In the wake of recent market fluctuations driven by policy uncertainties and sector-specific developments, investors are increasingly looking for stable opportunities amidst volatility. One key factor that can indicate a company's potential for growth is high insider ownership, as it often suggests that those who know the company best have confidence in its future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Global Tax Free (KOSDAQ:A204620) | 19.9% | 78.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Here we highlight a subset of our preferred stocks from the screener.

Canatu Oyj (HLSE:CANATU)

Simply Wall St Growth Rating: ★★★★★☆

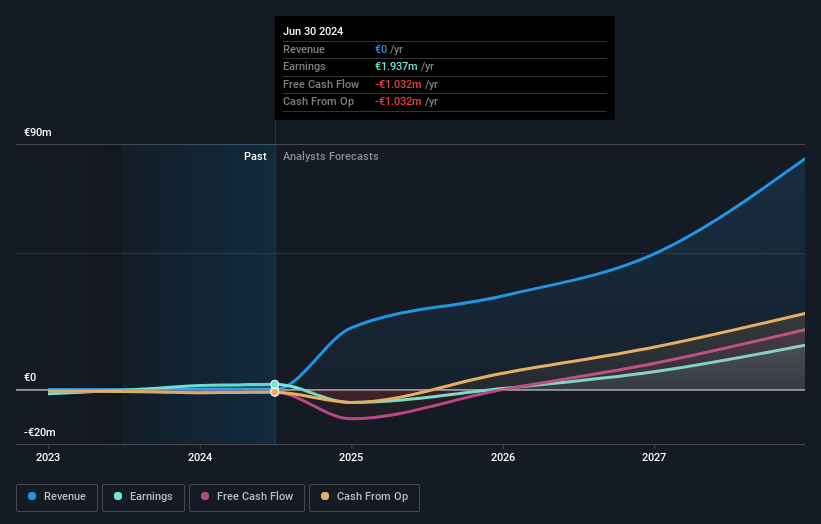

Overview: Canatu Oyj is involved in the development and manufacturing of advanced carbon nanotube (CNT) materials and related products, with a market cap of €408.54 million.

Operations: Canatu Oyj generates its revenue through the development and manufacturing of innovative carbon nanotube materials and associated products.

Insider Ownership: 7.7%

Canatu Plc, recently rebranded from Lifeline SPAC I Plc, is positioned for substantial growth with forecasted revenue and earnings increases of 44.6% and 58.4% per year respectively, outpacing the Finnish market. Despite recent shareholder dilution and a volatile share price, Canatu's transition to profitability this year marks a significant milestone. However, its debt coverage remains inadequate through operating cash flow, presenting potential challenges in financial stability as it aims to capitalize on its growth trajectory.

- Click here to discover the nuances of Canatu Oyj with our detailed analytical future growth report.

- The analysis detailed in our Canatu Oyj valuation report hints at an inflated share price compared to its estimated value.

Estun Automation (SZSE:002747)

Simply Wall St Growth Rating: ★★★★☆☆

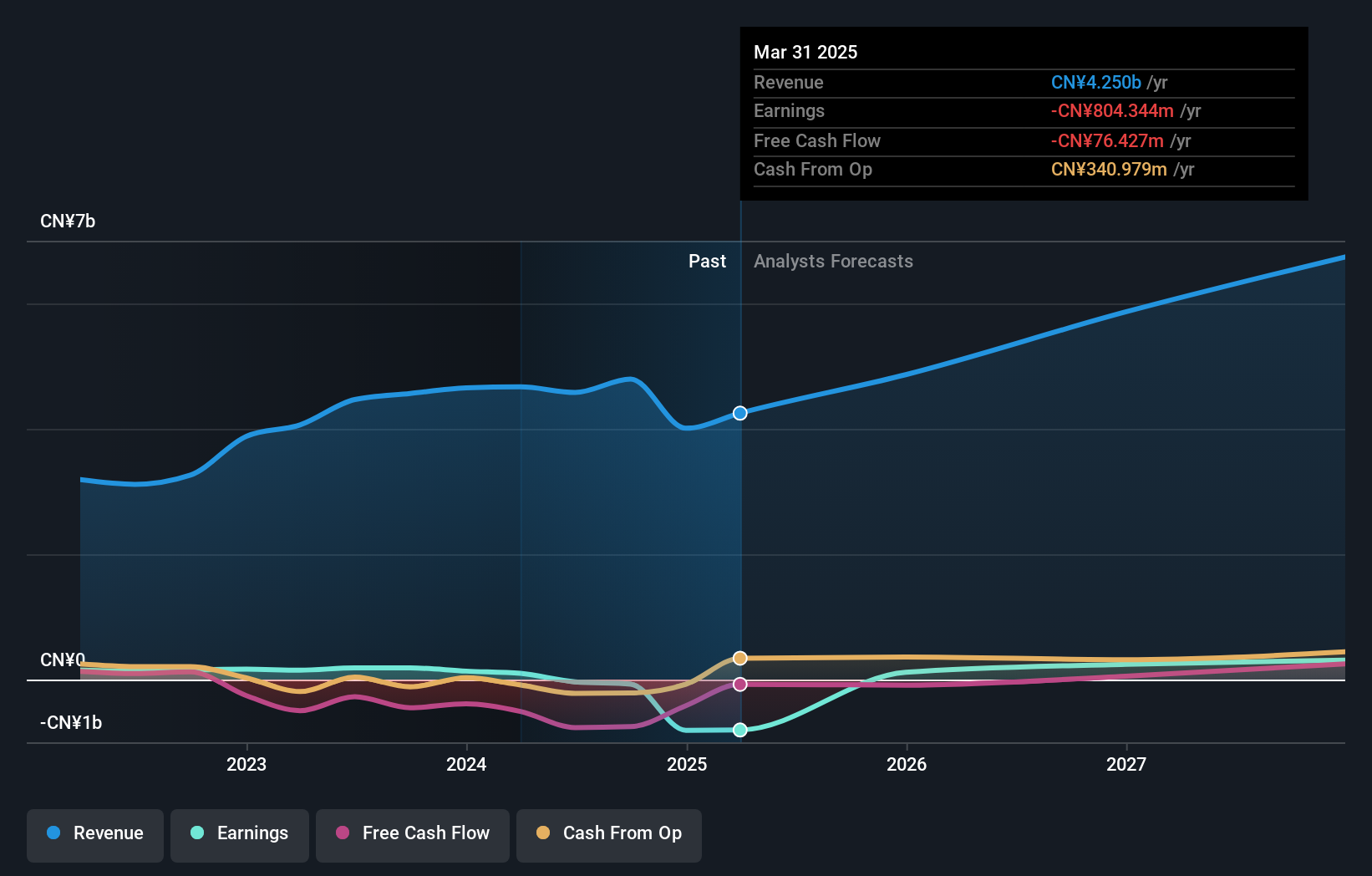

Overview: Estun Automation Co., Ltd. focuses on the research, development, production, and sale of intelligent equipment and its control and functional components in China with a market cap of CN¥15.47 billion.

Operations: The company generates revenue from its Instrument and Meter Manufacturing segment, amounting to CN¥4.79 billion.

Insider Ownership: 13%

Estun Automation is poised for growth with a forecasted annual revenue increase of 14.6%, surpassing the Chinese market average. Despite recent financial setbacks, including a net loss of CNY 66.7 million for the first nine months of 2024, Estun is expected to achieve profitability within three years, indicating above-average market growth potential. However, its return on equity is projected to remain low at 12.9% in three years, highlighting potential challenges in maximizing shareholder value.

- Click here and access our complete growth analysis report to understand the dynamics of Estun Automation.

- According our valuation report, there's an indication that Estun Automation's share price might be on the expensive side.

Chengdu Guibao Science & TechnologyLtd (SZSE:300019)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chengdu Guibao Science & Technology Co., Ltd. operates in the field of silicone sealant production and has a market cap of CN¥7.53 billion.

Operations: Chengdu Guibao Science & Technology Co., Ltd. generates its revenue primarily from the production of silicone sealants.

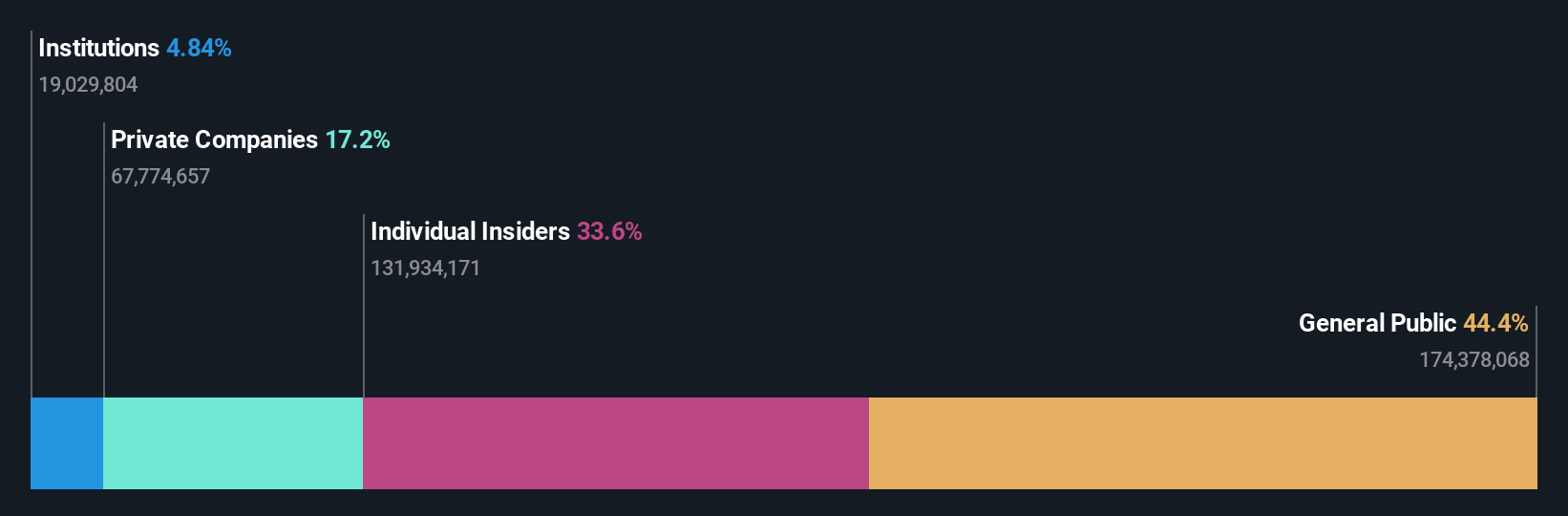

Insider Ownership: 35.3%

Chengdu Guibao Science & Technology Ltd. is projected to outpace the Chinese market with a 30.9% annual earnings growth, though its revenue growth rate of 16.4% lags behind the high-growth threshold of 20%. Despite a favorable price-to-earnings ratio of 30.1x compared to the market's 35.9x, recent financial results show declining net income and EPS for the first nine months of 2024, raising concerns about profitability sustainability amidst significant forecasted earnings growth.

- Click to explore a detailed breakdown of our findings in Chengdu Guibao Science & TechnologyLtd's earnings growth report.

- Our expertly prepared valuation report Chengdu Guibao Science & TechnologyLtd implies its share price may be too high.

Make It Happen

- Unlock our comprehensive list of 1535 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300019

Chengdu Guibao Science & TechnologyLtd

Chengdu Guibao Science & Technology Co.,Ltd.

Excellent balance sheet with reasonable growth potential.