Jiangyin Jianghua Microelectronics Materials And 2 Other Growth Stocks With Strong Insider Confidence

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and political uncertainty, global markets experienced notable declines, with U.S. stocks falling despite a late-week rally. As investors navigate these turbulent times, the focus on growth companies with high insider ownership becomes increasingly relevant; such firms often signal strong internal confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.9% | 37.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

Here's a peek at a few of the choices from the screener.

Jiangyin Jianghua Microelectronics Materials (SHSE:603078)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangyin Jianghua Microelectronics Materials Co., Ltd specializes in manufacturing and supplying wet electronic chemicals for microelectronics and optoelectronics in China, with a market cap of CN¥6.74 billion.

Operations: The company generates revenue primarily through the production and distribution of wet electronic chemicals used in microelectronics and optoelectronics within China.

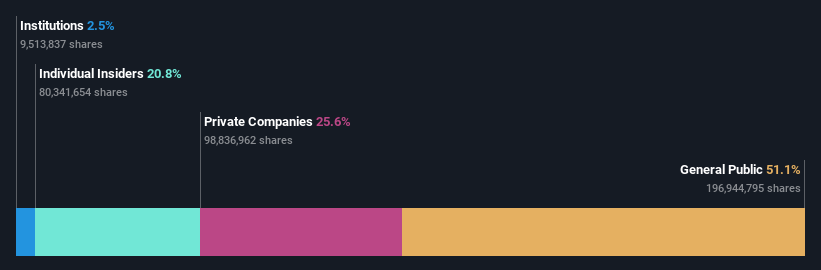

Insider Ownership: 20.8%

Earnings Growth Forecast: 38.7% p.a.

Jiangyin Jianghua Microelectronics Materials is experiencing strong growth prospects, with earnings forecasted to grow significantly at 38.71% annually, outpacing the Chinese market average. Despite a decline in net income to CNY 86.26 million for the nine months ended September 2024, insider ownership remains high without substantial recent insider trading activity. Revenue is also expected to grow robustly at 25.1% per year, although return on equity is projected to remain modest at 11.2%.

- Delve into the full analysis future growth report here for a deeper understanding of Jiangyin Jianghua Microelectronics Materials.

- Insights from our recent valuation report point to the potential overvaluation of Jiangyin Jianghua Microelectronics Materials shares in the market.

Estun Automation (SZSE:002747)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Estun Automation Co., Ltd. focuses on the research, development, production, and sale of intelligent equipment and its control and functional components in China with a market cap of CN¥16.10 billion.

Operations: The company generates revenue from its Instrument and Meter Manufacturing segment, amounting to CN¥4.79 billion.

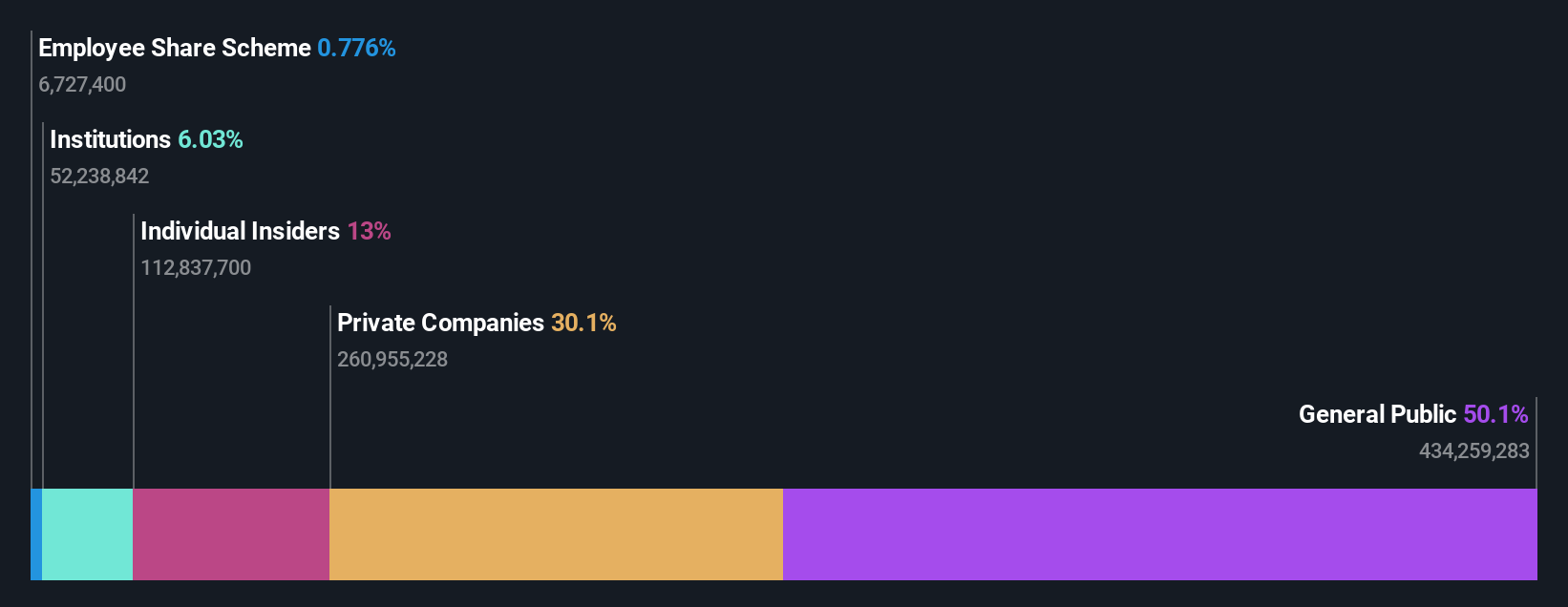

Insider Ownership: 13%

Earnings Growth Forecast: 60.9% p.a.

Estun Automation is projected to achieve profitability within three years, with earnings expected to grow 60.87% annually, surpassing market averages. Despite a revenue increase to CNY 3.37 billion for the nine months ending September 2024, the company reported a net loss of CNY 66.7 million compared to last year's profit. While insider ownership is significant, recent trading activity shows no substantial changes, and interest payments remain inadequately covered by earnings.

- Take a closer look at Estun Automation's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Estun Automation is priced higher than what may be justified by its financials.

Shenzhen Capchem Technology (SZSE:300037)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Capchem Technology Co., Ltd. engages in the research, development, production, sale, and servicing of electronic chemicals and functional materials both in China and internationally, with a market cap of CN¥27.75 billion.

Operations: The company's revenue segments include the production and sale of electronic chemicals and functional materials, catering to both domestic and international markets.

Insider Ownership: 39.4%

Earnings Growth Forecast: 28.4% p.a.

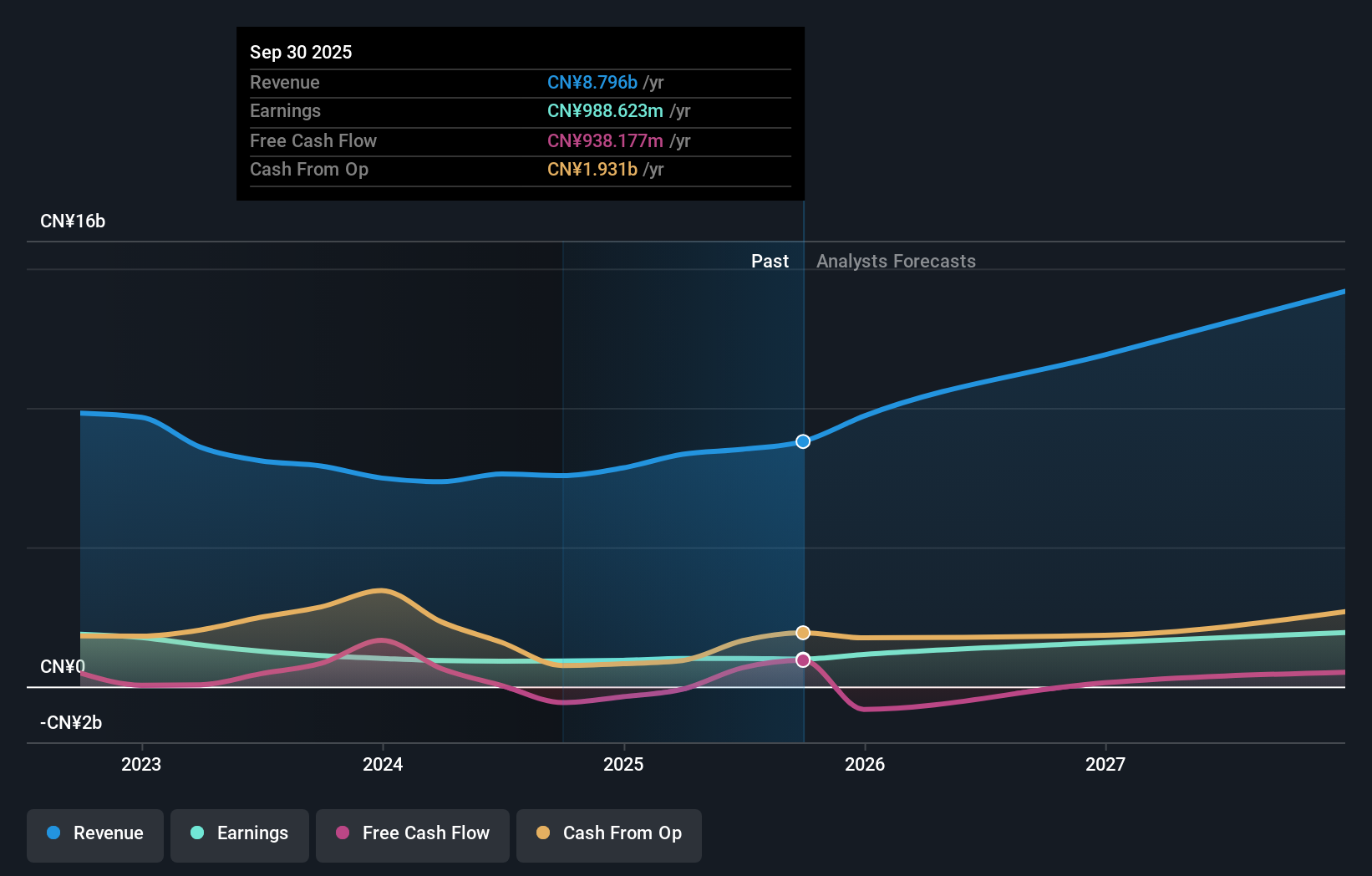

Shenzhen Capchem Technology is experiencing robust growth, with earnings and revenue projected to outpace the Chinese market at 28.41% and 22.4% annually, respectively. Despite a recent dip in net income to CNY 701.47 million for the first nine months of 2024, insider ownership remains high with no significant trading activity recently reported. The company's price-to-earnings ratio of 30.9x suggests it is valued attractively compared to the broader CN market at 35.5x.

- Unlock comprehensive insights into our analysis of Shenzhen Capchem Technology stock in this growth report.

- Upon reviewing our latest valuation report, Shenzhen Capchem Technology's share price might be too optimistic.

Make It Happen

- Gain an insight into the universe of 1514 Fast Growing Companies With High Insider Ownership by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300037

Shenzhen Capchem Technology

Researches and develops, produces, sells, and services electronic chemicals products and functional materials in China and internationally.

High growth potential with excellent balance sheet.