitability. The company's strategic share buyback and stable governance changes underscore its commitment to shareholder value, while its price-to-earnings ratio remains competitive at 25.8x against the market average.

- Click to explore a detailed breakdown of our findings in Fujian Yuanli Active CarbonLtd's earnings growth report.

- Our valuation report here indicates Fujian Yuanli Active CarbonLtd may be overvalued.

Longhua Technology GroupLtd (SZSE:300263)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Longhua Technology Group Co., Ltd. manufactures and sells heat transfer and energy-saving equipment in China, with a market cap of CN¥6.65 billion.

Operations: Revenue segments for SZSE:300263 are not provided in the text.

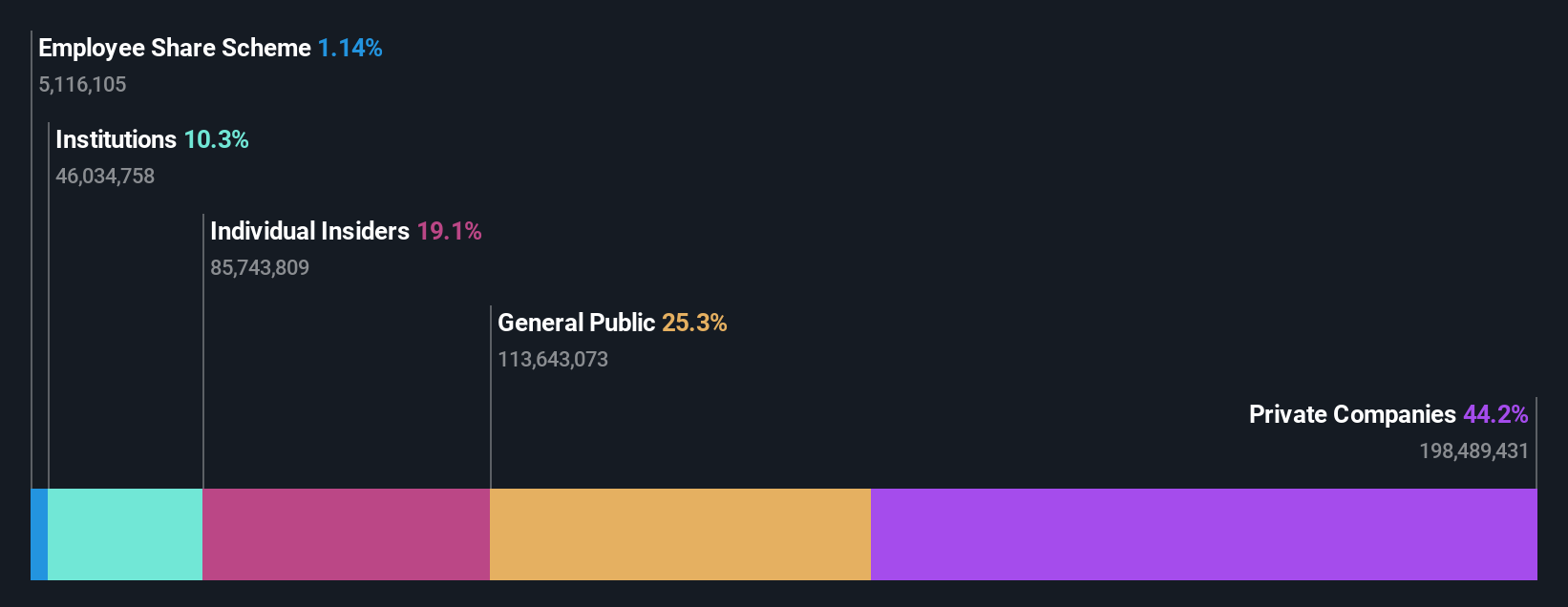

Insider Ownership: 22.4%

Revenue Growth Forecast: 19.3% p.a.

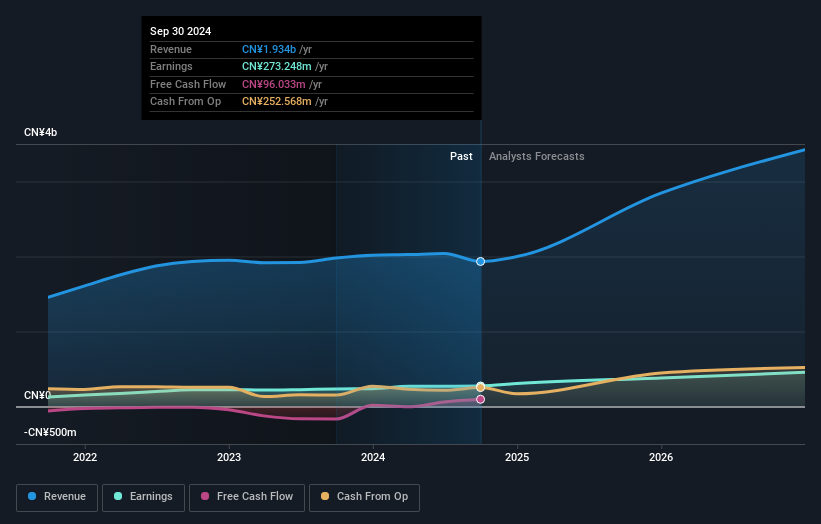

Longhua Technology Group Ltd. is positioned for significant growth, with earnings projected to increase by 43.8% annually, outpacing the Chinese market's average. Despite a slight decline in net income to CNY 154.71 million for the first nine months of 2024, revenue rose to CNY 1,930.19 million from the previous year. Recent board changes and stable insider ownership suggest robust governance support for its growth trajectory amidst slower-than-expected revenue expansion at 19.3% per year.

- Click here and access our complete growth analysis report to understand the dynamics of Longhua Technology GroupLtd.

- Our expertly prepared valuation report Longhua Technology GroupLtd implies its share price may be too high.

ApicHope Pharmaceutical (SZSE:300723)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ApicHope Pharmaceutical Co., Ltd, along with its subsidiaries, focuses on the research and development, production, and sale of pharmaceutical drugs with a market cap of CN¥8.13 billion.

Operations: The company generates revenue through its core activities in the research, development, production, and sale of pharmaceutical drugs.

Insider Ownership: 19.2%

Revenue Growth Forecast: 23% p.a.

ApicHope Pharmaceutical faces challenges with declining revenue, reporting CNY 1.24 billion for the first nine months of 2024, down from CNY 1.85 billion a year earlier, and a net loss of CNY 246.54 million compared to previous profits. Despite these setbacks, the company is forecasted to achieve profitability within three years with expected earnings growth at an impressive rate of over 80% annually and revenue growth surpassing market averages at 23% per year.

- Get an in-depth perspective on ApicHope Pharmaceutical's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that ApicHope Pharmaceutical is priced higher than what may be justified by its financials.

Seize The Opportunity

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1541 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300263

Longhua Technology GroupLtd

Manufactures and sells heat transfer and energy-saving equipment in China.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives